October retail sales: consumers: “We’re not dead yet!” – by New Deal democrat Retail sales, my favorite consumer indicator, was reported this morning for October. And it was a good number, up +1.3% nominally, and up +0.5% after adjusting for inflation: On the bright side, this was the highest absolute number since April. On the down side, retail sales have still gone essentially nowhere for the last 18 months. As a result, YoY retail sales are only up +0.5%. Since real retail sales YoY have an excellent historical record of coinciding with imminent recession, here they are historically from 1997 through 2019, compared with real aggregate payrolls for non-supervisory employees, another excellent coincident indicator (gold), and also real

Topics:

NewDealdemocrat considers the following as important: Fed Chair Powell, Hot Topics, politics, recession, US EConomics, US/Global Economics

This could be interesting, too:

Robert Skidelsky writes Lord Skidelsky to ask His Majesty’s Government what is their policy with regard to the Ukraine war following the new policy of the government of the United States of America.

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Ken Melvin writes A Developed Taste

October retail sales: consumers: “We’re not dead yet!”

– by New Deal democrat

Retail sales, my favorite consumer indicator, was reported this morning for October. And it was a good number, up +1.3% nominally, and up +0.5% after adjusting for inflation:

On the bright side, this was the highest absolute number since April. On the down side, retail sales have still gone essentially nowhere for the last 18 months.

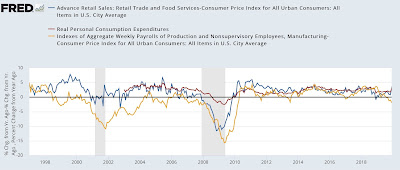

As a result, YoY retail sales are only up +0.5%. Since real retail sales YoY have an excellent historical record of coinciding with imminent recession, here they are historically from 1997 through 2019, compared with real aggregate payrolls for non-supervisory employees, another excellent coincident indicator (gold), and also real personal spending YoY (red):

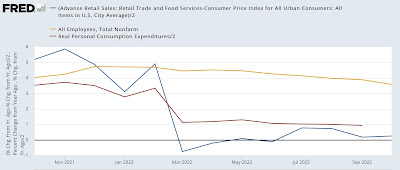

The latter historically has lagged somewhat, but is included because there is an excellent case that this year consumers have shifted from spending on goods, which are more reflected in retail sales, to spending on services, which are better picked up in the personal income series. Here’s the close-up of all three for the past year:

Real retail sales did go negative for several months in the spring, coinciding with the negative Q1 and Q2 real GDP reports, but have since turned slightly positive. As I noted the other day, real aggregate payrolls remain positive – although certainly not strong; and real personal consumption expenditures are still pretty robust.

Short conclusion: no recession yet.

Because real retail sales have also historically been an excellent short term indicator for payrolls, here is that comparison for the past year, together with real personal spending as well:

Although this month’s retail sales report was very good, it nevertheless continues to imply further weakening jobs reports in the months going forward.

So, a good report, but one that does not change the underlying decelerating trends.

“September real retail sales lay another egg,” – Angry Bear, angry bear blog