Share the post "The Fed Should Sit Tight Despite Good Jobs Report" With the recent market and global economic turmoil the Fed has signalled some hesitancy to raise rates this year. Fed Funds Futures were pricing in a 30% chance of a rate hike this year as of one month ago, but after a 10% stock rally and another good jobs report for February the odds of a rate hike in 2016 have jumped to over 70%. So, where do we stand? I have been vocally against rate hikes for the last few quarters. My...

Read More »Understanding Modern Portfolio Construction [New Research]

Share the post "Understanding Modern Portfolio Construction [New Research]" My newest research paper, Understanding Modern Portfolio Construction, is available on SSRN. This paper is the culmination of years of work and I consider it to be the most important piece of research I’ve published. I wrote this paper in much the same way that I wrote my paper, Understanding the Modern Monetary System, however, since I’m not an academic economist, this paper is more along the lines of my...

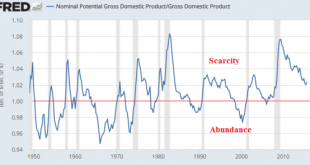

Read More »Scarcity VS Abundance

Share the post "Scarcity VS Abundance" Josh Brown and Gavin Jackson have both written excellent pieces on the current environment and the state of the business cycle. Josh argues that we’re in a state of “abundance” and that we’re due for a recession whereas Gavin argues that there is not so much a broad abundance, but a more fragmented abundance. Let’s explore this a bit more. This has become an increasingly difficult conversation in the global economy because there are several...

Read More »How Could the Fed Implement a Helicopter Drop?

Share the post "How Could the Fed Implement a Helicopter Drop?" In a recent post I said that the Fed doesn’t have a helicopter in the current environment. That is, political and realistic constraints mean that the Fed won’t implement anything close to what we think of as a helicopter drop. My thinking is more complex than this, but here’s the short story: When the Central Bank “monetizes” debt it is acting in an ex-post manner that responds to fiscal policy. That is, it can only...

Read More »Why Has Heterodox Economics Become Orthodox on Wall Street?

Share the post "Why Has Heterodox Economics Become Orthodox on Wall Street?" I recently noted that heterodox economics is not so heterodox anymore.¹ There’s been a growing trend, especially on Wall Street, in the use of heterodox economic models and particularly Post-Keynesian Economic models. What’s the cause of this surge in popularity? I think it’s derived from two primary sources: Orthodox economic models largely ignore the financial system (though this has improved recently) and...

Read More »Three Things I Think I Think – Monday Funday Edition

Share the post "Three Things I Think I Think – Monday Funday Edition" Here are some things I think I am thinking about: T-Bonds, Consumerism & Factor Investing… 1 – Why are T-Bonds the safe haven asset? As the markets have gotten jittery we’re once again seeing Treasury Bonds perform very well in both nominal and risk adjusted terms. I’ve noted this repeatedly over the years based on a rather simple point that, interestingly, is now finding some empirical support in academia....

Read More »“Heterodox” Economics is not so Heterodox Anymore

Share the post "“Heterodox” Economics is not so Heterodox Anymore" Noah Smith says that “heterodox” economics is occult (mystical) because someone in his Twitter feed was bothering him.¹ Noah also says there just isn’t any accessible research on heterodox economics.² Both of these statements are incorrect. I’ve noticed a strong trend in the last 10 years where heterodox economics is becoming increasingly mainstream where the rubber meets the road – on Wall Street. Now, Noah has a...

Read More »Warren Buffett’s Greatest Strength

Share the post "Warren Buffett’s Greatest Strength" “The intelligent investor is a realist who sells to optimists and buys from pessimists.” – Ben Graham I was going to write some general thoughts about Warren Buffett’s annual letter just like I always do, but given the political and economic climate I want to do something else. I want to talk about a central aspect of Warren Buffett’s investment strategy – his long-term optimism. In a political world where we’re constantly being...

Read More »Is Indexing Just Another Wall Street Fad?

Share the post "Is Indexing Just Another Wall Street Fad?" Here’s an interesting comment from value investor Seth Klarman on the rise of indexing (this is from 1991!): Klarman is obviously biased because he’s in the business of selling a high fee asset management platform. If indexing is right then his form of highly active alpha chasing asset management is wrong. This is basically what Bill Ackman was saying when he lashed out against indexing earlier this year. Anyhow, I think Klarman...

Read More »Why Stock Market Declines are Good

Share the post "Why Stock Market Declines are Good" James Bullard, the St Louis Fed President, gave an interview today discussing how the stock correction has been good because it has helped to prevent a bubble. He’s inferring that lower prices are bad in the short-term and good in the long-term. And he’s totally right. I’ll show you why. What happens when the stock market booms is that future returns get pulled into the present. Stock bubbles are dangerous because they pull so much of...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism