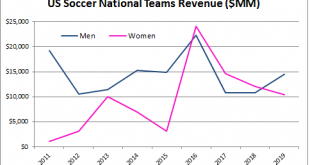

“Woohoo, the Three Things we’ve all been waiting for – the soccer edition.” – Said no one ever. 1) Women’s Soccer and equal pay. The US Women’s National Team has been involved in a longstanding lawsuit against US Soccer over equal pay. Basically, the men’s team makes a lot more on average than the women do and the women argue that this is discrimination. Now, this is a tricky discussion because there are a lot of moving parts, but here’s where I stand on this. You have to look at this...

Read More »Three Charts I Think I’m Thinking About

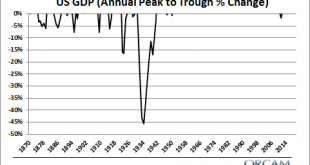

Here are some pretty pictures I think I am thinking about: 1. The USA is bankrupt, part 3,478. It’s been at least 1 or 2 blog posts since I talked about the USA being bankrupt so I would be remiss if I didn’t remind you that the USA is actually not bankrupt at all. This chart comes to us courtesy of Mary Meeker’s annual internet report. Now, the annoying thing about this chart is how the government is being compared to a corporation. This doesn’t make sense. The government is more like a...

Read More »Three Things I Think I Think – Don’t Piss in my House

Here are some things I think I am thinking about: 1) Don’t Piss in my House. YouTube demonetized some people and now Conservatives are up in arms about the first amendment. In case you missed it – basically, there’s some Conservative guy on YouTube who says a lot of inappropriate things about homosexuals and other people. A VOX Media reporter was the target of some of these insults and made a big stink about it. Big enough that YouTube decided to demonetize the YouTuber (meaning, he won’t...

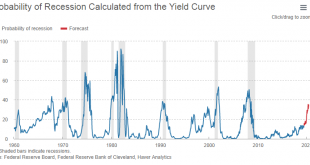

Read More »Is the Bond Market Predicting Recession?

Sorry for the radio silence here. Real work got in the way of blogging about work. A lot of people seem to think that the bond market is forecasting a recession now that yields are declining again and the curve has completely flattened. Is a recession coming? Do you need to jump in your bunker? Do you need to build your bunker? Let’s explore. I’ve touched on the flattening and inverting curve a number of times in the last few years. Here’s my general view over time: November, 2017 – The...

Read More »Is Vanguard Better at Predicting Future Returns?

I sometimes poke fun at short-term forecasts. It’s not that I don’t believe in making forecasts (we all have to do that). It’s just that I find it a little silly to try to forecast short-term stock market moves because the stock market is an inherently long-term instrument (the stock market has at least a decade+ duration depending on how you calculate it).¹ Forecasting the monthly or annual changes in stocks is like looking at a one year 2% yielding bond and trying to forecast the ten day...

Read More »Three Things I Think I Think – It’s Rubio!

Here are some things I think I am thinking about on this beautiful Saturday morning…. 1) Are buybacks propping up the stock market? One of the more annoying narratives going around these days is this idea that buybacks are propping up the stock market. I was reminded of this yesterday while reading a Ned Davis Research piece which said the stock market would be 19% lower without buybacks. Let’s think about this rationally…. This sort of thinking assumes a hyper inefficient market where...

Read More »Capitalism Vs. Socialism

I really enjoyed this segment on CNBC about capitalism and socialism. In this short clip Warren Buffett, Charlie Munger and Bill Gates discuss the nuance of their view and many of the confused narratives that are going around these days. Take a look for yourself, but here’s how I basically see this debate and the many problems around the use of these terms: Socialism means social ownership of the means of the production. Capitalism means private ownership of the means of production. No...

Read More »Three Things I Think I Think – Berkshire, Jobby Jobs and Chase Tweets

It’s almost Cinco de Drinko weekend so hang in there for a few more hours. Or, if you’re reading this on Sunday, salud! In the meantime, here are three things I think I am thinking about: 1. Buffett buys….zzzzzzzzzz. So, Berkshire bought some Amazon stock recently. I am not gonna lie, this is a big snoozefest. The financial media always goes crazy when Buffett buys something new, but why is this news? Seriously? Berkshire stock hasn’t outperformed the S&P 500 in over 10 years. It’s...

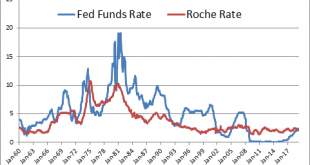

Read More »Whom Would I Nominate for the Federal Reserve?

So, Stephen Moore is no longer being considered for the Fed. As I explained in detail this is a good thing. Moore was nowhere near qualified and had a long track record of misunderstanding basic things about the Fed. So good for Trump for recognizing this and dropping the nomination. Now what? Someone asked me an interesting question on Twitter: “Who would you nominate?” I (half jokingly) answered FRED...

Read More »How Will The Fee Structure of Financial Advisory Change in the Future?

Financial advisory fees are a huge controversy at present. After all, there is significant evidence that paying higher fees for asset management services is detrimental to your portfolio. And while the average fee for portfolio managers has fallen significantly the average financial advisory fee remains pretty much where it has been for the last decade at 1%. What explains this and will it persist? When I started in the world of financial services we were mostly commission based. You...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism