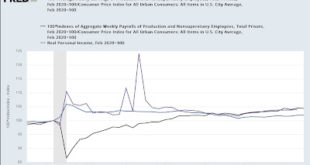

Labor has gained since the pandemic, but corporations have been sucking up the lion’s share of those gains . . . – by New Deal democrat I neglected to add a link to my Weekly Indicators piece at Seeking Alpha on Saturday, so here it is. Also, I’ve been trying to understand why, with all of the long and short leading indicators lined up in almost classic formation, no recession has started yet. I discussed that in another piece at Seeking...

Read More »Insurance Carriers Are About To Rebate Another $1.1 Billion To Policyholders Thanks To The ACA

My old Michigan standby on the PPACA. If there was something I needed to know, I could always count on Charles knowing the answer. I believe some of the state and federal politicians also relied on Charles for information. What is also kind of cool is Michigan Governor Gretchen Whitmer issuing a directive on Medicaid re-enrollment. The federal Families First Coronavirus Response Act, passed to respond to the COVID-19 pandemic, required Medicaid...

Read More »You can move the people to a better environment, or you can move the polluting facilities

I had read the JAMA Network version of this report although I could not get into the Full Text version. You can find a more open version by using a New in Private Window. Cliff notes . . . the polluting company paid for moving the people. In which, the health of the people, the children improved. The options are move the company or move the people. The findings from articles? “Children whose families participated in a program that helped them move...

Read More »Why Does Poverty Continue to Exist in America?

A long and good NYT take on why poverty continues to exist, stays stagnant or continues to grow in one of the richest nations in the world and the most capable of all to end poverty. A good read. “Those who have amassed the most power and capital bear the most responsibility for America’s vast poverty. Political elites have utterly failed low-income Americans over the past half-century. Corporate bosses have spent and schemed to prioritize...

Read More »Prescription Drug Price Increases for 2016 -2022

What I like about this Issue-Brief is the use of terminology we see, not knowing what it means, and seeing a description or definition. I have added links so as to do a deeper dive into the terminology. Carefully read, a person can garner an understanding of initial drug costs, intermediate costs, discounts, and what pricing results to the consumer. It is not pretty and reflects much pricing rent-taking over the last two or so years, blaming...

Read More »Ending the False Debate Over the Debt Ceiling

Joseph Stiglitz is calling for an honest and open debate on the debt ceiling and future expenditures and whether there is any relationship between the two. He states the expansion of the debt ceiling has no relationship between it and laws having future expenditures. The debt ceiling has no bearing on legal expenditures. It is about raising the debt ceiling to meet the expenditure congressional acts. Mostly a Stiglitz Opinion piece with some...

Read More »Housing update: sales have bottomed, prices in process

Housing update: sales have bottomed, prices in process – by New Deal democrat No important economic news today. Yesterday existing home sales were released, but their economic impact isn’t all that important, except as it can confirm what has been happening with new houses under construction. And confirmation is what it gave us. First, *sales* of houses have bottomed, following the peak in mortgage rates over 7% at the end of last October....

Read More »Jobless claims: yellow caution flag persists

Jobless claims: yellow caution flag persists – by New Deal democrat In response to last week’s big jump in new jobless claims to 264,000, I wrote that it might be an outlier vs. the beginning of a rising trend. This morning claims fell back to their previous average range, at 242,000. The 4 week average declined -1,000 to 244,250, while continuing claims from the previous week declined -8,000 to 1.799 million: I’ve been paying particular...

Read More »How does parking affect homelessness and crime?

This is an interesting commentary by David Zipper in his talk with Henry Grabar. Henry is the author of “How Parking Explains the World.” The AB title is from two questions. David was asking Henry to explain. If you have lived in or near a large city like Chicago, you are always on the hunt for a parking space unless there is a commercial garage around. If you are living in the suburbs and have to go into the city, parking is expensive. I now...

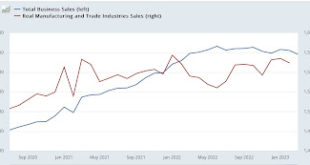

Read More »March total business sales strongly suggest that real total sales have entered a downturn

March total business sales strongly suggest that real total sales have entered a downturn – by New Deal democrat Today’s final significant economic report was total business sales for March. This is a nominal figure; the “real” number won’t be updated until personal income and spending is reported for April in two weeks. And here, the report was a clear negative. Not only did total March sales decline -1.1%, but January was revised down by...

Read More » Heterodox

Heterodox