Sales lead employment: real aggregate payrolls update – by New Deal democrat The drought in new data ends tomorrow with consumer inflation. In preparation, let’s take a look at real aggregate payrolls. These increased 0.2% in December, one of the lower readings in the past 2 years: On a YoY basis, aggregate nonsupervisory payrolls increased 5.8%, compared with consumer inflation in November, which increased 3.1%: Recall that over the long term, real aggregate payrolls YoY have been an excellent coincident marker of recession: They have typically made a rounded peak roughly 6 months before its onset. With real aggregate payrolls being up over 2.5% in November, and at a new record, the expansion has remained on solid

Topics:

NewDealdemocrat considers the following as important: Employment, Hot Topics, January 2024, sales, US EConomics

This could be interesting, too:

NewDealdemocrat writes JOLTS revisions from Yesterday’s Report

Joel Eissenberg writes No Invading Allies Act

Bill Haskell writes The North American Automobile Industry Waits for Trump and the Gov. to Act

Bill Haskell writes Families Struggle Paying for Child Care While Working

Sales lead employment: real aggregate payrolls update

– by New Deal democrat

The drought in new data ends tomorrow with consumer inflation. In preparation, let’s take a look at real aggregate payrolls.

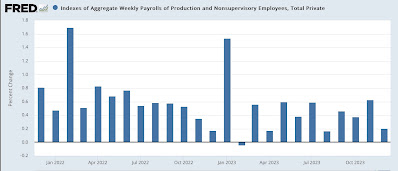

These increased 0.2% in December, one of the lower readings in the past 2 years:

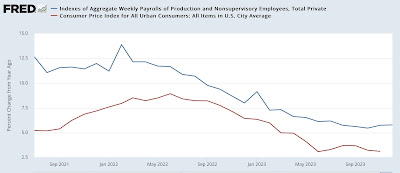

On a YoY basis, aggregate nonsupervisory payrolls increased 5.8%, compared with consumer inflation in November, which increased 3.1%:

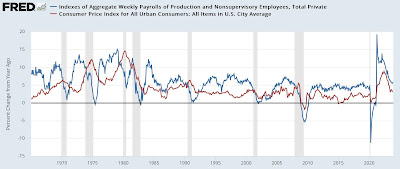

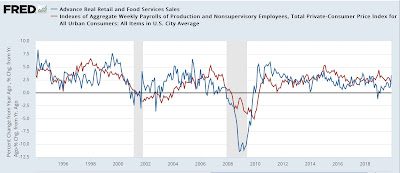

Recall that over the long term, real aggregate payrolls YoY have been an excellent coincident marker of recession:

They have typically made a rounded peak roughly 6 months before its onset. With real aggregate payrolls being up over 2.5% in November, and at a new record, the expansion has remained on solid footing.

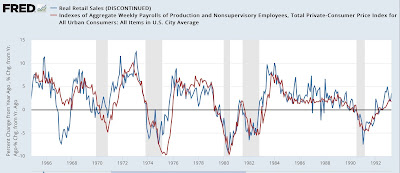

Yesterday I posted another installment of “consumption leads jobs,” so I decided to take a look comparing real retail sales (blue in the graphs below) with real aggregate payrolls. I’ve split it up into three historical segments for better visibility.

Here is 1965 through 1993:

Here is 1994 through 2019:

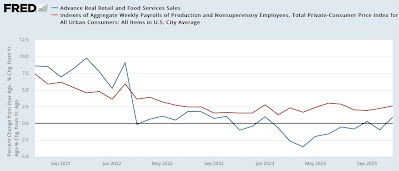

And here is the post-pandemic record:

As usual, real retail sales are somewhat noisy, and the relationship is not perfect. But in general, real sales have tended to lead real aggregate payrolls by 1-2 months, especially as a smoothed average. Because of the noise, I don’t think we can use the former to forecast the latter, but because each measure independently has been generally reliable, watching them together will be particularly helpful.

I will update again tomorrow or Friday after the inflation report.

Real aggregate payrolls rise to new high as CPI ex-shelter continues somnolent, Angry Bear, by New Deal democrat.