Here are some things I think I am thinking about: 1) Crypto All Going To Zero? John Paulson of subprime mortgage fame has some negative thoughts on cryptocurrencies: “Cryptocurrencies, regardless of where they’re trading today, will eventually prove to be worthless. Once the exuberance wears off, or liquidity dries up, they will go to zero. I wouldn’t recommend anyone invest in cryptocurrencies,” I’m not sure why people need to take such extreme views on so many things financially related....

Read More »Three Things I Think I Think – I See Dead Mutual Funds

Here are some things I think I am thinking about. 1) I see dead people. I mean, dead mutual funds. Back in 2012 I wrote an article about how horrible mutual funds are. I said: Mutual funds are a dinosaur product. The higher fees, reduced tax efficiency, lack of liquidity, and weak performance continues to hurt the industry. And this is only just beginning. There’s still $24 trillion in global mutual funds just waiting to find a new home. This tidal wave of money will flow out of mutual...

Read More »Should House Prices be in the CPI?

The rapid rise in house prices has stirred up the old debate debate about how the BLS calculates housing’s contribution to the CPI. This is no small debate since the US housing market is essentially the economy, mortgage debt comprises 75% of all household debt AND shelter is 33% of the CPI. Some people claim that the existing methodology understates inflation and gives people a false impression of how much our living standards are being impacted. The BLS, on the other hand, argues that...

Read More »Three Things I Think I Think – Some Weekend Reading

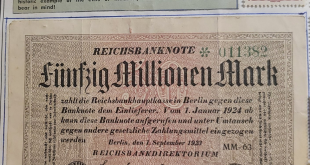

Here are some things I think I am thinking about: 1) Weimar Inflation! I was back home last week to see my family in DC and boy was that nice. My daughter got to meet her 10 nieces and nephews and I got to drink beer with my 7 brothers, sisters and parents. It almost felt like life was normal again. While I was there I was rummaging through my grandfather’s old stamp collection and I had to laugh at this little note he left on one page with a 50 million mark note from Weimar Germany. He...

Read More »The Investors Podcast – Masterclass in Inflation

I joined The Investor’s Podcast for a special Masterclass in Inflation. In this episode we covered the following topics: 00:00:00 – Intro 00:00:45 – What is inflation, and what is it not 00:05:51 – How much of inflation is due to base effects 00:09:53 – How can expected inflation drive inflation 00:14:21 – If the current inflation is temporary 00:21:37 – How is inflation reflected in the real estate prices 00:28:27 – Why do we have regional differences in inflation 00:36:40 – If...

Read More »370 TIP. Inflation Masterclass w/Cullen Roche

Investment expert Cullen Roche is back on the show to teach us a masterclass in inflation 2021. You don’t want to miss out on this one! IN THIS EPISODE, YOU'LL LEARN: 00:00:00 - Intro 00:00:45 - What is inflation, and what is it not 00:05:51 - How much of inflation is due to base effects 00:09:53 - How can expected inflation drive inflation 00:14:21 - If the current inflation is temporary 00:21:37 - How is inflation reflected in the real estate prices 00:28:27 - Why do we have...

Read More »Inflation 2021 w/Cullen Roche (TIP370)

Investment expert Cullen Roche is back on the show to teach us a masterclass in inflation 2021. You don’t want to miss out on this one! IN THIS EPISODE, YOU'LL LEARN: 00:00:00 - Intro 00:00:45 - What is inflation, and what is it not 00:05:51 - How much of inflation is due to base effects 00:09:53 - How can expected inflation drive inflation 00:14:21 - If the current inflation is temporary 00:21:37 - How is inflation reflected in the real estate prices 00:28:27 - Why do we have...

Read More »Three Things I Think I Think – Deep Weekend Thoughts

1) How About That Jobs Report? Wowzers. That was something else. Yesterday’s Jobs Report was huge figure after huge figure. The unemployment rate collapsed to 5.4% and the US economy added almost a million jobs. Truly great numbers across the board. I said it in my recent interview – people are pouring back into the workforce. This momentum is really picking up now and that’s only going to continue as the stimulus winds down and the demand for labor picks up into year-end. Now, the really...

Read More »Three Things I Think I Think – Macro Thoughts

Here are some things I think I am thinking about: 1) MACRO IS USELESS! NO, MACRO IS GREAT! The most recent Howard Marks memo is a real rollercoaster of macro emotion. He starts off by declaring that macroeconomics is useless. But then spends 15 pages explaining some of his macro views and why they might be important. It’s easy to hate on macroeconomists. They didn’t predict the financial crisis and they pretty much don’t predict anything at all. But I think this is a misinterpretation of...

Read More »What’s Next for the Fed and Inflation

Here’s an interview I did on the TD Ameritrade Network explaining a few current hot topics: Why the Fed should stop using the term “transitory” What’s the likely future of inflation? At what point will the Fed start worrying about inflation and potentially raise rates? Why housing and the recovery could pose the biggest risks to inflation upside. I hope you enjoy. [embedded content]

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism