Burger King Whopper is 4 ounces. A Wendy;s single is 4 ounces. The real question is, can you misrepresent a product in advertising? Everyone may know the product is not what it is claimed to be. However, does this relieve the seller of responsibility for misrepresentation? The ten and fifteen cent McDonald’s burgers were tiny at the time. The McDonalds Quarter Pounder weighs 4.25 ounces. Did McDonalds brag of their size? or is it all in what you...

Read More »New Deal democrats Weekly Indicators for August 28 – September 1

Weekly Indicators for August 28 – September 1 at Seeking Alpha – by New Deal democrat My Weekly Indicators post is up at Seeking Alpha. The long leading indicators continue to forecast that a hard landing is out there, while the short leading indicators – aided by a sharp increase in consumer spending in the past few weeks – say it isn’t close to being here, at least not yet, As usual, clicking over and reading will bring you up to the...

Read More »Rule Changes Offer Little Relief as Student Loan Payments Resume

If I was new to this dilemma, I would believe this is better news than prior announcements. But it is not good news, it is news coming too late for the borrowers holding exaggerated debt due to penalties, consolidation fees, interest, interest on that interest, and rate changes. If this was said a decade ago, it might make sense. It is only now, the Department of Education has caught up with how old some of these loans are today. Why does this...

Read More »August jobs report: deceleration shows up in spades

August jobs report: deceleration shows up in spades – by New Deal democrat My focus remains on whether jobs growth continues to decelerate, particularly manufacturing and residential construction jobs, but also total construction and goods production jobs as a whole; as well as watching for the increase in jobless claims to translate into a higher unemployment rate (a leading relationship that it has had for over 50 years). And, with help...

Read More »Building a Mixed City Use Concept from Scratch

To pull off the project, the company will almost certainly have to use the state’s initiative system to get Solano County residents to vote on it. The hope is voters will be enticed by promises of thousands of local jobs, increased tax revenue and investments in infrastructure like parks, a performing arts center, shopping, dining and a trade school. What Moritz is talking about is a concept called Mixed Village Use. A village or a town which is...

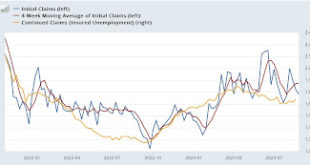

Read More »YoY initial claims restart the yellow caution flag, suggest unemployment will rise towards 4.0%

YoY initial claims restart the yellow caution flag, suggest unemployment will rise towards 4.0% – by New Deal democrat I’ll post on personal income and spending a little later. But first, initial jobless claims declined -4,000 to 228,000 last week. The more important 4 week average increased 250 to 237,500. With a one week delay, continuing claims increased 28,000 to 1.725 million: For forecasting purposes, the YoY% change is more...

Read More »Open Thread August 31, 2023 Mixed News Topics

Not Everything We Call Cancer Should Be Called Cancer, rsn.org. The NYPD Denied Our Request for Body Camera Footage of a “Friendly Fire” Killing. Here’s How We Got It Anyway, ProPublica, Mike Hayes. Clarence Thomas officially discloses private jet trips on GOP donor Harlan Crow’s plane, CNN Politics, Ariane de Vogue and Devan Cole. Stay away from Arizona. That’s what Canada essentially is telling its people, msn.com, Phil Boas. Arizona...

Read More »China’s Economy in Need of Rescue?

In the last post “Trump, Biden Policies Shifted Trade from China, Study Shows,” voanews.com, (read again if needed) we were talking about China sneaking its parts into the US through Mexico and Vietnam. The VOA article is the same as shown on Bloomberg. As you read that post, I think you will see I had real issues with being able to sneak the same Chinese parts out of those countries and into the US. Furthermore, for either country to manufacture...

Read More »July JOLTS report: is the game of reverse musical chairs in employment ending?

July JOLTS report: is the game of reverse musical chairs in employment ending? – by New Deal democrat For the past 18 months, I’ve likened the job market to a game of reverse musical chairs, where there are more chairs put out by potential employers than there are job applicants willing to fill them. Also for many months, I have noted the gradual deceleration in that game. July’s JOLTS report not only continued that trend we’ve seen for the...

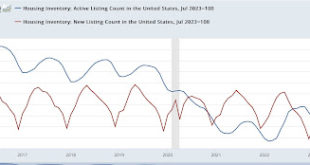

Read More »Frozen homeowners means record low inventory, meaning existing home prices have stopped declining

Frozen homeowners mean record low inventory, meaning existing home prices have stopped declining – by New Deal democrat Before discussing this morning’s reports on existing home prices, let’s start with a look at new listings and total active listings of housing inventory, which are very instructive: This information is not seasonally adjusted, and obviously follows a seasonal pattern. The important thing to notice is that since late last...

Read More » Heterodox

Heterodox