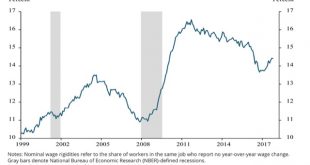

The percentage of employees who don’t get wage raises; is the Taboo undergoing an “extinction burst”? I came across the below graph yesterday from the Kansas City Fed. It’s pretty shocking: It represents “wage rigidity.” In english, that means the percentage of employees who don’t get any annual wage increases. It speaks for itself. Nine years into the economic expansion, with an unemployment rate under 4%, and un underemployment rate of 7.8% (only...

Read More »Intercompany Guarantee Fees and Trump’s Lido City Loan

Intercompany Guarantee Fees and Trump’s Lido City Loan Matthew Yglesias notes: Trump stands to gain from an Indonesian project that got a $500 million loan right before he flip-flopped on ZTE… But it also happened the same week a Chinese state-owned company came through with hundreds of millions of dollars in loans, some of which will go to facilitate the construction of Trump-branded properties in Indonesia. Does anyone know what the interest rate will...

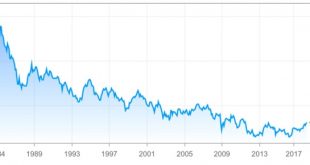

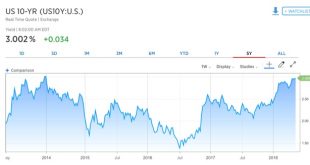

Read More »R.I.P. bond bull market, 1981-2016

R.I.P. bond bull market, 1981-2016 On September 30, 1981, the 10 year US Treasury bond yielded 15.84%. It has not been that high since. On July 8, 2016, it fetched only 1.37%. It is unlikely to see that low rate again for a very, very long time. Those two dates likely mark the birth and death dates for perhaps the biggest bond bull market in history. Here (from CNBC) is the relevant graph: Today the 10 year closed at 3.067%, having hit an...

Read More »ZTE and the Iran Nuclear Deal

ZTE and the Iran Nuclear Deal The whiplash that many observers have felt on learning of President Trump’s about-face on China’s ZTE telecom company from condemning it as violating US national security and violating sanctions rules by selling to North Korea and Iran has been pretty easily explained by our soon thereafter learning that China has provided a mere half a billion dollars to a project in Indonesia where Trump interests are deeply involved. ...

Read More »Intelligent Economist names Angry Bear among the top 100 Economics blogs for 2018

Angry Bear made the list again on the Intelligent Economist list of top blogs. We are listed in the general category seventh from the top. I see some new names on the list. Congratulations to all contributors for making a fine publication. The Angry Bear is a multi-author blog. Each author has his or her own unique area of expertise. Authors include a tax law expert, historian, numerous economists, and business and financial professionals. The varying...

Read More »Real wage growth adjusted for gas prices

Real wage growth adjusted for gas prices One of the things I note from time to time in my discussions of wage growth is how much its fluctuation in real terms has been affected by gas prices. For example, in the middle of the worst recession in nearly 70 years, real wages actually went up! Why? Because gas prices fell from $4.25/gallon to $1.50/gallon in just a few months. So, what would a long term view of real wages look like if I took out the...

Read More »Since 2010, Minnesota’s economy has performed far better for working families than Wisconsin’s

(Dan here…unemployment rates were about the same at 3.1 per cent (M) and 3.0 per cent (W). Taking a look at other measures of the success of an economy for the average person is well displayed here) Via Eeconomic Policy Institute comes this study: Since 2010, Minnesota’s economy has performed far better for working families than Wisconsin’s… At the time of the November 2010 elections, most states were still reeling from the economic devastation caused...

Read More »Comment on CEPR Policy Insight 91 section 4.2.1

Sorry for the title which is pure click bait. I would like to discuss a reform of the Stability and Growth Pact proposed by Agnès Bénassy-Quéré Markus Brunnermeier, Henrik Enderlein, Emmanuel Farhi, Marcel Fratzscher, Clemens Fuest, Pierre-Olivier Gourinchas, Philippe Martin, Jean Pisani-Ferry, Hélène Rey, Isabel Schnabel, Nicolas Véron, Beatrice Weder di Mauro, and Jeromin Zettelmeyer in CEPR Policy Insight 91 “Reconciling risk sharing with...

Read More »Real wages and unemployment update: April 2018

Real wages and unemployment update: April 2018 Now that we have the inflation numbers for April, let’s update the wage situation for ordinary Americans. Real wages YoY are only up +0.2%: More significantly, they are still down -0.3% from their most recent high 9 months ago: They are also only up +0.2% for the entire last 2 years and 2 months. Increased consumption by ordinary Americans isn’t up because they are making more in real...

Read More »Two real economic consequences of the Trump presidency

Two real economic consequences of the Trump presidency Next week we will be 1/3 of the way through Trump’s Presidential term. Last year I used to point out that it was really still Obama’s economy, as the GOP had failed to pass, nor Trump commence, any economic policy of consequence. That is no longer the case. In late December the GOP Congress passed and Trump signed their huge giveaway for the wealthy. Yesterday, Trump pulled out of the Iran nuclear...

Read More » Heterodox

Heterodox