The civilized American peoples were here long before the colonists arrived from other countries. This is the story of some discovering their past in what was called America after the arrival of the new people. Researchers reveal U’s painful past with Minnesota’s Indigenous people, MPR News, Dan Kraker and Melissa Olson. A massive new report details the University of Minnesota’s long history of mistreating the state’s Native people and lays out...

Read More »Consumer inflation is about 3.0% YoY. The economy has experienced Deflation since last June

Properly measured, consumer inflation is only about 3.0% YoY, and the economy has experience Deflation since last June – by New Deal democrat One month ago, I “officially” took the position that inflation had been conquered, and that, properly measured, the economy had actually been experiencing deflation since last June. This morning’s report only confirmed that position. The primary reason, as I have been pounding on for almost 18 months,...

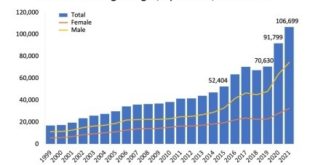

Read More »Drug Overdose Death Rates in the US

This post is more of a copy and paste. If you read the sections and then the original piece, you will see I have changed some of the wording to accommodate the post itself. For example, the charts appear to the right of the wording rather than above. For the longest time, I could not find graphs breaking out the numbers of deaths due to opioids until I happened upon the Senate’s Joint Economic Committee (JEC) report. This report by the NIDA...

Read More »Wall Street, venture capital drive high drug prices

And undermine public health in the process I ran across Merrill at the Washington Monthly writing about Healthcare. This particular article is on the mark in terms of what is occurring in pharmaceutical healthcare today. Kip, Merrill, and I are all hitting similar notes with regard to healthcare and other issues impacting it. Some such as Kip and Merrill more so on the details than I. The costs and prices of Pharma are overstated by the industry....

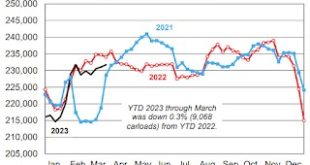

Read More »AAR: March Rail Carloads and Intermodal Decreased Year-over-year

AAR: March Rail Carloads and Intermodal Decreased Year-over-year by Calculated Risk on 4/07/2023 03:25:00 PM From the Association of American Railroads (AAR) Rail Time Indicators. Graphs and excerpts reprinted with permission by AAR to Bill McBride. Rail volumes today are being negatively influenced by broader economic trends, including slowdowns in industrial output, high inventory levels at many retailers, lower port activity, and...

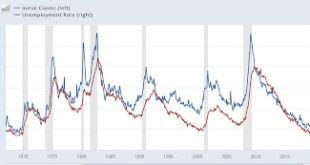

Read More »March employment report 2: unemployment recession indicators

Scenes from the March employment report 2: unemployment recession indicators – by New Deal democrat A reminder: I may be offline for the next couple of days. In the meantime, yesterday I looked at the 5 leading indicators contained in the employment report, and summarized how they either signal recession now or within the next 3 to 6 months. Today I want to focus on unemployment and underemployment. Economist Gloria Sahm’s Rule, namely...

Read More »They Can Only “Win” by Cheating …

Editorial by Ten Bears at Homeless on the High Desert. Ten Bears is reviewing the politics or the changing of the rules in Montana for the 2024 Senatorial Election. And changing the rules only for 2024. Sounds almost like Wisconsin plans to impeach a newly elect Supreme Cour Justice. They Can Only “Win” by Cheating . . . , Homeless on the High Desert, Ten Bears, g’da says . . . Daily Chaos: Republicans in the Montana state Senate on Tuesday...

Read More »Judge bans Abortion Pill Nationally and Overrules the FDA

Not sure where these critters come from; but, it sure is tiring. One person lacking the foundation for making such a decision is allowed to make the decision only because of his status. If he has a legal background (???), he knows he is wrong So much for “leave it up to the states:” Right-wing activist w/no medical training overrules FDA, bans mifepristone nationally, ACA Signups, Charles Gaba. Charles: I was out of town for much of last week...

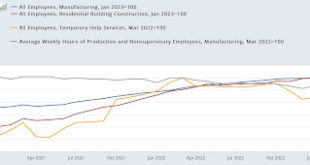

Read More »Scenes from the March employment report 1: Leading sector indicators

Scenes from the March employment report 1: leading sector indicators – by New Deal democrat There’s no significant economic news this week until Wednesday’s CPI report, and as a side note, I might be offline for a day or two later this week. In the meantime, today and tomorrow let’s take a look at some of the important information from last Friday’s employment report. Today, I’m taking a look at the leading employment sectors and several...

Read More »April 9, 1865 . . . The Aftermath and the Economics of War

We died at Cold Harbor June 1864, an officer of the Iron Brigade. UW had his letters and I was allowed to read them. They were given to me, neatly tied up with a thin ribbon. I was allowed to make copies. It was interesting to read the letters of an ancestor who fought in the Civil War. In particular, his letters were used to detail the battle at Gettysburg. No news reporters had been there to record the events of the days. And neither could his...

Read More » The Angry Bear

The Angry Bear