A decade after the Global Financial Crisis (GFC) and the global economy is still so fragile that central banks are again talking about rate cuts and even a resumption of Quantitative Easing (QE). It’s likely that QE does work – it reduces the interest rate on government bonds and stimulates growth and inflation through easier financial conditions and the so-called portfolio rebalancing effect whereby investors sell their government bonds to the central bank and re-invest the proceeds in a...

Read More »The Case for People’s Quantitative Easing

Last night, the Resolution Foundation hosted a debate to launch my book, "The Case for People's Quantitative Easing". A great panel consisting of Jagjit Chadha, Director of NIESR; Fran Boait, Executive Director of Positive Money; and James Smith, Research Director of the Resolution Foundation, debated my ideas with immense verve, ably moderated by Torsten Bell, Chief Executive of the Resolution Foundation. You can watch the debate here.In 2008, QE did a great job of supporting asset prices...

Read More »The Troubles of Kier

Yesterday, the outsourcer Kier Group announced a major restructuring. The announcement makes grim reading. The company will divest or close down three of its business lines, with the loss of 1,200 full-time equivalent (FTE) jobs, half of them by the end of this month. The dividend will be suspended for two years. Kier's share price fell on the news, closing down 17.43%.Remarkably, some analysts took the restructuring announcement as a "buy" indication, which might explain why its share...

Read More »European banks and the global banking glut

In a lecture presented at the 2011 IMF Annual Research Conference, Hyun Song Shin of Princeton University argued that the driver of the 2007-8 financial crisis was not a global saving glut so much as a global banking glut. He highlighted the role of the European banks in inflating the credit bubble that abruptly burst at the height of the crisis, causing a string of failures of banks and other financial institutions, and economic distress around the globe. European banks borrowed large...

Read More »Dissecting the Eurozone’s (lack of) inflation

Eurozone inflation is in the doldrums again. After perking up to 1.7% in April, it slumped back to 1.2% in May. According to Bloomberg, this was "lower than expected". But I wonder who, apart from the ECB, really expected anything else. Core inflation has been well below target for the last five years: (chart from Bloomberg)And although the headine HICP measure increased in 2016-18, this was mostly due to the oil price bouncing back from its 2014-15 slump: (chart from Macrotrends)The...

Read More »The Abominable Laffer Curve

It's been pretty quiet in Lafferland since the Brexit referendum. All the talk has been of trade and sovereignty, not deregulation and tax cuts. But there's nothing quite like a Tory leadership election to bring supply-siders out of hibernation. So here is Sajid Javid singing an old sweet song to attract the votes of Tory party members: Cutting tax rates could bring in billions of extra revenue, which would mean: More nurses ?⚕️?⚕️ More teachers ???? More police ?♂️?♀️"I would cut...

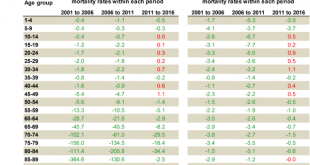

Read More »Despair deaths and regional inequality

I can't stop looking at this table. Mortality rates in England rose between 2011-16 for teenagers and most working-age adults under 50: That's bad enough. But what should give all of us pause is the reason that Public Health England (PHE) gives for rising mortality among young and middle-aged adults: Among people aged 20-44, an increase in mortality rates from accidental poisoning had a negative effect on life expectancy between 2011 and 2016 of -0.06 years in males and -0.11 years in...

Read More »Why targeting productivity is a bad idea

Last week I attended a workshop entitled "Enhancing the Bank of England Toolkit," hosted by the Progressive Economy Forum. Presented at the workshop, and underpinning most of the debate, was this report from GFC Economics and Clearpoint Advisers, which was written for the Labour Party and first issued last June. The report was widely criticised at the time, as one of its authors ruefully observed in the introduction to the presentation. Nonetheless, the authors presented it unamended.The...

Read More »An Experiment with Basic Income

In 1795, the parish of Speen, in Berkshire, England, embarked on a radical new system of poor relief. Due to the ruinous French wars and a series of poor harvests, grain prices were rising sharply. As bread was the staple food of the poor, rising grain prices increased poverty and caused unrest. Concerned by the possibility of riots, the parish decided to provide subsistence-level income support to the working poor. The amounts paid were anchored to the price of bread. Each member of a...

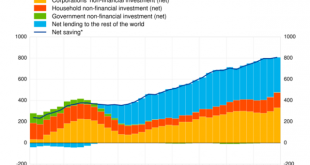

Read More »The Eurozone’s Long Depression

Sectoral balances can tell us so much about what is going on in an economy. Especially when they are expressed as a time series, as in this remarkable chart from the ECB: Although it is a time series, this is not a rate-of-change chart. The y axis is in billions of Euros, not in percentage growth rates. But the chart nevertheless shows that Eurozone net saving has risen steadily since the financial crisis, except during the Eurozone crisis of 2011-12 when it dipped slightly. What do we mean...

Read More » Francis Coppola

Francis Coppola