I wanted to find a post/article which could details the differences between 2011 and 2022. I could not find exactly what I wanted. Infidel’s post comes close. I am looking at the years after 2008 when the nation was struggling to get back on an even keel. What is difference between 2011 and 2022? For one thing, actions not taken in 2011, were taken in 2022 due to the pandemic. The extension of funds to help families with children, increased ACA...

Read More »Marking Ezra Klein’s Beliefs to Market

A tweet sent me to this column Ezra Klein wrote long, long ago in a city far away. In the heady day of April 8 2021, Klein discussed Joseph Biden’s radicalism and contrasted it with Barack Obama’s caution. I remember. Biden had just signed the American Rescue plan and was proposing what would be called the infrastructure bill and the Inflation Reduction Act (ne’ Build Back Better). “I covered him in the Senate, in the Obama White House, in the...

Read More »Student Loans

America is the land of equal opportunity. Well, yeah, truth be, your odds are little bit better if your parents can afford to send you to a good university. Other that, it’s even stephen. What if those who weren’t born to means could borrow the money? That would almost be as good, no.? Before 1965, if they went to their friendly banker, he asked them if they or their family had an account at the bank. If the answer was that their parents did have...

Read More »Weekly Indicators for August 22 – 26 at Seeking Alpha

Weekly Indicators for August 22 – 26 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. In the past couple of weeks, the decline in gas prices has slowed considerably. Once they stabilize, the underlying economic fundamentals should reassert themselves. In the meantime, there are cross currents of interest rates and manufacturing orders, among other things. As usual, clicking over and reading should be educational for you...

Read More »Who Should Have Children? If You have to ask . . .

[embedded content] April 10, 2008, at Economist’s View former Angry Bear writer Noni Mausa had this to say . . . Take the time. Watch this, I just did. It explains exactly why the middle class is in trouble and where the money has gone. Over on Angry Bear we were discussing who can afford children, in this post: “Who Should Have Children? Or, If You Have To Ask, You Can’t Afford Them“ Me again: Our Middle Class is still in trouble. The...

Read More »Will the Inflation Reduction Act (IRA) Reduce Inflation?

Will the Inflation Reduction Act (IRA) Reduce Inflation?, Econospeak Probably not, but it also will probably not increase it either. This is the judgment of the Congressional Budget Office and also the Penn Wharton Budget Model, as well as libertarian economist Tyler Cowen of George Mason, who is critical of much of its content. It has inflationary and disinflationary elements, and it looks that they about balance out, although in the longer run...

Read More »Seniors’ Medicare Benefits Are Being Privatized Without Their Consent

An Introduction Ok, What is or who is The Lever? “The Lever, formerly known as The Daily Poster, is a reader-supported investigative news outlet that holds accountable the people and corporations manipulating the levers of power. The organization was founder and owner is David Sirota, an award-winning journalist and Oscar-nominated writer who served as the presidential campaign speechwriter for Bernie Sanders.” What type of Org and how factual?...

Read More »$1.6 billion to Right-Wing Org. – Marble Freedom Trust

Ninety year-old electronics company executive Barre Seid donates his funds to a new right-wing organization. Marble Freedom Trust, is controlled by Leonard A. Leo, the co-chair of the Federalist Society, who has been instrumental in the right-wing takeover of the Supreme Court. Leo has also been prominent in challenges to abortion rights, voting rights, climate change action, etc. “August 22, 2022″ – Heather Cox Richardson (substack.com)...

Read More »DOT: Vehicle Miles Driven Decreased year-over-year in June

Bill McBride at Calculated Risk (8/23/2022 02:21:00 PM) had this report on mileage driven for June 2022. I am sure as Bill suggests gasoline prices may have played a role in the decrease. I wonder too if Covid kept people from travelling too? One of the links to the DOT page also shows travel by segments of the country. The West showing a far greater (5X) decrease than the Northeast. Calculated Risk: DOT: “Vehicle Miles Driven Decreased...

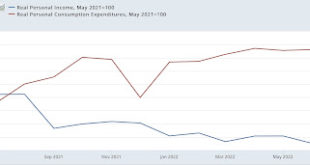

Read More »More modestly good fallout from lower gas prices

July personal income and spending: more modestly good fallout from lower gas prices There was more good fallout from the recent decline in gas prices in today’s July report on personal income and spending. Personal income rose 0.2% for the month nominally, and nominal spending rose 0.1%. But because the relevant measure of inflation, the PCE deflator, declined -0.1%, real income rose 0.3% and real personal spending rose 0.2%. Meanwhile June’s...

Read More » The Angry Bear

The Angry Bear