(Dan here…better late posted here than not…. ) by New Deal democrat HEADLINES: +313,000 jobs added U3 unemployment rate unchanged at 4.1% U6 underemployment rate unchanged at 8.2% Here are the headlines on wages and the chronic heightened underemployment: Wages and participation rates Not in Labor Force, but Want a Job Now: declined -40,000 from 5.171 million to 5.131 million Part time for economic reasons: rose 171,000 from 4.989 million...

Read More »The Final End Of The As-Is/Red Line Agreement

The Final End Of The As-Is/Red Line Agreement In London yesterday visiting Saudi Crown Prince, Mohammed bin Salman (MbS) allowed the signing of a set of trade memoranda with various British companies, including buying Typhoon aircraft, and many other things, 18 such deals, although some sources say only 14, total value maybe about $90 billion, although much of that already in the works and in the end may amount to what the $110 billion plus deals he...

Read More »Basil Moore dies

Basil Moore dies I have just learned that prominent Post Keynesian economist, Basil Moore, died yesterday. I do not know of what or how old he was, although he retired over a decade ago. He is best known as the author of Horizontalists and Vericalists, in which he strongly argued for the endogeneity of money. In more recent years he had become interested in dynamic complexity economics. He long taught at Wesleyan in Connecticut. In the final years of...

Read More »Not All Global Currencies Are The Same

by Joseph Joyce Not All Global Currencies Are The Same The dollar may be the world’s main global currency, but it does not serve in that capacity alone. The euro has served as an alternative since its introduction in 1999, when it took the place of the Deutschemark and the other European currencies that had also been used for that purpose. Will the renminbi become the next viable alternative? A new volume, How Global Currencies Work: Past, Present and...

Read More »Impacts of Temperature

As taken from the comments section. EMichael’s commentary on temperature and its impact. Interesting. “Air conditioning has changed demographics, too. It’s hard to imagine the rise of cities like Dubai or Singapore without it. As residential units spread rapidly across America in the second half of the 20th century, the population in the “sun belt” – the warmer south of the country, from Florida to California – boomed from 28% of Americans to 40%. As...

Read More »Cochrane Fails to Make His Case for the Trump Tax Cut Again

Cochrane Fails to Make His Case for the Trump Tax Cut Again John Cochrane recently noted: Stock Buybacks Are Proof of Tax Reform’s Success… A short oped for the Wall Street Journal here on stock buybacks. As usual, they ask me not to post the whole thing for 30 days though you can find it ungated if you search. I did search and found this. Does the Wall Street Journal get the fact that rebutting weak arguments against a policy are not exactly making an...

Read More »A thought for Sunday: the march of demographics and the 2018 midterms

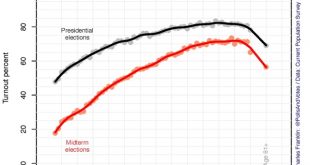

(Dan here…Better late than never!) A thought for Sunday: the march of demographics and the 2018 midterms Below is a graph showing that the older the demographic (up until age 80), the bigger the turnout during midterm elections. The data behind this graph isn’t just from 2014, but from a series of midterm elections over time — in other words, it has been durable over time. My purpose in this post is show that, even if these percentages hold in this...

Read More »Jeffrey Sachs on Trump’s Trade Fallacies

Jeffrey Sachs on Trump’s Trade Fallacies I heard on some news show an incredibly stupid statement from our President earlier today and in utter disbelief fired off this comment on some blog: Trump equates our trade deficit with us being ripped off. Let’s do this as a simple example. You walk into Best Buy and purchase a $1000 computer but do not have cash. So you put it on your credit card incurring a $1000 liability. Even though you now have the...

Read More »Eastern Economic Association Conference

Eastern Economic Association Conference So, I returned late last night from Boston where I presented three papers at the 44th Eastern Economic Association conference. Only about 70% of those preregistered made it due to weather, with airport and train station both closed on Friday, first full day of conference. One of those who did not make it was James Galbraith, scheduled to give the first Godley-Tobin plenary lecture, sponsored by the Review of...

Read More »Saudi Crown Prince Tortures Fellow Princes

Saudi Crown Prince Tortures Fellow Princes A new report by Hugh Miles at Middle East Monitor, Is the “Saudi Elite Cannibalizing Itself?” by Juan Cole, reports the recent purge of supposedly corrupt princes and high officials was (and continues to be) much more horrendous than previously reported, which I fear does not surprise me. Apparently Crown Prince Mohammed bin Salman (MbS), whom I have previously posted about here, hired mercenaries to...

Read More » Heterodox

Heterodox