April 8th, 2016 On Thursday 7th April Ann Pettifor took part in one of John McDonnell’s road shows with Professor Simon Wren Lewis. The events are aimed at broadening the debate around economics in Britain. Ann discussed The case for the Green New Deal, and her powerpoint presentation is attached below. Framing the Economic Narrative

Read More »April 13 informal UK gathering, Consumer credit

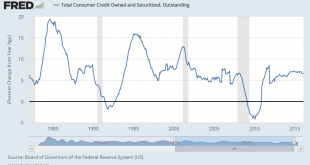

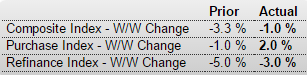

There are a few slots still open: Audience with Warren Mosler Not much happening here. Certainly no signs of any kind of a consumer spending boom,and it’s been decelerating some for the last year or so:

Read More »Purchase apps, Jobless claims

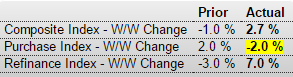

Reversed last weeks gain, and year over year gain down to 11% and falling rapidly towards 0: MBA Mortgage Applications Claims remain depressed, but it’s becoming more clear that the reason is difficulty in obtaining them, rather than an indication of a ‘healthy jobs market’:

Read More »NEP Maintenance

In order to complete system upgrades, it will be necessary to take NEP offline for awhile. The scheduled maintenance window for this is for Saturday April 9, 2016 between 8:00 a.m. and 10:00 a.m. [Translate]

Read More »US Gasoline demand, Non manufacturing and Employment index, Bank loans

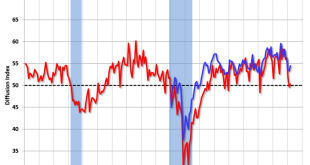

U.S. gasoline demand, one of the strongest pillars supporting oil consumption, fell in January for the first time in 14 months, U.S. Energy Information Administration data showed. Below growth rates that marked prior recessions:

Read More »ECB footnote, Trade, Fed Atlanta, Redbook retail sales, ISM non manufacturing

Who would’ve thought?;) The ECB makes this point in a footnote on page 10: The ECB Explains Why Central Banks Can’t Go Bankrupt in a Footnote “Central banks are protected from insolvency due to their ability to create money and can therefore operate with negative equity.” Trade deficit higher than expected. GDP estimates being revised down: International Trade And note the general downturn in trade which has always been associated with recessions in the past:GDP growth forecast down to...

Read More »Core capital goods, Euro

How bad does this look? If it was adjusted for inflation it would look even worse:QE, negative rates, easing bias vs the Fed in hiking mode, and the euro is going up anyway? Seems the ECB and euro area exporters might be getting concerned?

Read More »Labor market index, Factory orders, Durable goods

The Fed’s labor market index is showing some slack: Labor Market Conditions IndexHighlightsEmployment has been strong, especially the participation rate, but isn’t being reflected in the Federal Reserve’s labor market conditions index which came in at minus 2.1 in March vs a downwardly revised 2.5 percent decline in February. The index, experimental in nature, is a broad composite of 19 separate indicators and is rarely cited by policy makers. Another bad one, on the heels of very weak...

Read More »Car sales, Employment, Construction spending, Earnings, ISM manufacturing, Consumer sentiment

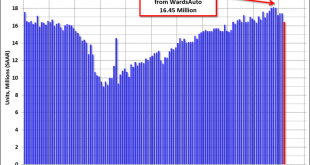

This is the big news today, and there’s nothing good about it. It’s way below expectations and continues the declilne from last year’s peak: U.S. Light Vehicle Sales decline to 16.45 million annual rate in Marchby Bill McBrideBased on an estimate from WardsAuto, light vehicle sales were at a 16.45 million SAAR in March.That is down about 4% from March 2015, and down about 6% from the 17.43 million annual sales rate last month. A bit better than expected, and, again, the growth rate (though...

Read More »Mtg purchase apps, ADP, Fed comment

Sorry, wrote this up yesterday and never sent it. Purchase apps remain depressed, though a bit off the bottom, and depressed housing sales reports indicate the growth in mtg purchase apps is more about how purchases are financed rather than an indicator of total home purchases: MBA Mortgage ApplicationsHighlightsPurchase applications for home mortgages rose by 2 percent in the March 25 week, with the year-on-year increase continuing very strong at 21 percent. Refinance applications declined...

Read More » Heterodox

Heterodox