Share the post "Understanding Flow of Funds Accounting" After the post a few weeks ago where I showed that Post-Keynesian Stock Flow Consistent modeling has become very popular on Wall Street I got a ton of emails asking for more details on this approach. So, here’s a short description and a few good links for you to explore if you’d like. Stock flow consistent modeling is a form of economic modeling that involves a comprehensive macro framework for understanding the integration of the...

Read More »Opinion: The Rise (and Fall) of Donald Trump

Share the post "Opinion: The Rise (and Fall) of Donald Trump" A bit off topic here, but since it’s the weekend and this is basically all anyone in the world talks about anymore, I figured I’d chime in with an update on Donald Trump. If you recall my 10 “Useless” 2016 predictions, I said: Donald Trump will be the next President of the United States. The American electorate will reluctantly vote for Donald Trump as he seizes on a world of instability and literally scares the American...

Read More »Economics Can’t be Tested in a Vacuum

Share the post "Economics Can’t be Tested in a Vacuum" The economy is one of the most complex systems that exists in the world. Perhaps even the most complex system. I like to think of the monetary system like a car. There are very specific institutional structures that act as certain parts of this system and in a vacuum that car or system will do certain things. For instance, when someone borrows money from a bank to finance investment in a productive innovation it is much like pouring...

Read More »Three Things I Think I Think – Financial Crisis Edition

Share the post "Three Things I Think I Think – Financial Crisis Edition" Here are some things I think I am thinking about: Warren Buffett on the financial crisis, investing with a sound premise & silly Congressional ideas. 1 – What Caused the Financial Crisis according to Warren Buffett? The National Archives released documents related to the Financial Crisis late last week. Among them were some interviews with Warren Buffett on the crisis. I noticed that, aside from being nerdy white...

Read More »The Single Entity Risk Problem

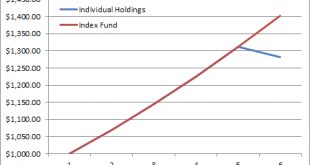

Share the post "The Single Entity Risk Problem" One of the points I emphasize in my new paper on portfolio construction is the risk of owning individual securities relative to indexing. A lot of people don’t know this, but since 1980 the S&P 500 has seen 320 departures from the index due to distress. This means that about 10% of the S&P 500 leaves every 5 years because of distress. So, if you’d bought all 500 individual stocks in the S&P 500 in 1980 you would have ridden a...

Read More »Passive Investing – I Doth Protest Too Much

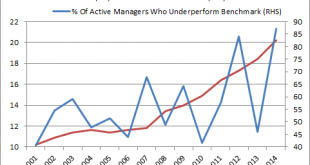

Share the post "Passive Investing – I Doth Protest Too Much" One of my favorite blogs, The Monevator blog, did a brief write-up on my new paper this weekend. If you don’t read their website you’re missing out because they consistently post some of the best financial content around. Anyhow, they had a very fair and objective view of the paper and approach to portfolio construction. However, one point that I seem to lose a lot of people on is my discussion of active and passive investing....

Read More »Passive Investing isn’t Hurting the Economy

Share the post "Passive Investing isn’t Hurting the Economy" The new sales pitch for the high fee active manager goes something like this: “passive investing has gotten so large that this creates greater opportunities for us to take advantage of these inefficiencies and outperform the market.” In fairness, this comment is partly true because more passive investors should create the need for more active investors (in the form of market making, index arbitrage opportunities, etc.) but it...

Read More »Why Equity Outperforms Credit

Share the post "Why Equity Outperforms Credit" In my new paper on asset allocation I go into quite a bit of detail about why certain asset classes generate the returns they do. Understanding this is useful when thinking in a macro sense and trying to gauge why financial assets perform in certain ways in both the short-term and the long-term. It’s important to understand the fundamental drivers of these returns in order to avoid falling into the trap that these assets generate returns due...

Read More »Are Debt Financed Booms/Busts a “Theory”?

Share the post "Are Debt Financed Booms/Busts a “Theory”?" Noah Smith has another piece up taking a swipe at heterodox economics and what he calls the “Folk Theory of the Business Cycle”. He says: A lot of people seem to subscribe to what I call the Folk Theory of business cycles (not to be confused with the Folk Theorem of game theory). Roughly speaking, this is the idea that: 1. Debt growth is necessary for GDP growth. 2. As GDP grows, debt levels become too large, leading to an...

Read More »The Perils of the Safe Income Illusion

Share the post "The Perils of the Safe Income Illusion" Here’s Josh Brown with a good piece on dividends. He asks, “are we too obsessed with dividend income?” Tricky question, but I would tend to answer by saying that, when we substitute equity income for bond income, we’re often searching for “safe income” in all the wrong places. As I noted in a recent piece, corporations don’t have to pay out dividends and we should expect capital appreciation to accurately reflect the true value of...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism