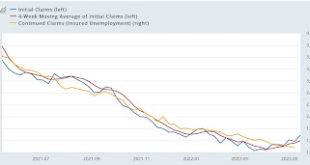

Initial claims: a little cooling in the white hot employment market Initial jobless claims rose 21,000 to 218,000, continuing above the recent 50+ year low of 166,000 set in March. The 4 week average also rose by 8,250 to 199,500, compared with the all-time low of 170,500 set six weeks ago. On the other hand, continuing claims declined another -25,000 to 1,317,000, yet another new 50 year low (but still well above their 1968 all-time low of...

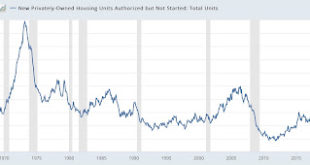

Read More »Housing still an economic positive over the next 12 months

Housing permits and starts decline slightly, but housing still an economic positive over the next 12 months Housing permits and starts declined, but not by much, in April. Importantly, while typically permits, especially single family permits, lead these series, in the past year there has been a unique divergence between permits and starts due to construction supply shortages. This has been reflected in the number of housing units...

Read More »Corporate profits have contributed disproportionately to inflation.

Economic Policy Institute offers an explanation that our current inflation is different from previous recessions in the US in addition to what NDd and Barkley Rosser offer : Since the trough of the COVID-19 recession in the second quarter of 2020, overall prices in the NFC sector have risen at an annualized rate of 6.1%—a pronounced acceleration over the 1.8% price growth that characterized the pre-pandemic business cycle of 2007–2019....

Read More »Real retail sales signal further expansion, but also continue to suggest slower payrolls growth ahead

Real retail sales signal further expansion, but also continue to suggest slower payrolls growth ahead Nominal retail sales for the month of April were up 0.9%, and previous months were revised higher. That means that, after inflation, real retail sales for April were up 0.6%, a very positive number. Yesterday I wrote that, rather than a YoY comparison with last April, during the stimulus spending spree, the more important comparison was...

Read More »What Is the Worst Part of the Current Inflation?

What Is The Worst Part Of The Current Inflation In the US we may have seen the peak of overall inflation, with the annualized CPI rate increasing at 8.3% in April, down from 8.5% in March, the highest rate of increase in 40 years. The issue has become the reported top concern of the US public, according to polling, with the hot job market apparently not offsetting the concerns that have arisen due to the emergence of this high rate of...

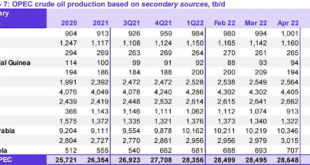

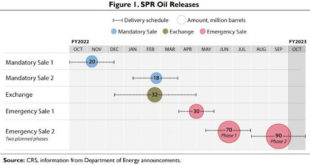

Read More »SPR and Distillates Low, Global Oil Surplus in April, Natural Gas Rigs High

RJS: Focus on Fracking Summary: Strategic Petroleum Reserve at a 21 year low, distillates supplies at a 17 year low; 300,000 bpd global oil surplus in April, despite loss of 1.2 million bpd from Russia & Kazakhstan; natural gas rigs at a 32 month high.. OPEC’s Report on Global Oil for April Thursday of this week saw the release of OPEC’s May Oil Market Report, which includes details on OPEC & global oil data for April, and hence it...

Read More »April’s consumer and producer prices; March wholesale sales

RJS, MarketWatch 666 Summary: Producer Prices Rose 0.5% in April; Record Annual Increase of 16.3% for Final Demand for Goods The seasonally adjusted Producer Price Index (PPI) for final demand rose 0.5% in April, as average prices for finished wholesale goods rose by 1.3% while final demand for services was unchanged . . . that increase followed a revised 1.6% increase in March, when average prices for finished wholesale goods rose by 2.4% and...

Read More »Farm & Ranch Quick Market Update

Harvest season has sprung upon us in a hurry. We had to spend a few evenings in the fields collecting squash, zucchini, cucumbers, and even dug up all of the potatoes, among the multitude of other things we planted this spring and continue to plant. It’s been a busy few weeks that have been hard both physically as well as mentally due to market conditions but we will get to that. Current Macro ag is coming in hot. Commodities futures are up...

Read More »SPR at a 21-year low, Distillates at a 17 year low

RJS, Focus on Fracking Summary: Strategic Petroleum Reserve at a 21-year low, distillates supply at a 17-year low The Latest US Oil Supply and Disposition Data from the EIA US oil data from the US Energy Information Administration for the week ending May 6th indicated that after another drop in our oil exports, another oil withdrawal from the SPR, and an increase in oil that could not be accounted for, we again had oil to add to our stored...

Read More »Decreased Pricing for Container Shipping

Having run a warehouse for a major $12 billion automotive component corporation, I can relate to container shipping globally. We shipped full containers to a number of countries on a weekly and monthly basis. This was dependent upon production demand. Reporting good news, a trend, and extreme profits? Peak of container shipping’s epic boom already passed? Hapag-Lloyd: The fifth-largest container line sees signs the market peaked back in the...

Read More » Heterodox

Heterodox