At the ICAEW's conference "Do Banks Work?" last week, there was a fascinating interchange between Ian Gorham of Hargreaves Lansdowne and RBS's Ross McEwan. Apparently RBS had refused a large deposit from Hargreaves Lansdowne, to the irritation of the asset manager. "There is a problem placing client money", said Gorham. And he went on: "Banks don't need people's savings, because they now have much more capital to support lending. This means that savers receive much lower interest rates on...

Read More »The angry WASPIs

Back in 1995, the UK government made what was widely regarded at the time as a sensible and long-overdue change to state pension legislation. Since World War II, women had retired five years earlier than men, a sop to compensate them for their inability to clock up pensions of the same size as their spouses - and incidentally to enable men and women to retire at approximately the same time, since it was assumed that most men were older than their wives. But by the mid-1990s far more women...

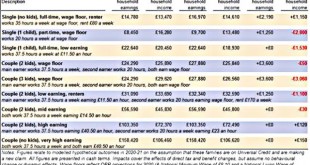

Read More »Those elusive welfare spending cuts

The Chancellor's Autumn Statement contained an apparent U-turn on the cuts to tax credits outlined in the July budget. Predictably, this was presented as the Chancellor "listening" to those concerned about the impact of sudden large falls in income for working families at the bottom end of the income spectrum. The Conservatives continue to position themselves as the party for "hard-working families".However, this isn't quite what it seems. The income cuts for low-income working families are...

Read More »Grexit, Brexit and financial stability

On October 30th 2015, I gave a keynote speech at Birmingham University's Finance Forum on the implications of Grexit and Brexit for financial stability. I've now written this up as a paper.I start by outlining the purpose of financial stability. Since the 2007-8 financial crisis, “financial stability” has been all the rage. We must prevent another crisis: we must solve the problems that make our financial system “unstable”. But what exactly do we mean by “financial stability”? Most people...

Read More »If we are terrified, the terrorists win

In this post, Tom issues a timely reminder that there are much worse threats to our freedom than terrorists. Like Tom, I remember as a child disappearing with my friends all day long, only coming home for lunch and tea - a freedom my own children never had. We seem much more fearful of loss (of all kinds) than our forebears. Perhaps that is because we are much less used to it. - Frances Guest post by Tom Streithorst. For the past four days, the city of Brussels has been on lockdown. The...

Read More »Eurodespair

In my last post, I warned about "siren voices" calling for tighter monetary policy while the Eurozone economy is stuck in a toxic equilibrium of low growth, zero inflation and intractably high unemployment. Specifically, the so-called "German Council of Economic Experts (GCEE)" has called for the ECB to reduce or unwind QE: ...the European Central Bank should slow down the expansion of its balance sheet or even phase it out earlier than announced. Of course, the GCEE is only concerned...

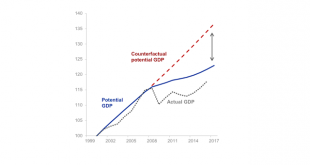

Read More »Euro area depression, charted

"The euro area economy is gradually emerging from a deep and protracted downturn. However, despite improvements over the last year, real GDP is still below the level of the first quarter of 2008. The picture is more striking still if one looks at where nominal growth would be now if pre-crisis trends had been maintained." So said Peter Praet, Member of the Executive Board of the ECB, in a recent presentation to the FAROS Institutional Investors' Forum.He's not wrong. From his presentation,...

Read More »The European Union must reform before it’s too late

At the Bank of England's Open Forum in London's Guildhall on Wednesday 11th November, an increasingly desperate-sounding Mario Draghi said this: As the majority of money is issued by private banks - bank deposits - there can only be a single currency if there is a single banking system. For money to be truly one, it has to be truly fungible, independent of its form and independent of its function. This is far from being the first time that Signor Draghi has pushed the case for common...

Read More »No apology, just an explanation

My Forbes post on the threat to democracy in the EU touched a nerve. Well, several nerves, actually. Some people regarded my invocation of the Prague Spring as insulting to the people who suffered under Soviet oppression: others objected to my comparison of the benevolent EU with the evil USSR: and a few complained that I had presented the Syriza government as "martyrs", when they are nothing of the kind. And lots of Portuguese called me out for misrepresenting how their parliamentary...

Read More »Can People’s QE Fix Britain’s Economy? With Chris Giles, Frances Coppola and James Meadway

A panel event run by the Post-Crash Economics Society at the University of Manchester debating the subject "Can People's QE Fix Britain's Economy?".

Read More » Francis Coppola

Francis Coppola