from Lars Syll [embedded content] Absolutely lovely! Comedian and television host Jon Stewart turns out to know much more about real-world economics than mainstream Harvard economist Larry Summers. Don’t know why, but watching this interview/debate makes yours truly come to think about a famous H. C. Andersen tale …

Read More »Blog Archives

The Money Illusion Exposed

Hawley Announces First Bill in Worker’s Agenda to Rebuild America: Ending Normal Trade Relations with China Act — U.S. Senator Josh Hawley (R-Mo.)

Today U.S. Senator Josh Hawley (R-Mo.) announced the first piece of legislation in his new Worker’s Agenda to Rebuild America. The Ending Normal Trade Relations with China Act would revoke China's normal trade relations status to reduce our dependency and protect America’s working class.China is America’s greatest adversary. To win the fierce economic competition for jobs, industry, and the future, America must return to the long-standing formula for American success: strong and independent...

Read More »The Fed’s New Supply Chain Pressure Gauge just went Negative — run75441

Some indication that supply-chain issues are normalizing. If the trend persists, this would portend lower supply-side inflationary pressure.Angry BearThe Fed’s New Supply Chain Pressure Gauge just went Negativerun75441Also by run75441Medicare Advantage uses Algorithms to block care for Seniorsrun75441

Read More »William I. Robinson, Can Global Capitalism Endure? — Book review by Elna Tulus

It should be obvious to just about anyone by now that transnational capitalism cannot survive in its present form if humanity is to survive. The amount of negative externality that is not priced in is too great. Markets are not a mechanism that delivers accurate economic calculation, contrary to what Hayek argued in his Nobel Prize Lecture (1974), and is now widely accepted as received wisdom. Valuation is biased by failing to consider true cost and reliance on this is leading to more...

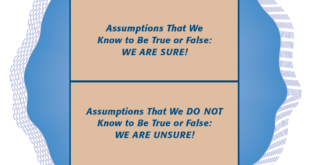

Read More »Assumption uncertainty

An ongoing concern is that excessive focus on formal modeling and statistics can lead to neglect of practical issues and to overconfidence in formal results … Analysis interpretation depends on contextual judgments about how reality is to be mapped onto the model, and how the formal analysis results are to be mapped back into reality. But overconfidence in formal outputs is only to be expected when much labor has gone into deductive reasoning. First, there is a need to feel...

Read More »Medicare Advantage uses Algorithms to block care for Seniors

Kip Sullivan has been writing about the issues with Medicare Advantage. I have joined with Kip in bringing the issues of Medicare Advantage to the forefront. Angry Bear has featured Kip and I have added to the dialogue. This next commentary details how Healthcare Insurance, mostly Medicare Advantage has been using artificial intelligence in the form of an algorithm to limit treatment or deny coverage. STAT Investigation has been providing the detail...

Read More »Average and aggregate nonsupervisory wages for February

Average and aggregate nonsupervisory wages for February 2023 – by New Deal democrat There’s no significant economic news today, so let’s update a couple of income indicators important to average American working households. Namely, because we now have the inflation report for February as well as payrolls, we can update average and aggregate nonsupervisory wages. Average hourly earnings for nonsupervisory employees increased 0.5% on a...

Read More »The Fed’s New Supply Chain Pressure Gauge just went Negative

Putting on a different hat today. My background includes supply chain management. I am look at what the industry experts are seeing and whether I agree with them. Much of what I have seen over the last two years is a repeat of 2008. We again are late to beginning issues. And again, we are waking up late to the beginning of the end of the same issues. No Cassandras amongst us. Good article . . . The Fed’s supply chain pressure gauge just went...

Read More »A Simple Solution to the Banking Crisis That No Country Will Implement

Though Silicon Valley Bank contributed to its own demise, the root cause of this crisis is the fact that private banks own government bonds. If they didn’t, then SVB would still be solvent. Its bankruptcy was the result of the price of Treasury bonds falling, because The Federal Reserve increased interest rates. As interest rates rise, the value of Treasury Bonds falls. With the resale value of its bonds plunging, the total value of SVB’s assets (which were...

Read More » Heterodox

Heterodox