Share the post "Fiscal Policy Has Failed the US Economy" The story of the post-crisis economic period is simple: The housing boom left the household sector mired in a deep debt hole. This was further exacerbated by the leverage Wall Street added on top of the household sector’s debt. This left the banks and household sector needing a great deal of support. Since 2008 we’ve seen huge amounts of stimulus from the Federal Reserve and global Central Banks, but we’ve had trouble transitioning...

Read More »The Best Asset Price to Know Twenty Years Out

Share the post "The Best Asset Price to Know Twenty Years Out" Tyler Cowen asks a fun question here: “You are an investor with $10 million planning to cash out in 20 years. A genie appears and offers to send you the price of one but only one asset 20 years from now to inform your investment decisions (a stock, currency pair, commodity, equity index, etc.). What do you want to know? The genie also gives you 20 year cumulative inflation (or exchange rate change for non USD assets) so you...

Read More »Why Do Corporations Pay Dividends?

Share the post "Why Do Corporations Pay Dividends?" There is increasing chatter in recent years about share repurchases, dividends, corporate investment and the ideal way for firms to use capital. But one question that economists can’t really agree on the answer to is why companies pay dividends at all? As noted in an excellent Twitter conversation initiated by Matthew Yglesias, even great thinkers like Richard Thaler and Tyler Cowen don’t have good answers. And even the legends in...

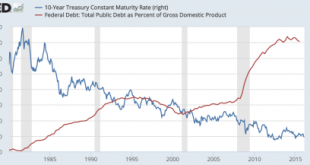

Read More »Let’s Talk About the US Government’s Interest Burden

Share the post "Let’s Talk About the US Government’s Interest Burden" Greg Ip had a piece in the Wall Street Journal yesterday discussing the debt burden in the USA and how low interest rates have “moved back” the “hands on the doomsday debt clock”. The article touches on the important topic of entitlement spending and whether it’s sustainable, but does so in a manner that misleads readers about why this might be a problem. For instance, Ip says that “higher federal borrowing puts upward...

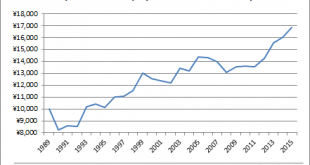

Read More »The Importance of Global Asset Allocation – Japan Edition

Share the post "The Importance of Global Asset Allocation – Japan Edition" I’m a big fan of owning a global equity market portfolio consistent with something resembling the Global Financial Asset Portfolio (though, I would also add that this portfolio isn’t necessarily ideal).¹ If you’re a US investor this has looked like a pretty silly idea in the last few years as foreign stocks have been poor performers in relative terms. Despite this short-term performance there is widespread...

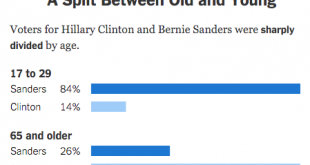

Read More »Three Things I Think I Think – In the Dark Edition

Share the post "Three Things I Think I Think – In the Dark Edition" Here are some things I think I am thinking about: 1 – Young People Don’t Like Hillary. The craziest thing about last night’s Iowa Caucus was the disparity on the Democratic side. Hillary Clinton is getting very little support from young voters. Even young females are voting for Bernie Sanders. Here’s the breakdown by age: This is very different from the Democratic party that Barack Obama won under where young voters...

Read More »What Financial News Sources Should You Read?

Share the post "What Financial News Sources Should You Read?" The Wall Street Journal recently noted that they will be closing the backdoor search loophole to their content thereby forcing readers to subscribe. For those who aren’t aware of this trick – you can access most pay-for financial news sites by searching for the headline on Google. Clicking on that link takes you to the full article even if the site is behind a paywall. Now, some people call this “theft”, but it’s really just...

Read More »Why are Treasury Bonds the Ultimate Safe Haven?

Share the post "Why are Treasury Bonds the Ultimate Safe Haven?" The last 10 years have exposed a very important reality for any global asset allocator – US Treasury Bonds are the ultimate safe haven investment. For decades we have heard stories about how gold, silver, real assets or other types of financial instruments would serve as the “safe haven” investment during times of crisis. Many of these stories were based on mythical ideas about the coming collapse of fiat money or the...

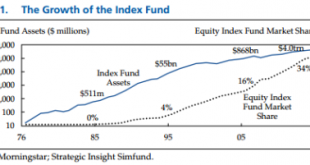

Read More »Dear Hedge Funds: Index Funds Didn’t Eat Your Returns

Share the post "Dear Hedge Funds: Index Funds Didn’t Eat Your Returns" Indexing strategies have been the fastest growing segment of the asset management world in the last 15 years due to low fees, tax efficiency, diviersification and the failure of higher fee active managers to justify their higher fees. As this trend plays out we’re hearing more and more stories about how this trend is bad for investors and how we need these old high fee active managers to better manage the asset space....

Read More »Three Things I Think I Think – Scary Stories Edition

Share the post "Three Things I Think I Think – Scary Stories Edition" Here are some things I think I am thinking about: 1 – Scary Stories Sell Well. Morgan Housel has a great piece over at Motley Fool about why scary stories sound so smart in finance. Morgan rings off a bunch of reasons why scary stories usually sound smarter than bullish stories. This is particularly important to keep in mind when we’re going through rocky times like right now. Scary stories always sell well. And for...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism