While claims are historically at record lows on a per capita basis, because they are now so hard to get the fact that they are rising some might mean something, but maybe not:Job cuts also look like they are trending a bit higher as well:Note how the chart shows this indicator has been zig zagging lower, so we’ll have to wait until next month to see if it zigs back down again: Chicago PMIHighlightsExpansion is March’s score for the often volatile Chicago PMI which surged 6 full points to a...

Read More »$ story

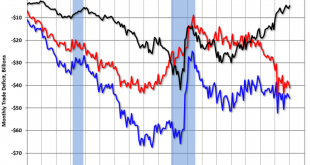

So well over a year ago the dollar started going up based on falling oil prices, which I suggested was a mistake. That was because it seemed to me that this time around the falling price of oil was not likely to lower the US current account deficit the way lower oil prices have lowered it in the past. I suggested two reasons. First, US production was likely to go down and therefore oil imports would rise, offsetting much of the price drop. Second, US exports to oil producers were likely to...

Read More »Redbook retail sales, Housing price index, Consumer confidence

At least so far, even with the easier comparisons with last year’s weak sales at this time, there’s still very little growth:Nothing happening here: The chart shows how it stopped rising when oil capex collapsed, and has been working its way lower ever since: Consumer ConfidenceHighlightsLack of wage gains and the exaggerated political climate have yet to dent consumer spirits as consumer confidence is holding firm, at a solid 96.2 in March. An initial drop in February had raised concerns...

Read More »Personal income and spending, Dallas Fed, Pending home sales, Atlanta Fed, Deportations

Remember the hype when spending came out at up .5 last month- hard evidence the economy was heading north? Well, it just got revised away to a recession like .1, and PCE down to only a 1% year over year increase, and no one is saying anything, with the core CPE gain down to .1 vs last month’s .3 which was deemed evidence of a return to inflation. Not mention the .1 drop in wages and salaries after all the hype about the return of ‘wage inflation’: Personal Income and OutlaysHighlightsThe...

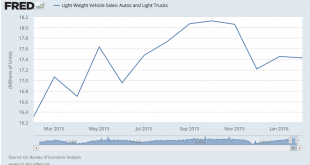

Read More »Car sales, GDP yoy comp, Rail traffic, Bank loans

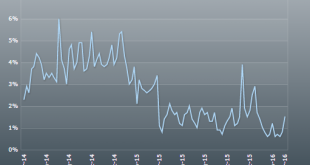

Ward’s Auto’s estimate is for a continuation of the flattening of the seasonally adjusted annualized rate of sales from prior higher levels: The report puts the seasonally adjusted annual rate of sales for the month at 17.3 million units, below the 17.4 million SAAR from the first two months of 2016 combined, but well above the 17.1 million SAAR from same-month year-ago. Looks to me like a deceleration from Q4: The table below compares the 3Q2015 third estimate of GDP (Table 1.1.2) with...

Read More »Corporate profits, Q4 GDP 3rd revision, Credit contraction and commercial property articles

Corporate ProfitsHighlightsHeld down by declines in the petroleum and chemical industries, corporate profits in the fourth quarter came in at $1.640 trillion, down a year-on-year 3.6 percent. Profits are after tax without inventory valuation or capital consumption adjustments. Revised up, but seems the odd looking spike in ‘recreational services’ that alone added most of the upward revision is likely to reverse in Q1, subtracting that much more from current forecasts, with real disposable...

Read More »KC Fed, Atlanta Fed, Relative incomes, Durable goods chart

This one’s still down: Kansas City Fed Manufacturing IndexHighlightsOther regional reports have been picking up a sudden turn of strength this month, all except Kansas City where the index came in at minus 6 in March which is however an improvement from minus 12 in February. New orders, in fact, do show improvement, at minus 2 vs February’s minus 15 which, however, is where backlog orders are this month. Production is also deeply negative at minus 14 with employment at minus 12. Price...

Read More »Durable goods, Claims, CNBC comment on GDP revisions

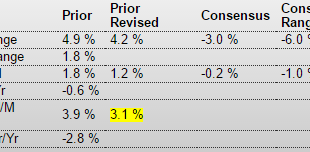

Unambiguously bad. And the downward spiral continues with sales falling faster than inventories: Durable Goods OrdersHighlightsThe manufacturing component of the industrial production report pointed to February strength but the durable goods report certainty isn’t. Orders fell 2.8 percent with the ex-transportation reading, which excludes the up-and-down swings of aircraft orders, down a very sizable 1.0 percent. And capital goods readings, which offer indications on business investment,...

Read More »Employment comments

So if unemployment benefits are a lot harder to get than last time around, what does this mean for the macro economy? 1. The weekly new claims number doesn’t correlate to the ‘labor market’ the way it did in prior cycles. 2. Federal spending on unemployment benefits increases less rapidly as the economy deteriorates. 3. New claims fall faster than employment as a % of the population increases. 4. There is that much more downward pressure on wages. 5. More jobs come from people who are...

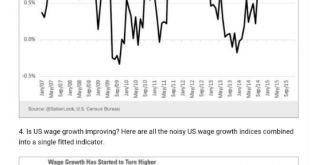

Read More »Household formations, Wage growth, Euro area consumer confidence, Chemical activity barometer

Household formations going the wrong way and wages going nowhere:From negative to more negative: From the American Chemistry Council: Chemical Activity Barometer Expands in March The Chemical Activity Barometer (CAB), a leading economic indicator created by the American Chemistry Council (ACC), expanded 0.1 percent in March following a revised 0.2 percent decline in February and 0.1 percent downward revision in January. All data is measured on a three-month moving average (3MMA)....

Read More » Heterodox

Heterodox