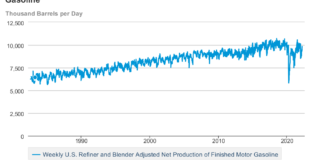

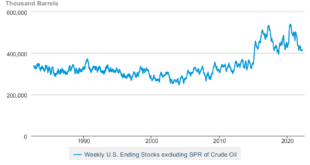

RJS, Focus on Fracking, US oil supplies are at a 13½ year low, but oil exports are at a 8 month high; SPR at a 19½ year low after biggest draw since Aug 2011, gasoline exports at a 39 month high; distillate supplies at a 95 month low, total oil + products supplies at a 95 month low after across the board drawdowns. The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the...

Read More »Bedfellows

To be very clear; there is no chance (as in zero, nada, ganz sicher nicht, rien, none) that NATO will invade Russia. Never was. There is no chance that the United States would ever invade Russia (everyone knows we only invade much smaller countries). No one knows the both better than Vladimir Putin. The fear of invasion by NATO, the EU, or the United States was not why he invaded Chechnya, Georgia, and now Ukraine. Putin invaded Ukraine because,...

Read More »Org-Dimensional Man

Org-Dimensional Man In 1959, Harold Rosenberg wrote the essay “The Orgamerican Phantasy,” published in The Tradition of the New. Rosenberg’s essay criticized the “post-radical” self-absorption of several of the same authors — William H. Whyte, C. Wright Mills, and Vance Packard — that Herbert Marcuse would subsequently praise in the Introduction to One-Dimensional Man for the “vital importance” of their work. In Vance Packard and American Social...

Read More »Why War Might Go On Longer

Why War Might Go On Longer An unfortunate reason the current war in Ukraine might go on longer than it should (with the should here being that it should never have happened in the first place, and the sooner it stops the better, with the onus here clearly on V.V. Putin to stop it as he started it without any justification), is that wartime leaders get a puff in their popularity at least for awhile and are let off the hook on domestic problems. ...

Read More »1974 Redux?

1974 Redux? The stock of Thomas Robert Malthus rises and falls with the real price of food. He was not the inventor of his theory of population, a point that Karl Marx threw at him among other criticisms, with such people as James Anderson and Benjamin Franklin preceding him with pretty much the entiretly of his theory. But his timing was much better, publishing the flawed first edition of his Essay on the Principle of Population in 1798, a year...

Read More »Despite OPEC shortfall, first global oil surplus of 360,000 barrels per day

RJS, Focus on Fracking; Oil prices went on another wild ride, but i’m going to copy what I wrote on the monthly OPEC report here. The oil surplus, albeit small, surprised me. If it was going to happen, it would be during the winter for most of the planet’s driving population. Note this is for February, before the Russian sh*t really hit the fan . . . February global oil surplus of 360,000 barrels per day is first in 13 months, despite OPEC...

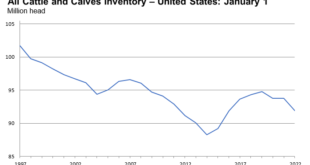

Read More »First Quarter ’22 Cattle & Ranch Report

Green grass is growing finally down south as some rainfalls are being received east of the Colorado River, not that Colorado River, the other one that moves through Austin, and has very little to do with it’s namesake. Grass growing in the spring brings on the grazing and let’s the ranchers get off the expensive feed. Now is also the time to sow sorghum for the herds to clear in the next few months. Net, net it’s still an expensive business to be...

Read More »Really Awful “Rhetoric”

Really Awful “Rhetoric” “Rhetoric” in quotes because it may not be just that. I have not been posting much, partly because I had a wedding for daughter, Sasha, last weekend, but also because I am seriously demoralized by the current situation, and every time I think I have something intelligent to say about the economics of it, that seems to keep changing, although I shall soon. Anyway, I have to get off my chest what I have heard from my...

Read More »Mixed Bag; Crude Oil, SPR, Oil and Product Supply, Distillates, etc.

RJS, Focus on Fracking, Commercial crude supply rise as SPR falls to 19½ year low, total oil + products supply at new 95 month low; exports of distillates at a 20-month high after largest drop in domestic demand in 18 months The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending March 11th indicated that even after a big increase in our oil exports, we...

Read More »Why Is Germany Increasing Defence Spending ?

Recently we have learned that the Russian military is vastly less capable than anyone imagined. Also in three whole weeks Ukrainians have markedly reduced the capabilities of the Russian military. Therefore, naturally many governments (including the German government) have decided they must spend more on their militaries to face the Russian threat. This makes no sense. To deal with Russian Germany needs liquified natural gas terminals and...

Read More » Heterodox

Heterodox