UAW-automakers negotiations pit falling wages against skyrocketing CEO pay: U.S. auto companies have the means to invest in EVs, pay workers a fair share, and still earn healthy profits | Economic Policy Institute, epi.org, Adam S. Hersh. Yet they are not paying Labor it’s overdue fair share of wages. United Auto Workers (UAW) members at the “Big 3” companies of Ford, General Motors (GM), and Stellantis are waiting to strike this week. Their contracts expire September 14. It’s a historic and economically momentous time for this foundational industry in America’s industrial-technological base. The outcome of the negotiations has potentially profound implications for how successfully we tackle the climate crisis. The deep roots of the

Topics:

Angry Bear considers the following as important: 2023, automotive, Hot Topics, labor, Taxes/regulation, Unions, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

UAW-automakers negotiations pit falling wages against skyrocketing CEO pay:

U.S. auto companies have the means to invest in EVs, pay workers a fair share, and still earn healthy profits | Economic Policy Institute, epi.org, Adam S. Hersh.

Yet they are not paying Labor it’s overdue fair share of wages.

United Auto Workers (UAW) members at the “Big 3” companies of Ford, General Motors (GM), and Stellantis are waiting to strike this week. Their contracts expire September 14. It’s a historic and economically momentous time for this foundational industry in America’s industrial-technological base. The outcome of the negotiations has potentially profound implications for how successfully we tackle the climate crisis.

The deep roots of the UAW’s current dissatisfaction share much with those taking labor actions to fight back after decades of rising inequality: The pay of typical workers has lagged far behind more-privileged actors in our economy, and the reason for this growing inequality is an erosion of workers’ leverage and bargaining power in labor markets. After surveying the recent trends in auto industry wages, corporate profits, and executive compensation, it is hard to blame workers for standing up now. It’s also clear the companies have more than enough means to meet worker demands, remain profitable, and make the necessary investments to grow into electric vehicles. In fact, the “Big 3” companies can ill-afford not to recruit and retain talented workers in a rapidly transforming industry.

In the 2008 auto industry crisis, GM and Chrysler (now Stellantis) agreed to bankruptcy and government-supported restructuring. While this deal saved jobs throughout the auto sector, it came with steep costs to workers. Union workers agreed to a wage freeze, entry of lower-wage “tiered” workers, and other concessions affecting retiree pensions and health care benefits.1 In 2009, the companies suspended contractual cost of living adjustments and have not had one since. Since that time, average consumer prices have increased nearly 40% and autoworker wages have not come anywhere close to keeping up.

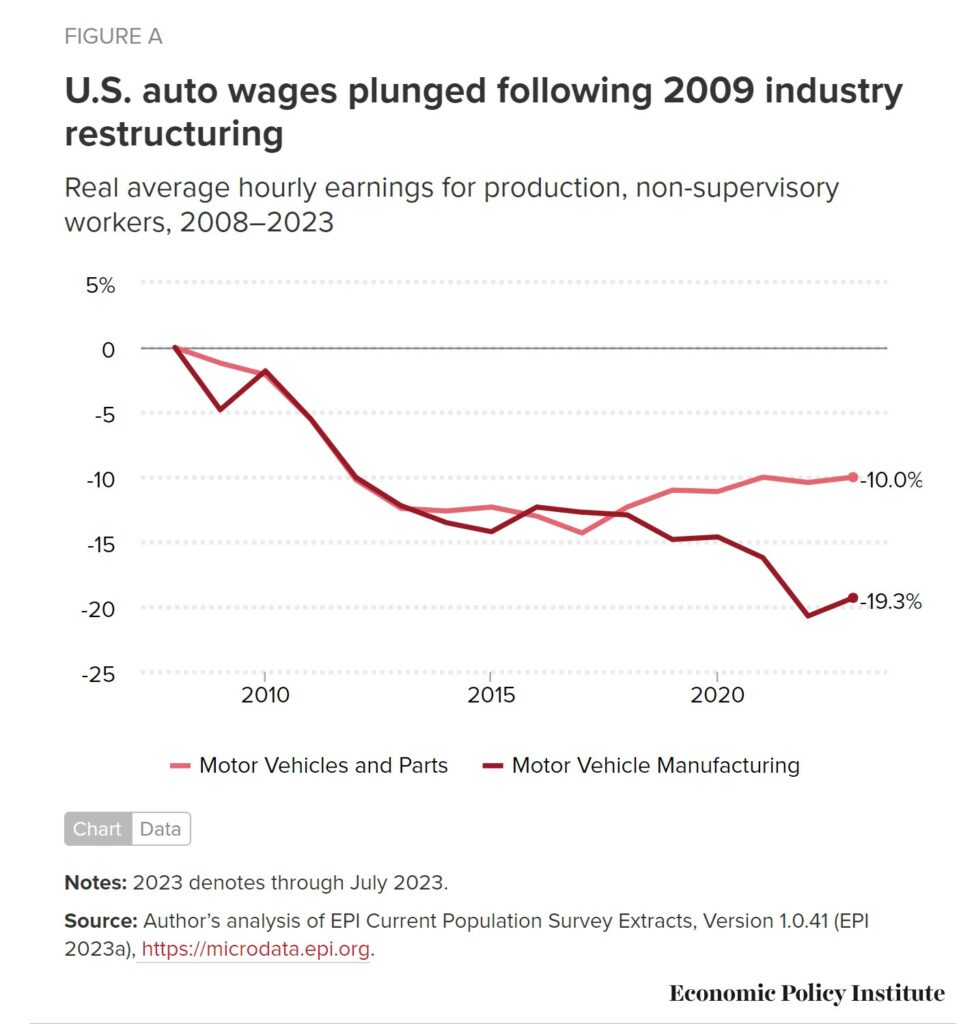

As unionized auto wages fell behind, so did non-unionized auto wages. This spillover effect of wage suppression of union workers filters out into the broader economy. It damages the wages of non-union workers as well and is a key dynamic driving U.S. inequality in recent years. Bureau of Labor Statistics data in Figure A show that production and non-supervisory workers across the broader motor vehicle industry, union and non-union, have taken it on the chin since the 2009 deal. Those working in motor vehicle manufacturing saw their average hourly earnings fall 19.3% since 2008, after adjusting for inflation. The broader motor vehicle parts industries impacted by outsourcing strategies have long compressed industry wage structures and thus didn’t have as far to fall. Average earnings fell 10% in real terms.

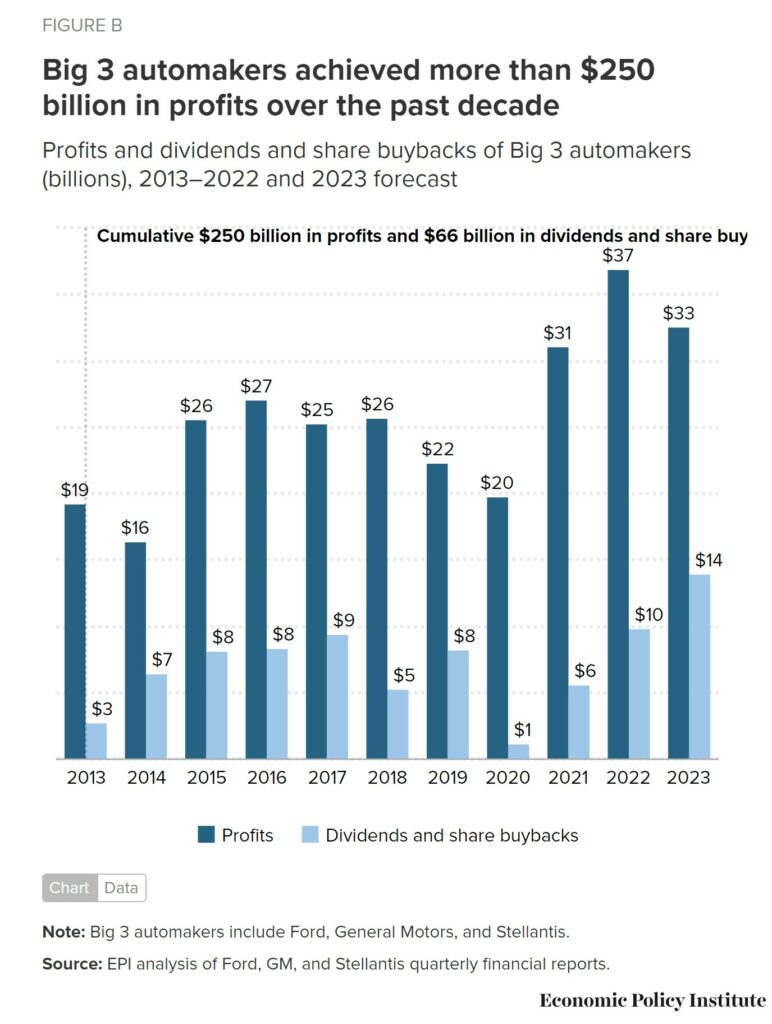

The U.S. Treasury held stakes in GM and Chrysler through the Troubled Asset Relief Program. The companies refrained from paying out CEO bonuses, shareholder dividends, and engaging in share buybacks to pump up stock prices. But after Treasury exited the restructured companies beginning in late 2013, they were free to resume their financial games, and it shows in Figure B (below).

From 2013 to 2022, the combined profits at the Big 3 are up 92%, an accumulated $250 billion in total. Forecasts for 2023 expect more than $32 billion in additional profits. Separately, Big 3 firm financial data show CEO pay is up by 40% and that they paid out nearly $66 billion in dividend payments and share buybacks over the same time period. Sustained profits over the past 14 years indicate that the Big 3’s financial performance is on solid footing, and not the result of temporary factors like pandemic price-gouging. Already this year, the Big 3 have paid out another $14 billion in dividends and share buybacks.

Companies complain paying workers more would put them at a competitive disadvantage. But even after making their research and development (R&D) and capital expenditures, the Big 3’s $250 billion in profits since 2013 amounts to nearly $1.7 million for each of the roughly 150,000 workers covered by UAW collective bargaining agreements.

What’s more, the automakers are set to receive record taxpayer-funded incentives to support their expansion into electric vehicle (EV) manufacturing. Business tax credits and government-backed loans provided by the 2022 Inflation Reduction Act (IRA) are there for the taking. Bipartisan infrastructure law will substantially boost the profitability of the companies’ investments in developing new EV technologies, expanding and retooling manufacturing facilities, and manufacturing critical EV components. While not directly receiving the tax credit, Big 3 producers will reap some of the benefits of consumer tax credits for purchasing and leasing EVs. These credits will boost consumer demand for the output of auto companies, giving them more scope to take profits.

Those of us invested in a fast and fair green transition know that this cannot succeed without the support of green manufacturing workers and their communities. If EV transition policies are seen as creating benefits that are shared broadly, it will provide a model for necessary transitions in other realms of the economy to proceed with speed and justice. If, instead, the EV transition is used as one more opportunity for the Big 3 to undercut its unionized workforce, political support for other necessary transitions will be slow. The wave of investment and jobs unleashed by the world racing toward EVs and other clean fuel vehicles is a potential opportunity for all. The UAW negotiations are one way to make sure this potential is achieved.

Instead, the Big 3 seem hell-bent on finding new ways to end-run their workers with outsourcing and joint ventures where large swaths of the IRA funds will flow. In a union suppression bluff, companies maintained (wrongfully) that the 2007 U.S.–Korea Free Trade Agreement provisions prevent unions from organizing in their joint ventures with Samsung and LG (it does not). Management’s vulgar attempt at subterfuge belies their real motives: keeping to themselves as much of their outsized treasure as possible.

Despite all the company tricks, there is more than enough money for them to make EV investments, to pay their workers a fair share, and to maintain healthy profits. Their interests would be better served. If they quickly were resolving these negotiations, building our transportation future with their own workers fully vested in a shared vision, and signaling to workers in competing foreign “transplant” producers and new upstarts like Tesla what their labor is really worth.

This would mean providing the job stability needed to attract the best workers forging real partnerships on the shop floor. This instead of squeezing their workforce, management could be reaping the benefits of higher productivity and adaptability needed to thrive in the transition. And it means sustaining smart policies to manage industry upheaval into reinvigorated industrial foundations. The outcome of this year’s UAW negotiations will prove a turning point in the fight for the high-road jobs in this economically critical sector.

We will have to see which pathway the Big Three automotive companies go down. Unless something has occurred the 14th was the deadline.