Via Diane Ravitch’s blog comes this note and bio to watch Dr. Fenwick livestream presentation. I am pointing to her work as somebody worth a look. Living with Histories That We Do Not Know with Leslie Fenwick Tuesday, April 11, 4 p.m. ET Dr. Fenwick will draw on her sustained contribution to education policy research and groundbreaking findings from her recently published award-winning and bestselling book, Jim Crow’s Pink Slip. Dr....

Read More »Child labor laws are under attack in states across the country

This is a mixture of my comments and comments pulled from multiple sources (BLS, Cosmopolitan, , Why do Child Labor Laws Matter? Federal laws provide a minimum of protections for child labor. The laws were enacted nearly a century ago in reaction to children being exposed to dangerous activities. Edwin Markham “Child at the Loom.” Cosmopolitan There was a time in this country when young children routinely worked legally. As industry grew in the...

Read More »There is now only one significant manufacturing datapoint that is not flat or down – but it’s the one the NBER relies upon

There is now only one significant manufacturing datapoint that is not flat or down – but it’s the one the NBER relies upon – by New Deal democrat I am increasingly of the opinion that at the moment, the only two economic data series that are important are nonfarm payrolls and the personal consumption expenditure deflator. That’s because almost every other important metric of the economy is either flat or declining. But payrolls keep chugging...

Read More »John Oliver Talks TANF Helping Families and States Sitting on the Funds

[embedded content] If you think there is abuse in our welfare system, in this case TANF, you are correct. Only, it is not the people for whom the system is suppose to be helping. In fact, there are state who are sitting on the money not having spent/distributed it as they should have. As usual, John does a great job on this issue. “States have broad flexibility over the use of state and federal Temporary Assistance for Needy Families (TANF)...

Read More »What is Wrong in Wisconsin?

What fired me up this morning? I retrieved a post sitting in the trash. A News clipping posted by Fred Dobbs considered to be dangerous by the Angry Bear system. I retrieved it and it sits at the end of my commentary on Wisconsin. The clipping is a nice history lesson on Wisconsin. Mine is editorial. I (we) lived in Wisconsin for almost a decade in the city built on an Isthmus. When I would fly home from some consulting manufacturing/supply chain...

Read More »New home sales for February increase; likely bottomed last July

New home sales for February increase; likely bottomed last July – by New Deal democrat Most of what you probably read elsewhere focuses on new home prices, which after finally declining -0.7% YoY in January, rebounded to +2.5% YoY. As is usual, prices follow sales YoY with a considerable lag (note since prices are not seasonally adjusted, this is the right way to make the comparison): In fact if you’ve been reading me and following my rule...

Read More »The Exxon Tiger Rampant

The Exxon Tiger Rampant, Bad Crow Review, Weldon Berger Links are at the end, doing linky stuff. _________________________________________________________________ “confidence is high in the oil and gas world” __________________________________________________________________ And why not? Record profits, massive new drilling projects in delicate environs, a presidential pronouncement validating decades more of fossil fuel burning and...

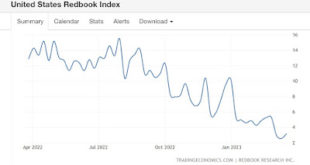

Read More »No recession yet, but no paucity of yellow flags

If you are not reading New Deal democrat as he marks the progress of the economy over the last year, you really should start. The detail on what certain economic markers determine are in his weekly analysis done on a daily basis for various markers. Updating 3 high frequency indictors: no recession yet, but no paucity of yellow flags – by New Deal democrat Aside from the Fed’s rate decision which will be announced this afternoon, it’s a...

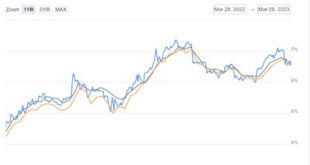

Read More »February existing home sales confirm prices have declined

February existing home sales confirm prices have declined, but bottom in sales and construction may be in – by New Deal democrat There were only two noteworthy takeaways from the February existing home sales report: (1) like mortgage applications, permits, and starts, existing home sales responded to lower mortgage rates (a decline from just over 7% to just above 6% between last October and January): (2) As usual, price changes lag...

Read More »Average and aggregate nonsupervisory wages for February

Average and aggregate nonsupervisory wages for February 2023 – by New Deal democrat There’s no significant economic news today, so let’s update a couple of income indicators important to average American working households. Namely, because we now have the inflation report for February as well as payrolls, we can update average and aggregate nonsupervisory wages. Average hourly earnings for nonsupervisory employees increased 0.5% on a...

Read More » Heterodox

Heterodox