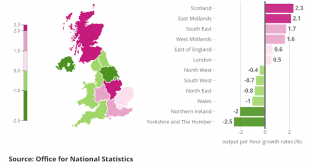

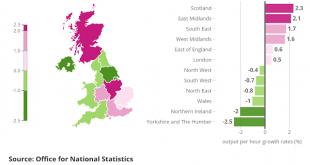

When the banks fell over, they knocked the stuffing out of the British economy. The UK’s productivity has been dismal ever since. Unemployment has fallen to historic lows and wages are rising, but productivity growth remains near zero. This “productivity puzzle,” as it is known, has had economists scratching their heads for best part of a decade.But UK productivity is a tale of two halves. Experimental statistics recently released by the Office for National Statistics (ONS) reveal widely...

Read More »A tale of two halves

When the banks fell over, they knocked the stuffing out of the British economy. The UK’s productivity has been dismal ever since. Unemployment has fallen to historic lows and wages are rising, but productivity growth remains near zero. This “productivity puzzle,” as it is known, has had economists scratching their heads for best part of a decade.But UK productivity is a tale of two halves. Experimental statistics recently released by the Office for National Statistics (ONS) reveal widely...

Read More »Much Ado About Nothing

The Fed's interventions in the repo market are attracting considerable comment. A lot of people seem to think the Fed has embarked on another QE program without Congressional approval. And the usual suspects are complaining that the Fed is pumping up stock prices and debasing the dollar. Stocks are indeed heading for the moon - though so is the dollar, which rather undermines those who think it is being debauched. But the Fed's interventions in the repo markets have nothing to do with stock...

Read More »Much Ado About Nothing

The Fed's interventions in the repo market are attracting considerable comment. A lot of people seem to think the Fed has embarked on another QE program without Congressional approval. And the usual suspects are complaining that the Fed is pumping up stock prices and debasing the dollar. Stocks are indeed heading for the moon - though so is the dollar, which rather undermines those who think it is being debauched. But the Fed's interventions in the repo markets have nothing to do with stock...

Read More »The NI Fund’s reserves don’t pay down the National Debt

The NI Fund discussed in this post covers England, Wales and Scotland only. Northern Ireland has a separate NI Fund, which is excluded from the figures given in this post. However, it works in exactly the same way as the Fund discussed here. Sometimes the government is its own worst enemy. HM Treasury's hamfisted response to this Freedom of Information request from Trudy Baddams of the pension rights campaign group "We Paid In, You Paid Out", has caused a very silly storm.Ms Baddams...

Read More »The NI Fund’s reserves don’t pay down the National Debt

The NI Fund discussed in this post covers England, Wales and Scotland only. Northern Ireland has a separate NI Fund, which is excluded from the figures given in this post. However, it works in exactly the same way as the Fund discussed here. Sometimes the government is its own worst enemy. HM Treasury's hamfisted response to this Freedom of Information request from Trudy Baddams of the pension rights campaign group "We Paid In, You Paid Out", has caused a very silly storm.Ms Baddams...

Read More »The blind Federal Reserve

Ever since the secured overnight repo rate (SOFR) spiked to 10% in September, there have been dire warnings that these exceptional movements show the financial system is fundamentally broken. The story goes that the post-crisis financial system is so dysfunctional that it is unable to operate without continual injections of money from central banks. The Fed's attempt to reduce the $4.2tn of reserves it added to the financial system in three rounds of QE has dangerously destabilised the...

Read More »The blind Federal Reserve

Ever since the secured overnight repo rate (SOFR) spiked to 10% in September, there have been dire warnings that these exceptional movements show the financial system is fundamentally broken. The story goes that the post-crisis financial system is so dysfunctional that it is unable to operate without continual injections of money from central banks. The Fed's attempt to reduce the $4.2tn of reserves it added to the financial system in three rounds of QE has dangerously destabilised the...

Read More »Hitting the wall

It is 2.30 am, and I can't sleep. Today I must file my final piece for American Express's FXIP blog, which is being mothballed. Writing for that blog has been my main source of income for the last four years. Once it is gone, my income will once again become precarious and inadequate, as it has been all too often in the past. Hence my sleeplessness.To be perfectly honest, I'm not sorry that the blog is closing. I've done some interesting work for it, and learned a lot. And it has been a...

Read More »Hitting the wall

It is 2.30 am, and I can't sleep. Today I must file my final piece for American Express's FXIP blog, which is being mothballed. Writing for that blog has been my main source of income for the last four years. Once it is gone, my income will once again become precarious and inadequate, as it has been all too often in the past. Hence my sleeplessness.To be perfectly honest, I'm not sorry that the blog is closing. I've done some interesting work for it, and learned a lot. And it has been a...

Read More » Francis Coppola

Francis Coppola