The Coordinated Activity Theory of the Firm I just got around to posting this paper on SSRN, although it was written a couple of years ago. I need to cite it for other work I’m currently doing, so it has to be out there, somewhere. It is a more concise version of the theory than previous renditions and stays closer to the main point. What it shows: There is a simple explanation for why firms exist, why they have the boundaries they have, and why they...

Read More »LOLFF on TED

LOLFF on TED In a TED talk, “3 myths about the future of work and why they are not true” from December 2017, Daniel Susskind channels Sandwichman: Now the third myth, what I call the superiority myth. It’s often said that those who forget about the helpful side of technological progress, those complementarities from before, are committing something known as the lump of labor fallacy. Now, the problem is the lump of labor fallacy is itself a fallacy, and...

Read More »A note of caution about opinion surveys with voluntary associations

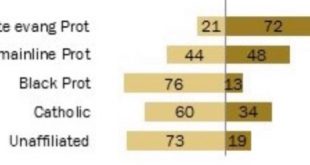

A thought for Sunday: a note of caution about opinion surveys with voluntary associations I read a Pew Research study a few days ago with a startling statistic: aside from self-identified Republicans, the single group most strongly approving of Trump was white evangelical Protestants (dark is approval, light is disapproval): This is mind-numbing, especially when you consider the ad hoc contortions of morality that are involved in excusing all of...

Read More »MMT and the Wealth of Nations, Revisited

by Steve Roth (at Asymptosis) I just had occasion, in replying to a correspondent, to reiterate much of the thinking in my recent MMT Conference presentation. I thought it might be a useful and comprehensible form for some readers, so I’m reproducing it here. I’ve also explained this at somewhat painful length here. Correct me if I am wrong but what you are saying extends MMT into the private sector. The govt boosts balance sheets with stimulative fiscal...

Read More »The Unsolved Riddle of Poverty Reduction

The Unsolved Riddle of Poverty Reduction A submission to the B.C. Poverty Reduction Strategy engagement process March 23. 2018 “What makes one poor is not the lack of means. The poor person, sociologically speaking, is the individual who receives assistance because of the lack of means.” – Georg Simmel “A tight labor market is important for all workers, but especially for historically disadvantaged groups.” – Janelle Jones, Economic Policy Institute...

Read More »JOLTS revisions paint brighter labor market picture

JOLTS revisions paint brighter labor market picture Last Friday’s JOLTS report for January included some important revisions, particularly with regard to hiring. So let’s take a closer look.As a refresher, unlike the jobs report, which tabulates the net gain or loss of hiring over firing, the JOLTS report breaks the labor market down into openings, hirings, firings, quits, and total separations. I pay little attention to “job openings,” which can...

Read More »Facebook, Cambridge Analytica, and the Economics of Privacy

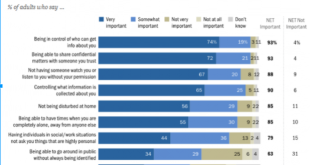

By Jeff Soplop Facebook, Cambridge Analytica, and the Economics of Privacy Cambridge Analytica – the data firm that provided consulting services for the Trump Campaign – has come under intense scrutiny for the firm’s capture and exploitation of vast quantities of user data from Facebook. These practices have added new urgency to questions about how information is collected online and how to protect users’ privacy rights. From The New York Times: “The firm...

Read More »Import and export growth and an expanding trade deficit do not need a strong dollar.

Import and export growth and an expanding trade deficit do not need a strong dollar. We have had some discussions about dollar weakness and questions for those of us who expected the federal deficit to lead to a larger current account deficit through a strong dollar. I’ve looked at the data in a different way and now wonder if we really need a change in the dollar to achieve a larger current account deficit. If you look at real imports and exports you...

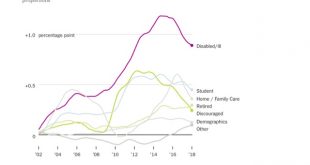

Read More »Prime age labor force participation: disability and homemaking decline

Prime age labor force participation: disability and homemaking decline About a year ago I wrote a series of posts on various reasons for the relatively low labor force participation by prime age individuals, and its effect on wages; In my post summing up that study I wrote: A major element of the participation rate is comparison with other alternatives to being in the labor force. Two alternatives to labor participation appear to have had a...

Read More »The dollar has devalued since Trump became President

Lifted from comments by PGL: The dollar has devalued since Trump became President: https://fred.stlouisfed.org/series/TWEXB Barry Eichengreen has some interesting thoughts here: https://www.project-syndicate.org/commentary/what-explains-dollar-weakness-by-barry-eichengreen-2018-03 “One of the big ones in the circles I frequent is dollar weakness. Between January 2017 and January 2018, the broad effective exchange rate of the dollar fell by 8%,...

Read More » Heterodox

Heterodox