We’ve seen a number of foreign debt based crises in the last few years with both Turkey and Argentina suffering from substantial episodes of inflation related to foreign denominated debts. Without getting bogged down in the specifics of these cases I want to touch on a more general question: Why do countries borrow in foreign currency? I reached out to an international banker I know for his opinion on why this theme seems to keep occurring. Here’s what he had to say: Many countries have...

Read More »EVERYONE Funds Their Spending

One of the most confused (and confusing) elements of endogenous money is the idea of “funding”. Endogenous money is not a new theory, but it is not well understood even to this day. Even many supposed endogenous money theorists, like the MMT people, misunderstand it and as MMT has gained some popularity I am seeing increasing misinterpretations. So let’s dive in and see if I can’t explain this more succinctly and clearly. Endogenous money is the fact that anyone can expand their balance...

Read More »Three Things I Think I Think – Bubbles Edition

Here are some things I think I am thinking about: 1) Is there a bubble in passive investing? Michael Burry of Big Short fame, says there’s a bubble in passive investing. The basic argument is that passive investing has skewed the markets and caused small cap value stocks to underperform. Burry, unsurprisingly, is invested in many small value stocks. Soooooo. This seems to happen once every few years where an active manager blames index funds for their performance. They’re an easy...

Read More »Let’s Stop Talking About “Paying Off the National Debt”

When we talk about personal finance we often talk about paying off our debts to become financially free. But this is a fallacy of composition. While some households can pay off their debts, the economy actually relies on expanding debt (and assets) to have liquidity and growth. After all, debt isn’t necessarily bad. Yes, there are bad types of debt (like credit card debt which almost always have a negative long-term return), but there are also good types of debt (for instance, when someone...

Read More »Black Hole Monetary Economics

Economic nerds are converging on Jackson Hole for their (our?) annual meeting and the big story of the event will be a controversial opinion by Larry Summers, which he laid out on Twitter yesterday. He is presenting a paper in which he argues [gasp] that monetary policy isn’t as effective as the economics profession has been led to believe. This is nothing new to readers of this site and anyone sympathetic to Post-Keynesian economics. I had publicly argued with Paul Krugman about this...

Read More »Let’s Get Inverted

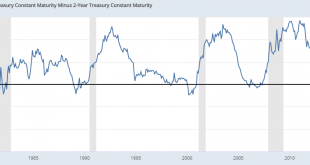

Alright, nerds. It’s time to put on our thinking caps and fill up our pocket protectors. We’re gonna talk about inverted yield curves. First things first – What is an inverted yield curve? An inverted yield curve is a description of the comparison between 10 year Treasury note yields and 2 year treasury note yields. Those are the only two instruments that matter here. If anyone else says an inverted curve is some version of some other set of instruments then take away their nerd badge....

Read More »Three Things I Think I Think – Recession Alert Edition

Here are some things I think I am thinking about. 1) About this negative yield thing….Interest rates just keep pumping lower. There’s now over $15 TRILLION worth of bonds in the world with a negative yield. Now, negative yields aren’t as crazy as some people think. There’s perfectly practical reasons for yields to be negative (for instance, if you believe inflation will be very low or negative). But check out this price action in 30 year Austrian Government Bonds: If that’s hard to see,...

Read More »How I Think of the Stock Market During its Ups and Downs

I’ve previously written about how I like to think of stocks as bonds. Of course, I know this is a bit of overreach, but it’s a useful exercise when putting things in the proper perspective. For instance, I find bonds intuitively easy to understand. After all if you buy a AAA rated T-Note with a 5 year maturity then you know your time horizon, nominal risk, and return. In other words, you know every single element of this instrument when accounting for how it fits into your portfolio. The...

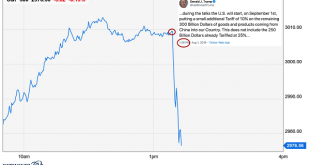

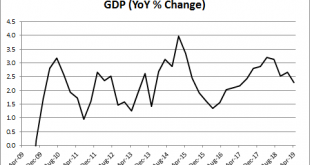

Read More »Three Things I Think I Think – Rate Cut Edition

It’s almost the weekend, folks. Hang in there a few more hours. In the meantime, here are some things I think I am thinking about: 1) The Fed did whaaaat? The Fed cut rates for the first time since 2007. Things are a bit different this time. In 2007 the housing market had been screaming higher and was softening quite a bit. GDP was consistently over 6%. Rates were 5.25% and inflation had been consistently close to 4% for years. This time around inflation can barely get over 2% and GDP is...

Read More »Three Things I Think I Think – Negative Rates and Stuff

Here are some things I think I am thinking about: 1) Q2 GDP – more of the same. Second quarter GDP came in at 2.1%. Pretty weak. But more of the same. As I’ve long been pointing out – this is the golden age of low and stable growth. It really is a sort of Goldilocks economy. Not too hot, not too cold. Just right. But this general trend has been going on for 10 years now. 2) Negative rates everywhere. There has been a lot of chatter in recent weeks about how bond yields are going negative...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism