Share the post "Revisiting Max Pain" This is a timely repost from last year. Sharp downturns are always a good reminder that our financial theories might not always align with our financial reality. As I like to say, if you don’t get your risk profile right at the start, the market will teach it to you at some point. Knowing your max pain point is a crucial part of good portfolio management. My biggest gripe with Modern Portfolio Theory is that it tends to lead investors into very...

Read More »5 Big Macro Myths

Share the post "5 Big Macro Myths" James Montier of GMO wrote a wonderful piece earlier this week that I am just getting around to posting. Pragcap readers will really enjoy it as it covers a lot of ground that I’ve been harping on for years now. James discusses 5 big macro myths that just won’t die including: Myth 1: Governments are like households Myth 2: Printing money to finance budget deficits is inflationary Myth 3: Budget deficits/high debt lead to high interest rates Myth 4:...

Read More »What a Time to Build Something!

Share the post "What a Time to Build Something!" While all the doom and gloomers are running into their bunkers to snuggle with their bars of gold the real visionaries of the future are licking their lips in the current environment. With interest rates close to 0% and commodities plummeting to 20 year lows the current environment is presenting itself as one of the truly incredible periods to be a builder. It’s almost as if the financial markets and non-financial asset markets are...

Read More »This Tech Cycle is/was Amazing

Share the post "This Tech Cycle is/was Amazing" Lots of people are declaring the end of the current tech cycle. And others are expressing their disappointment with the way it contributed to society. But I think these views are too near-sighted and unfairly malign technology’s incredible contributions in the last 10 years. Every time I read something about the evils of new technology I think about this Louis CK clip talking about how the world has become so amazing and how everyone is...

Read More »On the Probability of Another 2008

Share the post "On the Probability of Another 2008" I spoke at the AAII investor conference in Los Angeles this past weekend and one of the more common questions I got was whether we’re on the precipice of another 2008. I probably don’t know much better than anyone else, but I’ve stated in the last few quarters that I don’t see it. Here’s my thinking in a nutshell: US and European banks are much healthier today than they were in 2007. There hasn’t been a big credit boom in the US and...

Read More »The Great Myths of Investing

Share the post "The Great Myths of Investing" This is a guest post from the always awesome Bob Seawright (mostly awesome because he’s from San Diego) As the great Mark Twain (may have) said, “It ain’t what you don’t know that gets you into trouble. It’s what you know for sure that just ain’t so.” That’s particularly true in the investment world because we know, to a mathematical certainty, that avoiding errors provides more bang for the buck than making correct calls and generating...

Read More »60 TIP: Macro Investing

In this episode, Preston and Stig talk to financial educator, Cullen Roche, about his ideas on the modern monetary system. Cullen is the founder of Orcam Capital and the author of the book, Pragmatic Capitalism. IN THIS EPISODE, YOU’LL LEARN: - How innovation can overcome regulations and demographic problems - Why it’s the banks and not the Federal Reserve that is “printing money” - Why and how the US financial system is different than in Europe - Why quantitative...

Read More »Was Raising Rates a Yuge Mistake?*

Share the post "Was Raising Rates a Yuge Mistake?*" The recent market jitters have a lot of people saying that the Fed might have made a yuge mistake by raising rates. I’ve been a vocal proponent against raising rates, but I am not convinced that this was a policy error (just yet). The risk/reward doesn’t look great in a world where the US economy is fairly weak and global growth is clearly slowing. Here’s my thinking: The risk with rate hikes is creating an extreme divergence in global...

Read More »The Bear Market Playbook

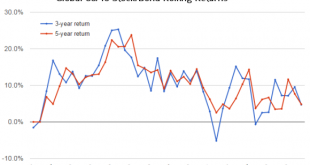

Share the post "The Bear Market Playbook" As many markets enter bear market territory around the globe investors are inevitably getting skittish. Bear markets are a regular part of the financial markets, but that doesn’t make them easy to handle. Here are some keys to handling a bear market: 1. Don’t lose your perspective. In the last 45 years a globally allocated 60/40 stock/bond portfolio has never had a negative rolling 5 year return. Of course, it’s not easy to maintain a 5 year...

Read More »AAII Roundtable Discussion This Saturday in Los Angeles

Share the post "AAII Roundtable Discussion This Saturday in Los Angeles" I’ll be part of a round-table discussion in Los Angeles this Saturday, 9AM at the AAII Los Angeles annual meeting. The awesome Tom Petruno from the LA Times will be joining me to discuss the financial markets and the maroeconomic environment. If you’re in the LA area you should come out and join us. The event will be mostly a Q&A session so come with questions prepared. It should be informative and a lot of fun...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism