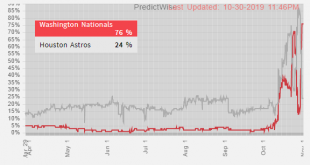

Here are three things I think I think about the Nationals winning the World Series¹: 1) Patience. Prior to the 2019 MLB season the Nationals were 18/1 odds to win the World Series. It was always a long shot, but there was never doubt that this team was pretty good and arguably the best team in the National League East. After all, despite losing their superstar, Bryce Harper, they’d been wise in picking up Patrick Corbin and Anibal Sanchez and bolstering their main 2018 weak spot – starting...

Read More »Three Things I Think I Think – This Might Make You Mad

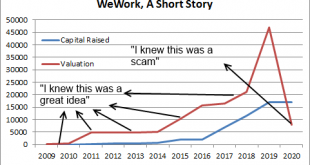

Here are some things I think will make you mad to think about: 1) Did Adam Neumann deserve to make a billion dollars? I asked a controversial question on Twitter yesterday – did Adam Neumann, the recipient of a billion dollar payout from suffering WeWork, deserve to make a billion dollars while the company struggles? Some people were furious about this. I very much get the anger and I didn’t mean to make people mad. After all, I just want to make people happy by discussing reserve...

Read More »No One Knows What Individual Stocks are Actually Worth

This is probably the most important thing you can learn about allocating your savings: No one really knows what individual firms are worth at any given time. When you recognize this fact you immediately step back from the constant media frenzy surrounding individual stocks. You recognize that it makes no sense to even try to have an opinion on individual stocks because they are so complex and unpredictable that trying to pick the winners and losers will inevitably result in excessive risk,...

Read More »Three Things I Think I Think – What if it All Comes Crashing Down?

Here are some things I think I am thinking about: 1. Do you need gold if it all comes crashing down? The Dutch Central Bank stated that we would need gold to recapitalize the system in the case that it all comes crashing down. I’ve never understood this view to be honest. If the whole system comes crashing down you’re not gonna care about gold and recapitalizing the system. If this zombie apocalypse scenario unfolds my guess is you’ll be fighting (perhaps hand to hand) for resources. The...

Read More »Three Things I Think I Think – Banning Billionaires and Other Stupid Ideas

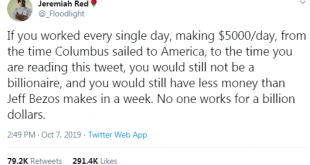

Here are some things I think I am thinking about on this beautiful Wednesday before the Washington Nationals defeat the Los Angeles Dodgers¹: 1) Should we ban billionaires? Bernie Sanders says we should ban billionaires. It’s all part of the growing trend in the idea of wealth taxes that have become popular with some Democrats. It sounds like an okay-ish idea if you’re into progressive taxation, but it’s also an impractical idea that is predicated on misunderstandings. For instance, the...

Read More »The Upside of Commission Free Trading

I hate short-termism and anything that feeds on it (financial news, get rich quick schemes, etc). It is, in my opinion, one of the most destructive aspects of any financial plan as it chews up taxes and fees thereby making the average investor more active and mathematically worse performing. Commission free trading feeds on this. It is essentially an incentive to trade more, as these trades, which are quite costly, are viewed as being cost-less. I bring this up as Schwab and Interactive...

Read More »Three Things I Think I Think – Impeachable Ideas

This website is, to a large degree, about impeachment and impeaching bad ideas out of the worlds of finance and economics. So, here are some impeachable ideas I’ve been thinking about lately: 1) Market Cap Weighted Index Funds are “immoral”. WHAT? Here’s an article on MarketWatch where someone who runs a “socially responsible investment” firm says that owning a simple index fund is “immoral”. The basic argument is that owning things like gun makers or cigarette makers in an index fund...

Read More »Three Things I Think I Think – Repo Madness!

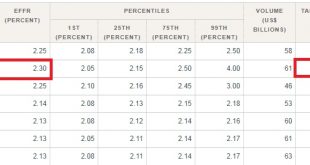

Here are some things I think I am thinking about: 1.2.3. The Great Repo “Crisis” of 2019. If you’ve opened the financial section of the newspaper in recent days then you’ve probably been blasted in the face with lots of confusing jargon about a liquidity “crisis” in the repo market. This sort of stuff really bugs me because it’s a market that is relatively opaque and just confusing enough that people can blow it out of proportion and make it sound like something really scary when in fact...

Read More »What is the Value of Financial Advice?

Vanguard released a new study showing that financial advice provides “meaningful” beneficial changes in behavior, performance and financial outcomes. They had previously published a study citing a 3% “advisor alpha”. I am not gonna lie – I always thought that number was BS and probably way too high. But is there a more reliable way to measure this? Let’s see. Investing is like being healthy – everyone knows how to do it, but implementing a plan and remaining disciplined is difficult. And...

Read More »Is This The Hardest Investing Environment Ever?

I was on the Stansberry Investor Hour last week with Dan Ferris discussing the markets and the broader macro environment. My segment starts at 29:30. Topics discussed: The general macro environment and why growth could remain sluggish. I was very bullish about bonds 24 months ago at the Stansberry Investment Conference, but that view has changed…. Bond math and why 0% yielding bonds make investing so difficult. FUN! Why I wouldn’t be surprised if markets don’t do much for a few years. Why...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism