Via the Boston Globe comes the consideration of boundary problems this pandemic poses between US states. Worth a discussion. Also, on the world stage, the EU and other countries consider relaxing travel restrictions from ‘safe’ countries, the US not among them. Visitor quarantines may seem like a smart intervention to keep the virus from crossing state lines. Symptoms can take up to 14 days to appear after someone is infected, and research suggests...

Read More »All 4 coincident indicators of recession improved in May vs. April

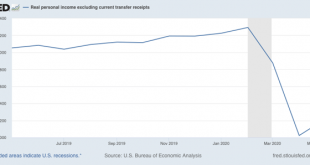

All 4 coincident indicators of recession improved in May vs. April With this morning’s release of personal income and spending, we now have all 4 coincident indicators for May that the NBER uses to determine whether the economy is in a recession or recovery/expansion. And all 4 improved from their “most horrible” readings in April. A recession is a generalized downturn in production, employment, sales, and income. The “income” metric that the NBER uses...

Read More »Weekly Indicators for June 22 – 26 at Seeking Alpha

by New Deal democrat Weekly Indicators for June 22 – 26 at Seeking Alpha My Weekly Indicators post is up at Seeking Alpha. The coincident indicators, as well as the short leading indicators, have continued to improve gradually each week. But this week may be the near term peak, as the reality of renewed exponential spread of the coronavirus in recklessly reopened States starts to hit home. You cannot force people to patronize businesses if they believe...

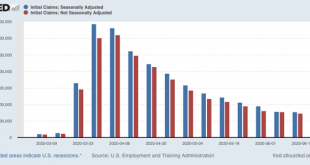

Read More »Initial jobless claims improve slightly; continuing claims resume decline

Initial jobless claims improve slightly; continuing claims resume decline Weekly initial and continuing jobless claims give us the most up-to-date snapshot of the continuing economic impacts of the coronavirus on employment. More than three full months after the initial shock, the overall damage remains huge, with large spreading new secondary impacts. The positive news is that the total number of claims, including continuing claims, has resumed being...

Read More »Housing rebounded sharply in May

by New Deal democrat Housing rebounded sharply in May One aspect of the economy that is important in terms of how well things will go once the pandemic ultimately recedes (which won’t occur until after next January 20) remains housing. And low-interest rates brought housing back from the depths in May. My look at the current state of mortgage rates, housing sales, and prices is up over at Seeking Alpha. ...

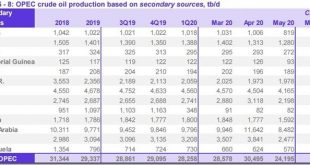

Read More »Global oil output surplus was at 8.6 million barrels per day in May, despite OPEC cut of 6.3 million bpd

Via Economic Populist, rjs writes: Global oil output surplus was at 8.6 million barrels per day in May, despite OPEC cut of 6.3 million bpd Submitted by rjs on June 22, 2020 – 3:16pm Wednesday of this past week saw the release of OPEC’s June Oil Market Report, which covers OPEC & global oil data for May, and hence it gives us a picture of the global oil supply & demand situation during the first month of the two-month agreement between OPEC,...

Read More »Open thread June 26. 2020

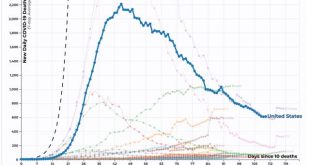

Coronavirus dashboard for June 23: focusing on deaths, and the Trumpist South and Southwest

Coronavirus dashboard for June 23: focusing on deaths, and the Trumpist South and Southwest Confirmed total US infections: 2,312,302. (+31,433 in past 24 hours) Confirmed total US deaths: 120,402 (+425 in past 24 hours) We know that new cases are accelerating again. Is it translating into an increase in deaths? The answer appears to be: not yet, but getting close. Here is the 7 day average of new deaths in the US: Figure 1 In the past 3 days, the...

Read More »Going Too Far

Going Too Far Unfortunately, it was going to happen, and we who support the movement need to call out those instances where it goes too far. I am talking about the justified Black Lives Matter (BLM) movement, mostly characterized by widespread peaceful protests even in small rural towns that never see such things, and with a solid majority of the American people currently supporting both the BLM and its main demands. As it is, one should probably not...

Read More »What Will History Say

———————————————————————–||———————– The Past Now The Future What Will History Say by Ken Melvin When the new US History books come out in 2040, what will they have to say about 2020? What will they say about: Globalization? The Trump Presidency? Global Warming? The 2020 Pandemic? China’s Rise? America’s Decline? Capitalism and Free markets? Mitch McConnell? to run...

Read More » The Angry Bear

The Angry Bear