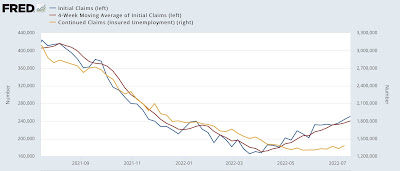

Increasing trend in jobless claims continues; on track to give recession warning in November Initial jobless claims rose another 7,000 to 251,000 last week, an 8 month high. The 4 week average rose 4,500 to 240,500, a 7+ month high. And continuing claims also rose 51,000 to 1,384,000, which is 78,000 above their 50 year low set on May 21: Three weeks ago I noted that reviewing the entire 50+ year history of initial claims, “there are almost always one or two periods a year where the four-week moving average of jobless claims rises between 5% and 10%. About every other year for the past 50+ years, it rises over 10%. Typically (not always!) it has risen by 15% or more over its low before a recession has begun. And a longer-term moving average of

Topics:

NewDealdemocrat considers the following as important: Featured Stories, initial jobless claims, recession, US EConomics, US/Global Economics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Ken Melvin writes A Developed Taste

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Increasing trend in jobless claims continues; on track to give recession warning in November

Initial jobless claims rose another 7,000 to 251,000 last week, an 8 month high. The 4 week average rose 4,500 to 240,500, a 7+ month high. And continuing claims also rose 51,000 to 1,384,000, which is 78,000 above their 50 year low set on May 21:

Three weeks ago I noted that reviewing the entire 50+ year history of initial claims, “there are almost always one or two periods a year where the four-week moving average of jobless claims rises between 5% and 10%. About every other year for the past 50+ years, it rises over 10%. Typically (not always!) it has risen by 15% or more over its low before a recession has begun. And a longer-term moving average of initial claims YoY has, with one exception, turned higher before a recession has begun.”

There is now a clear uptrend in all three numbers. The 4 week average of initial claims is about 40% higher than its low. If the present trend continues till about November, initial claims will be higher YoY, which would signal an imminent recession.

Just speculating here, but an entire very speculative sector of the stock market – internet-based delivery services – which boomed during the time of pandemic restrictions, has blown up. I suspect many of the increased layoffs are coming from that sector. Meanwhile more and more businesses are probably learning to make do with being short-staffed due to being unable to fill job openings. In any event, the rising trend in layoffs is very much intact. Because initial claims lead the unemployment rate, I fully expect to see an uptick in that rate in the next month or two.