SUPPORT THE SHOW: Visit LEDN to check out getting a bitcoin-backed loan https://platform.ledn.io/join/0a00cca3dd61dea5909c95cd41f41685 Get Wasabi wallet and enjoy your privacy https://wasabiwallet.io/ Wasabi Tutorial https://www.youtube.com/watch?v=ECQHAzSckK0 Get NORDVPN to protect your online privacy. 75% off a 3 year https://nordvpn.org/btcsessions Check out my website: http://btcsessions.ca/ Join my Telegram channel! https://t.me/btc_sessions If you value my work and would like to...

Read More »BTC Transaction Backlog | China Ban Imminent… Again | Bitcoiners Destroy Frances Coppola

SUPPORT THE SHOW: Visit LEDN to check out getting a bitcoin-backed loan https://platform.ledn.io/join/0a00cca3dd61dea5909c95cd41f41685 Get Wasabi wallet and enjoy your privacy https://wasabiwallet.io/ Wasabi Tutorial https://www.youtube.com/watch?v=ECQHAzSckK0 Get NORDVPN to protect your online privacy. 75% off a 3 year https://nordvpn.org/btcsessions Check out my website: http://btcsessions.ca/ Join my Telegram channel! https://t.me/btc_sessions If you value my work and would like to...

Read More »Quo Vadis?

When even anti-EU tabloids say the Government's official position on Brexit is insincere, it is time to take it seriously. On Tuesday last week, The Sun reported that the European heads of government had concluded that Johnson's latest genius plan to create a "double border" on the island of Ireland wasn't a serious attempt to negotiate a Brexit deal. "They believe his insistence the dossier be kept secret is an effort to disguise the fact it is designed to set up a “blame game” with...

Read More »Quo Vadis?

When even anti-EU tabloids say the Government's official position on Brexit is insincere, it is time to take it seriously. On Tuesday last week, The Sun reported that the European heads of government had concluded that Johnson's latest genius plan to create a "double border" on the island of Ireland wasn't a serious attempt to negotiate a Brexit deal. "They believe his insistence the dossier be kept secret is an effort to disguise the fact it is designed to set up a “blame game” with...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »The high price of dollar safety

The world is saving like crazy. Corporations are building up cash mountains that they can’t or won’t invest in expanding their businesses. Individuals are building up pensions and precautionary savings. Governments, especially in developing countries, are building up FX reserves. The “savings glut,” as former Fed chairman Ben Bernanke dubbed it, shows no signs of dissipating. It is sloshing around the world looking for a productive home. But there isn’t one - or at least, not one that...

Read More »Currency Wars and the Fall of Empires

This post was first published on Pieria in July 2013. I have re-posted it here on Coppola Comment because it now seems terribly, terribly timely. I have been reading James Rickards' book Currency Wars. In this, Rickards reviews the use of fiat currency over the course of the last century, and concludes that the present global fiat currency system is inherently unstable and on the point of collapse. He calls for return of the gold standard to stabilise firstly the US dollar and, following...

Read More »The Broken Contract

So the Lord God said to the serpent, “Because you have done this, cursed are you above all livestock and all wild animals! You will crawl on your belly and you will eat dust all the days of your life. And I will put enmity between you and the woman, and between your offspring and hers; he will crush your head, and you will strike his heel.” To the woman he said, “I will make your pains in childbearing very severe; with painful labor you will give birth to...

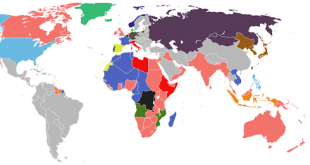

Read More »Yield curve weirdness

Yield curves have gone mad. Negative yields are everywhere, from AAA-rated government bonds to corporate junk. Most developed countries have inverted yield curves, and a fair few developing countries do too:(chart from worldgovernmentbonds.com)Negative yields and widespread yield curve inversion, particularly though not exclusively on safe assets. To (mis)quote a famous pink blog, this is nuts, but everyone is pretending there will be no crash.Here, for your enjoyment, is an à la carte...

Read More »“The Case for People’s Quantitative Easing” by Frances Coppola

A decade after the Global Financial Crisis (GFC) and the global economy is still so fragile that central banks are again talking about rate cuts and even a resumption of Quantitative Easing (QE). It’s likely that QE does work – it reduces the interest rate on government bonds and stimulates growth and inflation through easier financial conditions and the so-called portfolio rebalancing effect whereby investors sell their government bonds to the central bank and re-invest the...

Read More » Francis Coppola

Francis Coppola