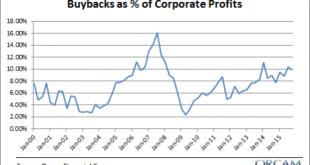

Share the post "Myth Busting: Stock Buybacks aren’t Propping up the Stock Market" There has been a good deal of concern about stock buybacks in recent years ranging from concerns that buybacks are a poor allocation of resources to the idea that buybacks are propping up the stock market. Today we’ll investigate the idea that stock buybacks are the primary source of elevated stock prices. A recent piece in Bloomberg stated: Buybacks are helping prop up a bull market that is entering its...

Read More »My “Wisdom” on the Being an Optimist About the Future

Share the post "My “Wisdom” on the Being an Optimist About the Future" Tadas ends his blogger wisdom series asking what we’re excited about that no one else is talking about. I said: I am excited about how great the future is going to be. We live on a rock spinning 1,000 mph through space in a universe where we might be the only creatures fully aware of it. The whole human existence is a miracle that should have us all waking up in the morning screaming “holy crap, this is amazing”. ...

Read More »My “Wisdom” on Changing my Mind

Share the post "My “Wisdom” on Changing my Mind" Tadas continues with the financial blogger wisdom series today asking: Think back to the last edition of this series a couple of years ago. Have you changed your mind about something (big or small) over that time period? If so, what and why? My answer alluded to a rather substantial change of opinion: Ben Bernanke would beat Paul Krugman in an arm wrestling competition. I used to think differently, but based purely on beard strength,...

Read More »What Does it Mean to be a “Low Fee” Investment Advisor?

Share the post "What Does it Mean to be a “Low Fee” Investment Advisor?" I pride myself on being a truly low fee investment advisor, financial planner & portfolio manager. With fees ranging from 0.1%-0.35% my firm offers one of the most competitive fee structures in the entire investment business. We could probably charge the standard 1% annual fee, but I made a conscious decision when I started my retail asset management business last year that I was going to get way ahead of the...

Read More »My “Wisdom” on Diversity in Finance

Share the post "My “Wisdom” on Diversity in Finance" The blogger wisdom series continued today with a question about diversity in finance. Tadas asks: It does not escape me that the entire distribution list on this “Blogger Wisdom” e-mail chain is entirely male. I have written extensively on why this is an issue for the investment industry. What, if anything, can be done to make the investment industry more inclusive? My answer was stupid and not nearly as funny as I wanted it to be:...

Read More »My “Wisdom” on Index Funds

Share the post "My “Wisdom” on Index Funds" Tadas Viskanta continues his series on “finance blogger wisdom” today discussing index funds. Specifically, he asks: Should we care that the percentage of assets in indexes is on the rise, or should we just sit back and enjoy the (low cost) ride? My answer was, um, not very thorough (again): Indexing requires active management in order to maintain the “passive” allocation held by the indexers. The rise of indexing is good for both the...

Read More »My “Wisdom” on Smart Beta & Factor Investing

Share the post "My “Wisdom” on Smart Beta & Factor Investing" The latest installment from Tadas Viskantas’s series on “financial blogger wisdom” (is that an oxymoron?) asked a bunch of smart people (and also me) about smart beta. I was short: Smart beta and factor investing are the newest versions of high(er) fee active management promising the fairy tale of “market beating” returns in exchange for higher fees and usually delivering lower returns (after taxes and fees). Regulars know...

Read More »My “Wisdom” on Robo Advisors

Share the post "My “Wisdom” on Robo Advisors" Tadas Viskanta has put together a nice collection of opinions regarding the new “Robo Advisor” trend. Here’s my general view: “Robo “advisors” aren’t really advisors. They’re robo asset allocators. The robotic allocations are susceptible to flawed risk profiling and inefficient portfolio management for most people with a sophisticated financial plan. The business of asset allocation is too personal and customized to ever become fully...

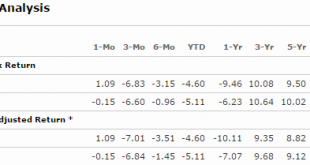

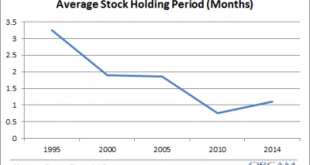

Read More »How to Avoid the Problem of Short-Termism

Share the post "How to Avoid the Problem of Short-Termism" If I had to pinpoint the biggest problem for most asset allocators I would probably say short-termism. Short-termism is the tendency to judge financial markets in periods that are so short that it results in higher fees, higher taxes and lower average performance. We’ve become accustomed to judging the financial markets in quarterly or annual periods which contributes to this short-termism, but some context will show that this...

Read More »The Investor Podcast – Macro Thoughts

Share the post "The Investor Podcast – Macro Thoughts" I was on The Investor Podcast this past weekend with the very awesome Stig Brodersen and Preston Psyh. We covered a lot of ground in this one including: The implication of negative interest rates for banks and bank customers Why quantitative easing doesn’t work in the current environment Why focus should be fiscal policy rather than monetary policy Why central banks works as a clearing house with the intention to avoid bank runs How a...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism