Industrial and manufacturing production continue to falter – by New Deal democrat I frequently call industrial production the King of Coincident Indicators, because so often the turning point in this metric has been at the peaks and troughs of the economy as a whole. That has not been the case since last September, when this indicator last peaked. And it continued its declining trend in June. Total production declined -0.5%, and manufacturing production declined -0.3%: On a YoY basis, total production is down -0.4%, and manufacturing production is down -0.3%: As you can see, up until the recent past, such declines had almost always been recessionary. But since the “China shock” that began in 1999, there have been similar production

Topics:

NewDealdemocrat considers the following as important: Hot Topics, King of Coincident Indicators, manufacturing, New Deal Democrat, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Industrial and manufacturing production continue to falter

– by New Deal democrat

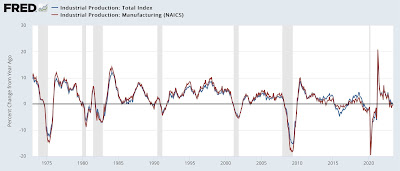

I frequently call industrial production the King of Coincident Indicators, because so often the turning point in this metric has been at the peaks and troughs of the economy as a whole. That has not been the case since last September, when this indicator last peaked.

And it continued its declining trend in June. Total production declined -0.5%, and manufacturing production declined -0.3%:

On a YoY basis, total production is down -0.4%, and manufacturing production is down -0.3%:

As you can see, up until the recent past, such declines had almost always been recessionary. But since the “China shock” that began in 1999, there have been similar production declines that have not spread out into the wider economy.

Finally, here’s a look at the sub-sector of motor vehicle production:

This series is noisy, so while the big decline played a role in the declines in both total and manufacturing production in June, there is simply no way to know if this is simply one bad month, or the beginning of a downward trend.

The bottom line is that this important indicator continues to be negative. Recession has been avoided – at least so far – because of resolving supply bottlenecks in vehicle production and housing construction, and robust spending on services. As we saw above, June was a poor month for vehicle production. We’ll find out about housing construction later this week.

Industrial production continues to falter in May, Angry Bear, New Deal democrat