June retail sales continue to falter, with the important exception of motor vehicles – by New Deal democrat As usual, retail sales is one of my favorite indicators, because it tells us so much about the 70% of the US economy that is consumption, as well as being a short leading indicator for employment. It has been faltering for the past year, and June was no different. Last month retail sales increased 0.2% nominally, but because consumer prices also increased 0.2%, real retail sales were unchanged: In real terms, retail sales remain -3.1% below their 2021 peak. The YoY comparisons, which have been very negative, continued to be negative, although slightly less so. The below graph also shows real personal consumption on goods, which

Topics:

NewDealdemocrat considers the following as important: Hot Topics, New Deal Democrat, Retail sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

June retail sales continue to falter, with the important exception of motor vehicles

– by New Deal democrat

As usual, retail sales is one of my favorite indicators, because it tells us so much about the 70% of the US economy that is consumption, as well as being a short leading indicator for employment. It has been faltering for the past year, and June was no different.

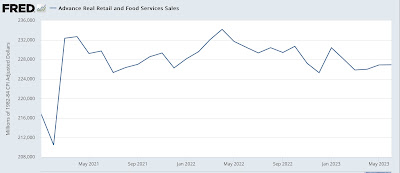

Last month retail sales increased 0.2% nominally, but because consumer prices also increased 0.2%, real retail sales were unchanged:

In real terms, retail sales remain -3.1% below their 2021 peak.

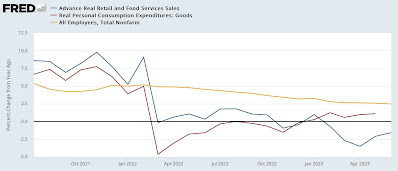

The YoY comparisons, which have been very negative, continued to be negative, although slightly less so. The below graph also shows real personal consumption on goods, which tends to closely track real retail sales, although with a different deflator which tends to make it more positive:

Although I won’t show the long term graph, the simple fact is that, going back 75 years, with rare exception a YoY decline of 2% in real retail sales has been recessionary.

Since real retail sales tend to lead the trend in employment by several months, nonfarm payrolls are also shown above in gold. The indication is that the deceleration in YoY employment gains is going to continue in the coming months.

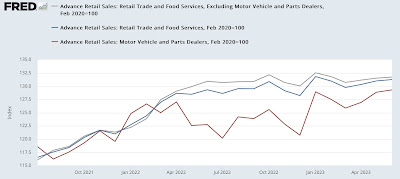

Finally, because a unique aspect of the current economic environment is the outsized role played by motor vehicle sales, which had been severely constrained by supply shortages – leading to outsized price increases as well – here is the comparison among nominal total, motor vehicle, and sales ex-motor vehicles for the past several years, all normed to 100 as of just before the pandemic recession of 2020:

Note again that the above graph is nominal, not real, and is shown for comparison among the sectors. Real sales of motor vehicles increased 0.1% in June. This sector continues to be a boon for the economy, and – along with robust real spending on services, which aren’t part of retail sales – an important reason why no recession has occurred yet.

Real retail sales continue to suggest recession, decelerating employment gains, Angry Bear, New Deal democrat