What if someone told you that one man from one mega law firm chose the last three appointees to the U.S. Supreme Court? In a new book, ‘Servants of The Damned’, David Enrich did just that, and much more. That one man was Don McGahn; the law firm, Jones Day. The suggestion leading to his being enabled to do so came from one Sen. Mitch McConnell. McGahn, a super lawyer from a powerful law firm with a right-wing agenda (better yet, a federalist Society...

Read More »White House Looking at Food and Nutrition, But Will it Matter?

Any given recession, food assistance needs increase. In an inflationary environment where purchasing power declines, food assistance needs increase. During a pandemic, well you get the idea. What is lost in that narrative is that the foods available to the general public, are same available to food assistance beneficiaries. The only difference is the bank account that it’s draws through the debit card, and a few other stipulations like beer and...

Read More »Open thread Sept. 30, 2022

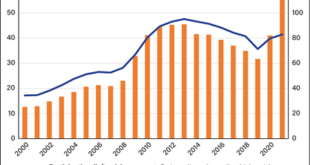

Distibution and Total Growth of Family Wealth

This popped up on “Letters from an American” just last night. I was too tired to read Prof. Heather Cox-Richardson’s article. So, I missed out on a good message about the income of America’s population. This is a recent commentary by the not-so nonpartisan Congressional Budget Office in September 2022. The thrust of the article? “Trends in the Distribution of Family Wealth, 1989 to 2019.” Prof. Heather Cox-Richardson’s Introduction; Since...

Read More »The positive trend in jobless claims continues

The positive trend in jobless claims continues For still another week, initial jobless claims continued their recent downtrend. Initial claims declined -16,000 to 193,000, a 5 month low. The 4 week average also declined -8,750 to a new 4 month low of 207,000. Continuing claims, which lag somewhat, declined -29,000 to a 2.5 month low of 1,347,000: The downtrend of the past 2 months is almost certainly a positive side-effect of lower gas...

Read More »Has the Third Era of Globalization Ended?

by Joseph Joyce (Capital Ebbs and Flows) Has the Third Era of Globalization Ended? Behind the headlines forecasting a global economic recession there is another narrative about the end of globalization. This reflects political tensions over trade, the impact of the pandemic on global supply chains and the shutdown of economic ties with Russia. But dating the beginning and end of the most recent era of the integration of global markets poses...

Read More »UK Macroeconomic turmoil

This is my second post on the recent troubles with Sterling. In the first, I discussed vibes, mood, and animal spirits. I do think that is the best way to think about what’s going on, but I promised to write as an economist typically do (not as we all our in this case). The basic facts are that Chancellor Kwasi Kwarteng announced a mini-budget revision including elimination of the 45% income tax bracket. Oddly many financiers who would directly...

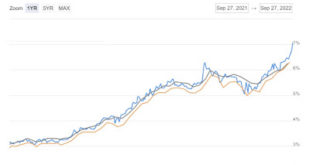

Read More »Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace

Interest rates, the yield curve, and the Fed chasing a Phantom (lagging) Menace There’s a lot going on with interest rates in the past few days. Mortgage rates have increased above 7%: This is the highest rate since 2008. Needless to say, if it lasts for any period of time it will further damage the housing market. The yield curve has almost completely inverted from 3 years out (lower bar on left; upper bar shows a similar curve in April...

Read More »Loss of Truss

I really have to write about macroeconomics given the drama across the Channel in the UK. The story so far is that New Prime Minister Liz Truss and Chancellor of the Exchequer Kwasi Kwarteng have managed to spook money managers by threatening to cut their taxes . Kwarteng proposed a mini budget cutting the top marginal tax rate (etc). The Pound depreciated not quite reaching parity with the dollar (fell bellow 104 cents though) and the 10 year...

Read More »Lana Theis’s Attack on Mallory McMorrow Failed

Yea, I know. Who the hell is Mallory McMorrow. First let me explain Lana Theis. Lana is a state senator representing the Michigan state district I lived in when I was near Brighton, Brighton Michigan. Lana is Republican and was pretty much protected from being replaced due to state gerrymandering. You may remember her as the Michigan Republican state senator who falsely described McMorrow as a “groomer” in an April fundraising email. In the...

Read More » The Angry Bear

The Angry Bear