Hooray! We did it folks. We raised the debt ceiling again and averted a self imposed default on US government debt. And to celebrate this joyous occasion I wanted to write my 3,589th article explaining some of the never-ending misconceptions about government debt and borrowing.¹ And to do that I found this David Stockman interview from last week. Stockman was Reagan’s budget director in the 80’s and seems like a good guy from everything I’ve read. But he’s also become the poster-child for...

Read More »My View On: ESG Investing

I write this post with some hesitancy because I suspect that it is going to annoy lots of people. This annoys me because the goal of this post is to emphasize the importance of being objective and emotionally agnostic when we’re investing. I’ll put on my flame retardant suit and see how well I can communicate this view without enraging people. Wish me luck. ESG investing (environmental, social and corporate governance) is a hot new space in the investment product landscape. The basic goal...

Read More »Seeing Both Sides of the Argument

Here was another fun question this week from Tadas at Abnormal Returns: Question: What have you learned in the past year (or so) that genuinely surprised you? Or said another way, what thing have you changed your mind about recently? A: “I’ve started doing this thing where I always assume that other views are right before I assume they’re wrong. For instance, I often hear political narratives about this or that and I tend to defer to my priors first. But now I start by considering all the...

Read More »Will Active ETFs Save Active Management?

Here’s Tadas again with a good question for a bunch of influential financial thinkers, and also me: Question: Traditional active management is dying a slow, painful death. Is the introduction of non-transparent, active ETFs a potential turning point or simply a finger in the dike of an unstoppable trend? Answer: “This conversion has been slowly taking place for years. ETFs are a flat out better product wrapper. 10 years ago I said that mutual funds are dinosaur products and that’s been...

Read More »Is Value Investing Dead?

There’s been a lot of chatter in recent years about the underperformance of value vs growth. This has led some people to declare that value is dead. But is it? Tadas Viskanta recently asked this question of some influential financial thinkers (and also me). Here’s a link to their answers. And here’s what I said: ”I have never liked the idea of “value investing” as a data traceable “factor”. That is, we are all value investors in the sense that we are all looking to buy assets that we can...

Read More »Four Fings I Fink I Fink

It’s the 4th of July so here’s an extra special three things… 1) Nike is Being Unpatriotic Again?…So, Nike decided not to release a new shoe with the Betsy Ross flag on it. They said that the flag was perceived by some as being a symbol of the slave era. Apparently this decision was influenced by Nike spokesperson Colin Kaepernick. Naturally, everyone lost their shit over this because that’s what we do these days – we lose our shit over things that we shouldn’t be losing our shit about....

Read More »When “Bonds” Aren’t Bonds

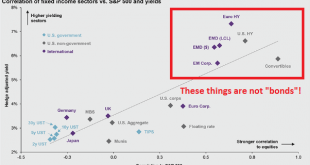

In finance and economics we tend to use oversimplified terms like “money” and “bonds” when the reality is that it’s important to be more nuanced in understanding these terms. That’s why, for instance, I prefer the term “moneyness” when I refer to a money-like instrument. It conveys the proper degree of flexibility about the item. Sometimes cash has more money-like properties than a bank deposit. Sometimes it doesn’t. We can apply the same type of thinking to the financial markets and in...

Read More »The Longest Recovery Ever – Does it Matter?

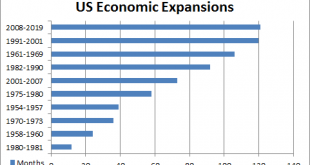

Today officially marks the longest recovery in US economic history. At 121 months the 2008-2019 expansion officially overtakes the 1991-2001 expansion. Here’s an overview of the post-war economic expansions: The most interesting bit here is that the expansions seem to be getting longer. I’ve written about this in the past and the reasons why the expansions seem to be expanding. The key points are: Monetary policy combined with fiscal policy’s automatic stabilizers are more likely to...

Read More »My View On: Student Debt Forgiveness

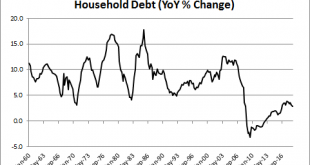

Bernie Sanders and Elizabeth Warren have proposed forgiving all student debt. Naturally, this is somewhat popular and garnering a lot of attention because free stuff is fun and having the government give out free stuff is also very controversial. Where do I sit on this issue? Well, it’s a complex one, but I’ll try to condense my thoughts here. The Student Loan Market – An Overview The student loan market is $1.6T spread out over 44MM people. That’s an average balance of ~$36K and a median...

Read More »Three Things I Think I Think – Libra Edition

I’ve been doing investment management long enough that it’s only logical that I begin to transition into horoscopes and fortune telling so here we go. Just kidding of course. Libra is not a strangely opaque reference to a kind of scammy pseudoscience. It’s a reference to Facebook’s new kind of money, which, err, hopefully won’t be based on a kind of scammy pseudoscience…. 1) What is Libra? Libra is what Facebook is calling their new cryptocurrency. Here’s a short primer on it from...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism