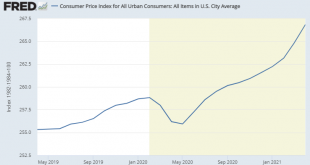

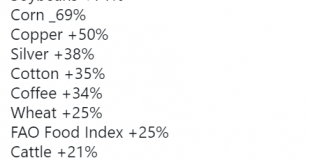

Whooboy. What a CPI print. Here are some highlights in case you have a life and don’t drool over BLS reports: The all items index experienced its largest increase (4.2%) since Sept 2008. The used car index was up 10% in April, its largest increase since 1953. The core index (ex food and energy) was up 0.9% in April, its largest increase since April 1982. Fun. There will be a tendency in many circles to assume that this is the return of the 1970s or something like that. I think we need to...

Read More »Three Things I Think I Think – Losing Reserve Currency Status

Here are some things I think I am thinking about. 1. Is the Fed “Playing with Fire”? Stan Druckenmiller had an op-ed in the WSJ about how Fed policy has been too loose for too long. I think there are some reasonable perspectives here. I’ve been pretty vocal about the risk of inflation overshooting the Fed’s target this year. I also think there’s an increasingly convincing argument that the Fed’s policies have contributed to a lot of financial market craziness in the last year. It would...

Read More »The Scarcity of Money Myth

I’m here to ruin some long running narratives. I apologize in advance. Money is not scarce. It never has been and it never will be. More importantly, scarcity of money is not a strength.¹ It is a weakness. Sound weird? Yeah, I bet. Let me explain. Back in college I was kind of obsessed with commodities and commodity money. I’d been reading a lot of Austrian econ and all that stuff. But then I came across the endogenous money theories and I learned over time that money is not a physical...

Read More »Credo Wealth Interview on the Macro Landscape

I recently joined Deon Guows of Credo Wealth, a $5B wealth management firm in London, to discuss the macro landscape in the years to come. We hit on a huge number of topics. Check out the chapter time stamps in the YouTube video to navigate to specific parts. I hope you enjoy! [embedded content]

Read More »Cullen Roche interview with Credo Wealth

Cullen Roche joins Credo Wealth for a discussion about the macro environment in 2021 including the future of inflation, interest rates, Bitcoin and much more. Chapters: 0:00 Introduction - Deon says way too many nice things about Cullen 2:51 Why Finance Twitter is great 4:00 Cullen's journey in finance 6:45 What is the Fed? 10:45 Grading the Fed's response to the GFC and COVID 15:00 The future of inflation from QE & fiscal policy 24:45 Where are interest rates headed? 27:00 How scary...

Read More »Fireside Chat with Cullen Roche

The latest Fireside Chat hosted by Credo Wealth was a thought-provoking conversation between Deon Gouws and Cullen Roche. They discussed a wide range of topics, including the role of the US Federal Reserve, the outlook for inflation and its impact on interest rates, Bitcoin, and the myth of passive investing.

Read More »Three Things I Think I Think – Housing Bubble 2.0, Passive Investing and Hyperinflation

Here are some things I think I am thinking about: Is the Housing Market a Bubble (Again)? I’m starting to see a lot of chatter about a housing bubble 2.0. So I went on Twitter and asked people what they thought. There were tons of smart responses if you want to review them. Ben Carlson also wrote a nice piece about the state of the housing market. I think Ben gets the big picture right. Basically, this isn’t that much like 2006 because: The buyers are mostly high creditworthy wealthy...

Read More »Let’s Talk Some More About Assflation

One of the persistent themes since 2008 is the theory that there has been excessive “asset price inflation”. I’ve talked about this quite a bit before, but it is worth repeating. And no, “assflation” does not refer to the 19 lbs we’ve all put on during COVID. It refers specifically to the term “asset inflation”. This is the idea that the “inflation” that was supposed to show up in consumer prices has been showing up in asset prices like stocks and housing. There’s a bit of truth to this,...

Read More »Understanding Government Liabilities

I keep running into a strange issue in macroeconomic discussions – no one seems to agree on how we should account for government liabilities. For instance, Gold standard economists believe government issued cash is not a liability (even though the Federal Reserve specifically shows it as a liability on their balance sheet). MMT economists say government “debt” is an IOU, but not borrowed debt. They also, at times, refer to government debt as equity.¹ Other people think the government’s...

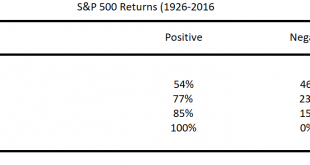

Read More »Stocks Don’t “Only Go Up”

It’s become popular during the last year to argue that “stocks only go up”. And yes, it sure feels like that some times. In fact, in the long-term, it’s mostly true. The odds of you losing money in the long-term are low: The problem with this view is that we don’t live our lives in the long-term. We live our lives in the short-term and a large portion of our financial liabilities are short-term – our rent, mortgage, car payments, etc. In financial portfolios we have what is called a...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism