When the banks fell over, they knocked the stuffing out of the British economy. The UK’s productivity has been dismal ever since. Unemployment has fallen to historic lows and wages are rising, but productivity growth remains near zero. This “productivity puzzle,” as it is known, has had economists scratching their heads for best part of a decade.But UK productivity is a tale of two halves. Experimental statistics recently released by the Office for National Statistics (ONS) reveal widely varying productivity levels across the UK. “Productivity grew in half of the 12 regions and countries of the UK in 2018,” says the ONS, “with output per hour increasing in both Scotland and the East Midlands by more than 2%; in contrast, output per hour fell in Yorkshire and The Humber and in Northern

Topics:

Frances Coppola considers the following as important: investment, productivity, trade, UK

This could be interesting, too:

Jeremy Smith writes UK workers’ pay over 6 years – just about keeping up with inflation (but one sector does much better…)

Merijn T. Knibbe writes The political economy of estimating productivity.

Merijn T. Knibbe writes In Greece, gross fixed investment still is at a pre-industrial level.

Merijn T. Knibbe writes ´Fryslan boppe´. An in-depth inspirational analysis of work rewarded with the 2024 Riksbank prize in economic sciences.

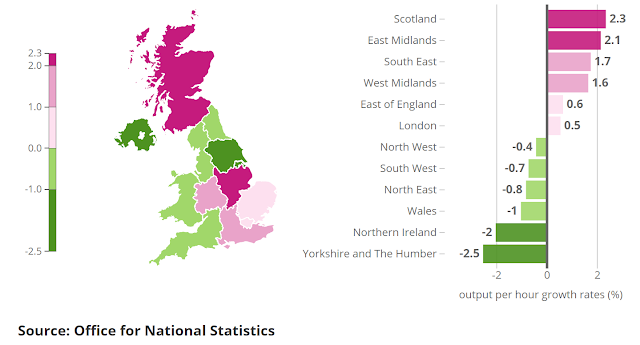

But UK productivity is a tale of two halves. Experimental statistics recently released by the Office for National Statistics (ONS) reveal widely varying productivity levels across the UK. “Productivity grew in half of the 12 regions and countries of the UK in 2018,” says the ONS, “with output per hour increasing in both Scotland and the East Midlands by more than 2%; in contrast, output per hour fell in Yorkshire and The Humber and in Northern Ireland by at least 2%.”

It would be easy to ascribe this stark divergence in productivity growth to the dominance of financial services and decline of manufacturing. Financial services are centred on London and to a lesser extent Edinburgh. The South East and the Midlands benefit from spillovers from London, and Scotland similarly benefits from spillovers from Edinburgh. The places losing out are traditional manufacturing and mining areas, which were gutted in the 1980s and have never recovered. It’s a neat explanation that fits well with the theory that the UK’s relative decline is due to the “finance curse,” a form of Dutch disease: an over-dominant financial services industry draining investment and talent from other industrial sectors and hampering exporters with an unnecessarily strong exchange rate. There is some support for this “finance curse” theory from IMF research showing that an over-large financial sector can be a drag on economic growth.

Those who subscribe to the “finance curse” theory say that if the financial services industry is cut down to size, manufacturing industries will recover, productivity growth will be restored, and Britain will be Great again. Or perhaps German again. Some people, particularly on the Left, seem to want the UK to become an export-led heavy manufacturing powerhouse like Germany.

At first sight, the ONS’s figures appear to support this theory. London and the South East are by far the most productive areas of the UK, exceeding average output per hour by (respectively) 36.1% and 9.1%. They are the only areas where output per hour exceeds the UK average. If this is entirely due to financial services, then cutting the financial services industry down to size would have a disastrous effect on UK productivity, at least in the short term. I suppose you can’t make an omelette without breaking eggs, but trashing the UK’s most productive industry doesn’t seem a great strategy for reversing the UK’s relative decline. Surely a better approach would be to find ways of raising investment, wages and productivity in other sectors?

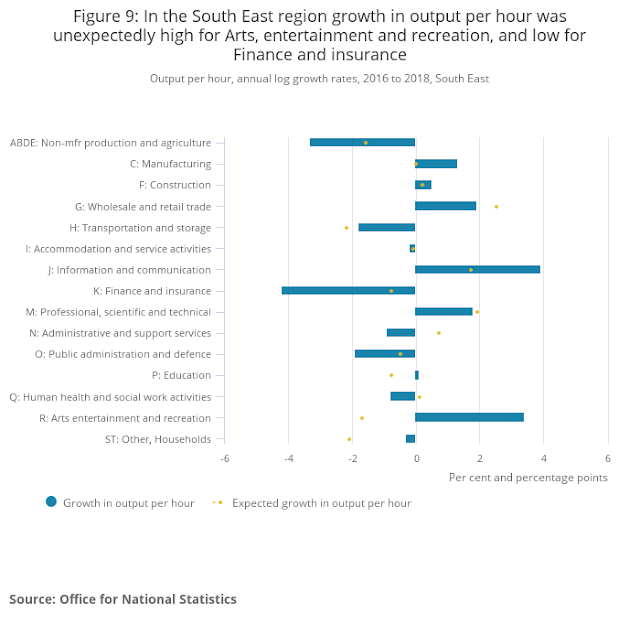

Fortunately – or unfortunately, depending on your point of view – the “finance curse” theory doesn’t stand up to close analysis, at least in these statistics. The ONS analyses UK productivity growth by industrial sector in two example regions, one dominated by financial services and the other a traditional manufacturing and mining area. The map above shows that the South East (financial services) is storming ahead, while Yorkshire & the Humber (manufacturing & mining) is declining.

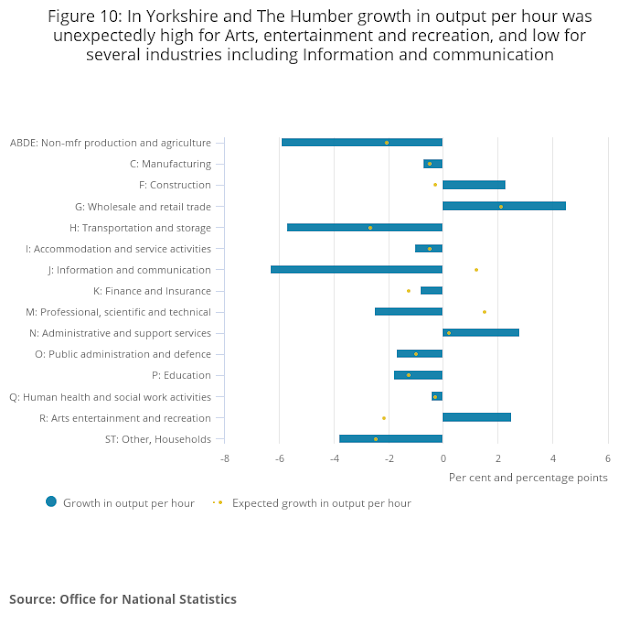

And Yorkshire & the Humber’s falling productivity isn’t primarily in manufacturing & mining, as might be expected. No, it seems to be technology. Information & communication output per hour dropped by over 6%. However, “arts, recreation and entertainment” was a bright spot, so perhaps technology growth isn’t quite as dismal in this region as the collapse of the information sector suggests.

This chart shows that Yorkshire and the Humber is suffering from falling productivity across most industries, including sharp falls in transportation and storage and in non-manufacturing production and agriculture. Productivity has fallen in these industries in the South East, too, though not as much. This could speak of an aggregate demand shortage, not so much within the UK (since wholesale and retail trade seems to be holding up) but outside it. When the external sector struggles, so does the transportation industry. If so, then the UK's "productivity puzzle" might be partly due to the slowdown in global trade that has been evident since the financial crisis - and is now worsening because of trade frictions, rising protectionism and the strong US dollar. But this doesn't explain the divergence between the regions. Why would Yorkshire and the Humber be more affected by a global trade slowdown than London, one of the largest trading hubs in the world?

No, there is something else going on. And to understand it, we need to look more closely at these charts. The yellow dots indicate that in certain sectors productivity growth is much lower than was expected, and in others it is much higher than expected. And there is regional divergence in these figures. Productivity in financial services, for example, is far worse in the South East than was expected, but in Yorkshire and the Humber financial services are performing as poorly as expected. Productivity in transportation and storage is far worse in Yorkshire and Humber than was expected, but in the South East is better than expected. And the most stark divergence is in information, where the forecasters appear to have completely misread the direction of travel.

This speaks to me of a supply-side slowdown due to investment collapse, particularly since the UK voted to leave the EU (hence poor performance relative to the pre-2016 trend). The investment axe seems to have fallen particularly hard on those areas that voted for Brexit. Belligerence towards the EU in those areas hasn't gone unnoticed. Investors are unforgiving, and attitudes matter.

The UK’s “tale of two halves” may in the past have been about over-dominant financial services and declining manufacturing & mining. But now, it seems to be more about technology. Technology is important in all industries. When there is inadequate investment in technology – perhaps coupled with over-reliance on cheap labour - productivity falls. So the UK’s productivity puzzle won’t be solved by cutting financial services and resurrecting the heavy manufacturing industries of the past. Substantial investment in technology and associated skills will be needed, particularly in the regions where productivity is falling across the board.

But investment alone will not be enough. Equally important will be openness to trade and labour mobility. Sadly popular opinion not only in the UK, but around the world, seems to be pushing governments towards protectionism and closed borders. I fear that even with the investment that the Government is talking about pouring into the North, it will remain depressed relative to London, the South East and Scotland for the foreseeable future. Rejuvenation of the North may prove to be yet another beautiful but unfortunately evanescent dream.

Related reading:

Why "get on your bike" may be the right message for the Blue Wall - CapX

Memo to Boris: Buses will only get you so far - UnHerd