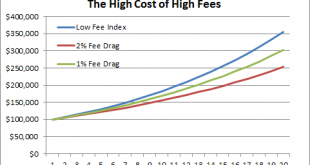

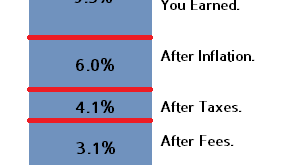

Share the post "Indexing Doesn’t Win When It’s Implemented Via a High Fee Advisor" I’m a big advocate of indexing strategies because they’re low fee, tax efficient and diversified approaches to allocating one’s savings. But I see a worrisome trend in the asset management business – high fee advisors endorsing low fee indexing and selling it as something different from “active” management. We should be very clear here – these high fee advisors are not much different than their high fee...

Read More »The Money Multiplier and the Myth that Just Won’t Die…

Share the post "The Money Multiplier and the Myth that Just Won’t Die…" Almost every single mainstream economic textbook teaches some version of the money multiplier theory of banking. In short, this is the view that $1 of central bank reserves allows a bank to make $10 of loans or something like that. The basic premise works from the causation that Central Banks control the money supply. Of course, as I’ve explained many times before, this is completely backwards. Banks make loans by...

Read More »The Importance of First Principle Thinking

Share the post "The Importance of First Principle Thinking" I loved this interview with Elon Musk discussing a wide range of topics. Of particular interest were his comments on first principle thinking. First principle thinking is the formation of fundamental truths from which we can build understandings. Musk has described what he means: “What reasoning from first principles really means is boiling something down to the fundamental truths, or what appear to be the fundamental truths,...

Read More »The Best of the Financial Blogosphere in 2015

Share the post "The Best of the Financial Blogosphere in 2015" If you didn’t pay much attention to the financial markets you’re in luck because it wasn’t a whole lot of fun. And if you didn’t read a single financial blog all year you’re also in luck because here’s a great round-up of some of the best items from the financial blogosphere: Share the post "The Best of the Financial Blogosphere in 2015" Got a comment or question about this post? Feel free to use the Ask Me Anything section...

Read More »Control What You Can Control

Share the post "Control What You Can Control" Vanguard has a timely reminder for investors – “cost is the new performance”.¹ We’ve entered a new era in the asset management business. The era of low fees. We now know definitively that paying high fees is hugely destructive to long-term performance. You don’t don’t get what you pay for and you don’t get better returns by paying for more expensive money managers. In fact, high costs are correlated with lower returns. As I’ve outlined in...

Read More »The Best of Pragcap in 2015

Share the post "The Best of Pragcap in 2015" Well, another year is coming to an end. It wasn’t a great one for the financial markets, but one thing that’s getting better and better is the sheer amount of free information being provided to investors helping them make smarter decisions every day. I hope that this blog contributes a little bit to that process. Here are some of the things I wrote in 2015 that I hope contributed to the pursuit of knowledge and better decisions in the world of...

Read More »Three Things I Think I Think – No, You’re Wrong, Edition

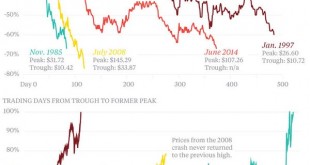

Share the post "Three Things I Think I Think – No, You’re Wrong, Edition" Here are some things I think I am thinking about: 1) Called out by Andreessen. Last week on Twitter I mentioned that oil prices were on the verge of their worst decline in decades. Marc Andreessen of Netscape and Venture Capital fame called me out for posting this chart and calling it “the worst decline”: “Best.” @cullenroche https://t.co/aObXfp1br8 — Marc Andreessen (@pmarca) December 18, 2015 @cullenroche...

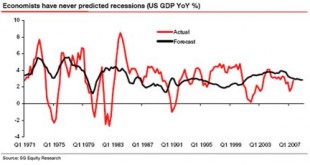

Read More »The Confirmation Bias of the Anti-Forecasters

Share the post "The Confirmation Bias of the Anti-Forecasters" It’s become fashionable in recent years to shun all types of forecasting about the future. This narrative usually involves the cherry picking of bad forecasts to prove the point. For instance, we often hear about how economists have never predicted recessions or how Wall Street strategists never predict bear markets. Something like this might be presented as evidence of how bad these people are at forecasting the future:...

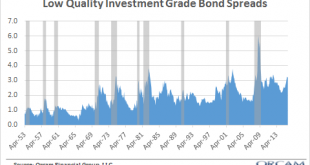

Read More »Are Junk Bonds Pointing to Economic Doom?

Share the post "Are Junk Bonds Pointing to Economic Doom?" There is a good deal of worry in recent weeks over the sharp increase in junk bond yields and what they might portend for the future of the economy. I wanted to explore this a bit more closely to see if we can’t decipher what might be going on here. First, it’s important to put the “junk” bond market in perspective: Junk bonds are a relatively young asset class as they were first sold en masse in the mid-80s. The junk bond category...

Read More »Three Things I Think I Think – Martin Shkreli Edition

Share the post "Three Things I Think I Think – Martin Shkreli Edition" Here are some things I think I am thinking about: 1) Why does the world hate Martin Shkreli? Christmas came a few days early for the 90% of the world that completely despises Martin Shkreli, the hedge fund manager and pharma CEO who allegedly ripped off investors. An interesting discussion has surrounded the hatred of Shkreli. Ezra Klein says he’s a symptom of the system and not the problem. In essence, Klein...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism