May jobs report: excellent news on unemployment, underemployment, and wages HEADLINES: +223,000 jobs added U3 unemployment rate fell -0.1% from 3.9% to 3.8% U6 underemployment rate fell -0.2% from 7.8% to 7.6% Here are the headlines on wages and the braoder measures of underemployment: Wages and participation rates Not in Labor Force, but Want a Job Now: up 68,000 from 5.115 million to 5.183 million Part time for economic reasons: down -37,000 from...

Read More »Rejoinder To Rauch’s Response To Me On The Happiness Curve Overhyped

Rejoinder To Rauch’s Response To Me On The Happiness Curve Overhyped On May 15 I posted here on “Overhyping the Happiness Curve,” a critique of the recent book by Jonathan Rauch, The Happiness Curve: Why Life Gets Better After 50. After it was linked to on Marginal Revolution, author Jonathan Rauch wrote a Response to my post on May 25, which was also linked to on MR. I did not immediately reply as I was in Santa Cruz and did not have my copy of the...

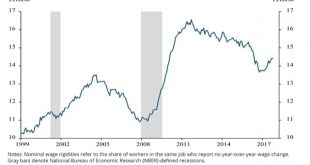

Read More »More evidence of increasing deflationary pressure on wages

More evidence of increasing deflationary pressure on wages One of my pet peeves is that economics as a discipline needs to import the entirety of learning theory from psychology, not just parlor tricks like the endowment effect. For example, learning from models. To wit, once Jack Welch was successful in using a pay scheme at GE that ensured that a given percentage of employees would not get a raise in any given year, it was inevitable that other...

Read More »Bring Back the Deutschmark

My plan for Europe. In comments JackD asked me what I thought of Italy leaving the Eurobloc. The problem is that it is easier said than done — the instant it becomes a serious possibility there will either be the mother of all bank runs or a banking holliday. Everyone (including your humble blogger) will want to get our hands on paper Euros which can’t be converted into Lire or Italos or whatever. So it has to be done quickly and by surprise — oh and...

Read More »Investors Not Pleased With Italian Politicians

The extreme conflict between the establishment and the new natonal populist majority in Parliament has spooked investors. The difference between the Italian and German 10 year treasury rates just jumped up about 100 basis points. This isn’t a crisis yet. I recall back when Italia caught a bit of Greek contagion (before ECB president Mario Draghi said “whatever it takes”) that the experts at the tesoro said they could handle interest rate spreads up to...

Read More »In consideration of Trade and Tarrifs

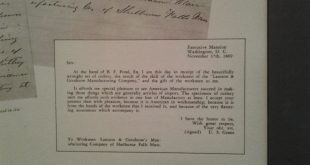

Updated This past weekend, I was in North Adams, Ma. We did some exploring of the area and came across a company started in 1837 that still exists today in Buckland. It no longer produces there, as it has moved to Westfield, Ma. It’s only move in 178 years. However, it has not survived the trend of Capital Investment companies. Though, their being purchased does not appear to be a bad thing based on their website. This picture I took is why I am...

Read More »Carlo Cottarelli

Carlo Cottarelli was asked to try to form an Italian government by President Sergio Mattarella. There is no chance that Cottarelli will obtain the confidence of Parliament (parties including a majority of deputies have brought up the possibility of impeaching Mattarella for nominating Cottarelli). Mattarella is using his extraordinary powers to fight populist nationalists who disrespected the Euro. Cottarelli is an odd choice for an anti-anti-globalist —...

Read More »The Italian Crisis: La resa di Conte

(literally the surrender of Conte but a reference to The Big Gundown). updated to comply with the Italian criminal code (which forbids vilifying the President of the Republic) I have to write about Italian politics, because everyone is (and I live in Rome) but you don’t have to read it. I will try one paragraph of background. In the last election angry Italians gave a very thin majority to two extremist parties the movimento 5 stell and La Lega Nord is...

Read More »Housing prices and recessions II

I wrote about how high house prices are correlaed with poor growth (partly because that which has gone up goes down). The data set was heroically collected by Jorda, Schularick, and Taylor who also used it for a paper which is actually very worth publishing (and published here). They find that high housing prices and rapid growth of total credit are correlated with greater severity and duration of the next recession.. I wonder if the bubble and credit...

Read More »Regulation: A Gut Check

Regulation: A Gut Check How do we get the word out that our underlying conception of how regulations should be designed and enforced needs to change? The New York Times has an ominous article about the overuse of antibiotics by the livestock industry and its risks for animal health and ours. Flooding our digestive system with these drugs damages the gut microbiome we depend on for nutrition and waste processing, and it promotes the evolution of...

Read More » Heterodox

Heterodox