by New Deal democrat February update: real wages and real spending Now that we have February inflation, let’s take an updated look at real wages and real spending. First of all, real average hourly wages increased slightly in February, but are still -0.6% under their July peak: But, because the total hours worked surged so much in February, real aggregate wage earnings, which had stalled since July, rose to a new record: If it’s not revised...

Read More »Real trade balance and 1st Q real GDP growth

(Dan here. Spencer sends this e-mailed post): by Spencer England Real trade balance and 1st Q real GDP growth Figure 1 With the federal deficit jumping from 3.5% to 5% of GDP the US will be expanding its current account deficit by a like amount. You can see it in the January trade balance where the real trade balance has expanded from around $60,000 ( real 2009 ) to around $70,000 ( real 2009 ) or 16%. The real trade deficit is the flip side of the...

Read More »Trump on Our Trade Surplus/Deficit With Canada

Trump on Our Trade Surplus/Deficit With Canada Menzie Chinn listens to the latest from Donald Trump so we don’t have to: And by the way, Canada? They negotiate tougher than Mexico. Trudeau came to see me, he’s a good man, he said we have no trade deficit with you, we have none. Donald, please. Nice guy, good looking guy. Comes in. Donald we have no trade deficit. He’s very tough. Everyone else, getting killed or whatever. But he’s tough. I said, well...

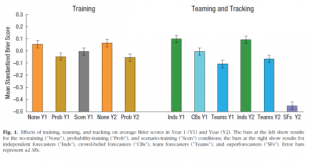

Read More »The Simpsons’ Predictive Powers Demonstrate the Limits of Forecasting

by Jeff Soplop (Dan here…not so heavy post) The Simpsons’ Predictive Powers Demonstrate the Limits of Forecasting The long-running TV show The Simpsons is attracting much attention for some of its uncannily accurate predictions. The United States’ curling team’s defeat of Sweden in the Olympics – something The Simpsons predicted in 2010 – being the most recent example. And, of course, there is the notorious episode from 2000, which referenced a Trump...

Read More »Real M1 and M2 growth the lowest since 2010

by New Deal democrat (Dan here … lifted from Bonddad) Real M1 and M2 growth the lowest since 2010 In view of yesterday’s inflation report, I take a look at the recent big deceleration in both real M1 and M2 over at XE.com.

Read More »Kudlow Predicts An Investment Boom

Kudlow Predicts An Investment Boom Kudlow channels his inner Gerald Friedman: Larry Kudlow, picked to be President Trump’s new economic adviser, has privately told the White House that the nation’s economy is on the verge of 4 percent to 5 percent growth, or more than double the last decade. In a recent gathering with Trump, he said that many firms held back investing until the tax reform package passed and “some of that is already showing up.” What’s...

Read More »The Grand Illusion 2.0

The Grand Illusion 2.0 Introductory note: this is a very long epistle. But I think my point needs to be made fully and at length. Before you go further, in fairness here is the TL:DR version: Advocates of free trade and globalization were taken aback a week ago by the assumption by China’s President Xi Jinping of rule for life. This was because it runs completely contrary to their theory that free trade leads to economic liberalization, which in turn...

Read More »Wealth and the National Accounts: Response to Matthew Klein

by Steve Roth (via Asymptosis) Wealth and the National Accounts: Response to Matthew Klein I’m both abashed and delighted that the truly stand-out econ writer Matthew Klein has offered wonderfully fulsome praise of one of my pieces, Why Economists Don’t Know How to Think about Wealth, and some very interesting discussion as well. Some responses here. Please excuse me if I repeat some of the points from the first article. >His key point is that...

Read More »Kudlow

Kudlow Menzie Chinn notes: Mr. Kudlow is apparently on the short list for new National Economic Committee chair. Maybe a good time to review some of his macro predictions. Yours truly goes back memory lane: But let’s turn back the clock to the first term of the Bush43 Administration when Kudlow writing for the National Review was all in defending Bush’s fiscal stimulus and arguing at several points how the labor market was booming even when it was not....

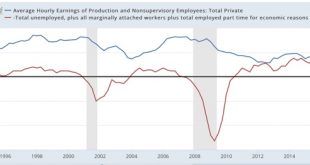

Read More »Labor force participation, unemployment, and wages: an update

Labor force participation, unemployment, and wages: an update About a year ago I wrote a series of posts on the relationship between the unemployment rate, labor force participation, and wage growth. Especially in view of last Friday’s jobs report, which showed blockbuster hiring, but a continuation of tepid wage growth over 8 years into the expansion, now is a good time for an update. To recapitulate, history shows that wage growth is lags the economy,...

Read More » Heterodox

Heterodox