– by New Deal democrat The Bonddad Blog My “Weekly Indicators” post is up at Seeking Alpha. Not much churn in the short leading or coincident timeframes this week. But one of the long leading indicators joined the “less bad” parade. This is what I would expect to see coming out of a recession, before growth in the shorter term improves. Just one week, but still . . . As usual, clicking over and reading will bring you up to the virtual...

Read More »Protesting Now and in the Sixties and Seventies

You gotta be old enough to remember what took place in the sixties and into the seventies with regard to protesting. In 1970 when I was bathing in and drinking the Camp Lejeune water, we were selected to be trained in riot control. JIC the protestors, the student protesters were a bit rambunctious in Washington D.C. All the better we were not called out. Still the same fears we are seeing today on college campuses. Similar right-wing dialogue by...

Read More »Another strong personal income and spending report, but beware the uptick in inflation

– by New Deal democrat The Bonddad Blog Personal income and spending has become one of the two most important monthly reports I follow. This is in large part because the big question this year is whether the contractionary effects of Fed tightening have just been delayed until this year, or whether the fact that there have been no rate hikes since last summer mean that the expansion will strengthen. Because real personal spending on services...

Read More »Never-Ending Water Crisis and ‘Punishment Nightmare’ of Flint Michigan

This is a rehash of what was going on in Flint from 2014 onward. It is mostly what I had seen, read about, and wrote about from 2014 till 2022. Republicans were in control of the state during most of this time if not all of it. Attorneys will lay claim to 1/3rd of the payout. If the state gov had been more active in resolving the issue, I am sure the attorney fees would have been less. Article by Gabrielle Gurley with a lot of input by a former...

Read More »Governor Katie Hobbs Announces $500K in FAFSA Initiatives to Assist Arizona Families Afford College

According to The Hill the New FAFSA forms were supposed to be easier and shorter. Shorter yes, nut not so easy. There is a list of 2024-24 FAFSA issues which are confounding parents and students attempting to complete the FAFSA so as to be eligible for student aid. FAFSA forms were changed in 2023 and were supposed to be available in October 2023. Availability was delayed till December 2023. When finally released there were complications with the...

Read More »Leading indicators in the Q1 GDP report are mixed

– by New Deal democrat The Bonddad Blog Most of the commentary you will read about Q1 GDP that was released this morning will be about the core coincident components. For that I will simply outsource to Harvard’s Prof. Jason Furman: “much of the slowdown was in non-inertial items like inventories (-0.35pp) and net exports (-0.86pp). The better signal of final sales to private domestic purchasers was 3.1%.” I agree. With that out of...

Read More »College Financial Aid Scramble

by Lora Kelly The Atlantic A plan to simplify the Free Application for Federal Student Aid process, better known as FAFSA has been a few years in the making. In 2020, as part of a spending bill, Congress ordered the Department of Education to create a shorter version of the FAFSA form. The new application would reduce the maximum number of questions from 108 to 36. Rose Horowitch writes, the goal was to make things easier for applicants,...

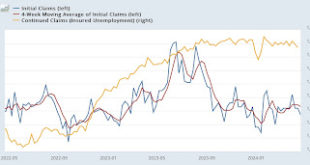

Read More »Jobless claims continue their snooze-fest

– by New Deal democrat The Bonddad Blog [Note: I’ll put up a post discussing Q1 GDP later today.] Initial and continuing claims continued their snooze-fest this week. Initial claims declined -5,000 to 207,000, continuing their nearly 3 month long range of between 200-220,000 per week. The four week average declined 1,250 to 213,250. This average has remained in the 200-225,000 range for over half a year! Finally, with the typical one...

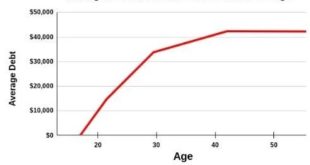

Read More »Claims of Student Loan Cancellation Benefiting the Wealthy are Still False

by Alan Collinge Medium A number of beltway “experts” are currently claiming that cancelling student loans would unduly benefit the wealthy. These claims are based upon blatantly flawed research, They have been used by very well-coordinated media/social media campaigns, designed to kill the push for student loan cancellation, and have flooded the zeitgeist in recent weeks. Most recently, Professor Kent Smetters (The Wharton School at the...

Read More »One born every minute

And the grift goes on:“Jerry Dean McLain first bet on former president Donald Trump’s Truth Social two years ago, buying into the Trump company’s planned merger partner, Digital World Acquisition, at $90 a share. Over time, as the price changed, he kept buying, amassing hundreds of shares for $25,000 — pretty much his “whole nest egg,” he said.“McLain, the tree service owner in Oklahoma, said he believes the stock could “go to $1,000 a share, easy,”...

Read More » The Angry Bear

The Angry Bear