Ms. Seema Verma is the Administrator of the Centers for Medicare & Medicaid Services. She is the over seer of Trump’s attempts to repeal the ACA. She is smiling now as there has been a reduction in the numbers of people enrolled in public healthcare such as Medicaid and CHIPS. Why did this occur? States having work requirements for Medicaid, adding more red tape to the application process, cutbacks in in outreach and enrollment funds by the...

Read More »Has 21st century conservatism contributed anything useful at all ?

(Dan here…lifted from Robert’s Stochastic Thoughts) by Robert Waldmann Has 21st century conservatism contributed anything useful at all ? This is a question I haven’t asked myself. I have long looked for reasonable and reasonably honest conservatives. It is frustrating, because I have found many, but few are still conservative. I don’t want to get distracted from my distraction; but there is a pattern of me finding a conservative whom I consider...

Read More »An update on forecasts

by New Deal democrat An update on forecasts I have a new post up at Seeking Alpha, describing the order in which data has tended to deteriorate before consumer-led recessions. A few conditions have been met; most others have not. I have previously written that if a recession is in the works over the next few quarters, it is more likely to be a producer-led recession, a la 2001. In that regard, a few weeks ago I said that Q2 corporate profits would be a...

Read More »Whither Ukraine?

Whither Ukraine? Or “wither Ukraine?” some might suggest? But no, after nearly 30 years of serious economic stagnation and massive corruption, along with losing territory to neighboring Russia with whom it has on ongoing military conflict, things are looking up there. GDP grew at 4 percent annually last quarter. The hryvnia currency has been the second most rapidly rising currency in the world during 2019. There has even been a prisoner exchange...

Read More »F**king Old Enough to Vote

It’s That Day again. I mostly stayed off Facebook (except for birthday greetings) and Twitter, but even LinkedIn has posts of now-yellowed newspaper articles of survivors–and probably some of those who didn’t. In another ten years, it will be as far from 11 Sep 2001 as that date was from 11 Sep 1973. At least now, most people know what a sh*t Rudy Giuliani was, both in setting up the firefighters for disaster and moving the NYC Office of Emergency...

Read More »Tariffs and Price Changes

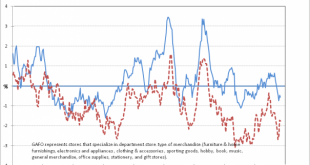

I have been looking at the data recently to find economic series that would quickly reflect the impact of rising tariffs on the consumer. One is Retail Sales: GAFO. Think of it as department store type merchandise — goods excluding autos, food and energy. It is reported every month in both the Census retail sales press release and in the BEA measures of retail sales they compile in putting together personal spending and GDP. I have long preferred the...

Read More »July JOLTS report: m/m improvement, but slowing trend

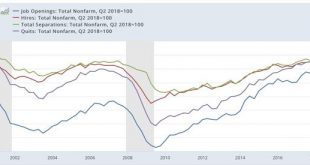

July JOLTS report: m/m improvement, but slowing trend Yesterday*s morning’s JOLTS report for July was in general surprisingly positive on a monthly basis, but continued to show a slowing trend. To review, because this series is only 20 years old, we only have one full business cycle to compare. During the 2000s expansion: Hires peaked first, from December 2004 through September 2005 Quits peaked next, in September 2005 Layoffs and Discharges peaked...

Read More »Scenes from the August jobs report

Scenes from the August jobs report The August jobs report was the mirror image of most earlier reports this year: a lackluster Establishment report but a strong Household report. Let’s take a look. By now the fact that there has been a jobs slowdown is pretty well established. In the last 7 months, only 964,000 jobs have been added, an average of 138,000 per month. If we subtract this month’s temporary census hiring of 25,000, those numbers drop to...

Read More »MbS Consolidates Immediate Family Control Of Saudi Oil Industry

MbS Consolidates Immediate Family Control Of Saudi Oil Industry Saudi Oil Minister al Falih, who also ran ARAMCO, has been replaced by Abdulaziz bin Salman bin Abdulaziz al Sa’ud, half brother of Crown Prince Mohammed bin Salman bin Abdulaziz al Sa’ud, (MbS),who was Ambassodor to the US untile the Khahoggi murder got hot between USA and KSA. The New York Times claims that this is part of an effort by MbS to modernize the Saudi economy, an ongoing line...

Read More » The Angry Bear

The Angry Bear