Read More »

Where we are now, and where we are probably going

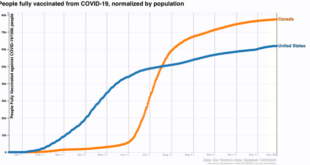

Coronavirus dashboard for year-end 2021: the Graph of the Year, where we are now, and where we are probably going At the end of the 2nd year of the pandemic, a little self-assessment of what I got right and wrong, where we are and where we are probably going. The one thing I got wrong in a big way is explained by this Coronavirus Graph of the Year: I thought sure that once the effectiveness of the vaccines was widely known, opposition...

Read More »Paul Samuelson On Knut Wicksell

Paul Samuelson On Knut Wicksell Something I have been doing for several years now is serving as Senior Coeditor of the Fourth Edition of the New Palgrave Dictionary of Economics, with the original one published back in 1894 in London (my coeditors are Matias Vernengo and Esteban Perez). As part of this effort, a multi-year project, I have been reading cover-to-cover, the entire Third Edition, co-edited by Steve Durlauf and Larry Blume, which came...

Read More »Single Payer Healthcare Financing – Part 3

PNHP Single Payer Healthcare Financing Series, Kip Sullivan JD As you can determine for yourself, this is the last Part of the Series by Kip Sullivan. I hope you have been listening to everything and reading being presented. A lot of detail here about what is wrong with Commercial Healthcare, Managed Care, and Medicare Advantage. I posed a question to Kip after a couple of paragraphs. Me: This series is perfect for me. It arms me with...

Read More »Russell Baker

Also at dinner tonight, we discussed funny essays. My contribution was a famous piece called Francs and Beans by New York Times columnist Russell Baker, which begins like this: As chance would have it, the very evening Craig Claiborne ate his historic $4,000 dinner for two with 31 dishes and nine wines in Paris, a Lucullan repast for one was prepared and consumed in New York by this correspondent, no slouch himself when it comes to titillating...

Read More »Snarky reviews

Tonight at dinner we discussed snarky reviews, which brought back memories. I was raised in New York City, which was usually fantastic, at least when it wasn’t terrifying. One of the great things about it was the music. I saw Lou Reed at the Bottom Line in 1976 or so. And a few years later I went to the Met opening of Akhnaten, an opera by Phillip Glass. My mom hated (and I think still hates) Glass, and couldn’t understand why I would go. ...

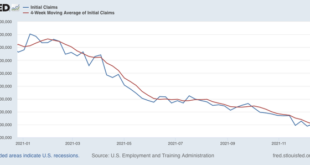

Read More »The labor market closes out 2021 on the best note yet

The labor market closes out 2021 on the best note yet The final economic data in 2021 was this morning’s report on initial and continued jobless claims. And the good news for workers continued. New claims declined back under 200,000 to 198,000, the best pandemic showing except for November 20’s 194,000, and December 4’s 188,000. The 4 week average of new claims declined to 199,250: This is the best showing for the 4 week average in over...

Read More »A Free Market is Always Full of Cheap Ideas

A Free Market is Always Full of Cheap Ideas I may have scoffed in the past at the notion of “the marketplace of ideas” but I am coming around to think that maybe it’s not such a bad metaphor. Back in the days of primitive economy, families, clans, tribes produced and consumed their own subsistence. If a surplus was produced beyond what was to be set aside for contingencies, it might be given as a gift to a neighboring group, setting up the...

Read More »Single Payer Health Care Financing – Part 2

PNHP Single Payer Healthcare Financing Series, Kip Sullivan JD Kip Sullivan is known for his commentary on commercial healthcare and healthcare insurance. He is one of the few who can honestly depict what the issues are today and where we are going with healthcare in the US. In this segment Kip discusses the overuse of healthcare claim of being caused by Fee for Service healthcare. This was supposedly reduced by HMOs and a method of payment...

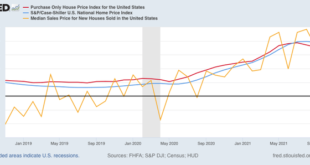

Read More »House price increases continue to show strong market at the end

House price increases continue to show strong market at the end The last housing market data for 2021, the FHFA and Case Shiller house price indexes, were reported this morning. Both showed a very slight deceleration in the soaring prices that have marked this year. The FHFA purchase-only index rose 1.1% for October. The YoY% increase was 17.4%, down from the 19.3% YoY peak in July. Meanwhile the Case Shiller national index rose 0.8% m/m, and...

Read More » The Angry Bear

The Angry Bear