Share the post "Yellen Fears the Boom, Part Deux" Last September I talked about how Janet Yellen was more afraid of a boom than a bust. Basically, she is scared that the US economy is stronger than many think and that the global economy’s weakness won’t persist and so we’ll start to see all of this translate into a stronger overall picture on the other side. I can’t say that I disagree. After all, if oil prices and China ever stabilize then inflation comparisons will start to look high...

Read More »Rate Hikes and Roulette Wheels

Share the post "Rate Hikes and Roulette Wheels" In my book I tell a story about a friend in college who claimed to have a foolproof gambling strategy. We would simply watch a roulette wheel and identify a trend in specific spins and then bet against it until we won. The thinking here is that a roulette wheel has about a 50% chance of landing on red or black (it’s actually a bit lower than that depending on where you play and the number of green slots the casino uses to tilt the odds in...

Read More »Three Things I Think I Think You Should be Reading

Share the post "Three Things I Think I Think You Should be Reading" Here are three things I think I think you should be reading: 1) Here’s a very smart piece by Jesse Livermore over at Philosophical Economics. Jesse questions the validity of backtesting, systematic approaches and the importance of looking into these approaches with a grain of salt. I’m a big fan of well reasoned skepticism in finance and economics and Jesse always does a nice job of making you think deeply and thoroughly...

Read More »The Macro-ization of the Investment Landscape

Share the post "The Macro-ization of the Investment Landscape" I was intrigued by this recent comment in a JP Morgan piece of research concerning the biggest trends in finance: The macro-ization of the investment landscape (‘macro” investors have always existed but just as the tech boom and bust created a permanent pool of money that to this day focuses on that industry beyond what its market cap and earnings contribution would justify, the same has happened to “macro” events. The...

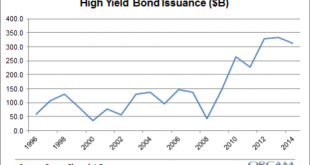

Read More »Three Lessons From The Junk Bond Collapse

Share the post "Three Lessons From The Junk Bond Collapse" The junk bond collapse of the last few months has reminded us of some important lessons going forward. Here are three that I find most pertinent: 1) Most investors have no reason to own junk bonds. As I discussed the other day, junk bonds are basically a crappy version of equity and don’t compare favorably to holding an aggregate bond index. I said: Since 1985 high yield bonds have generated an average annual return of 8.1%...

Read More »Assessing the Utility of Wall Street’s Annual Forecasts

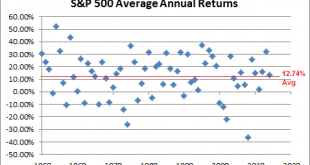

Share the post "Assessing the Utility of Wall Street’s Annual Forecasts" It’s that time of year when everyone starts preparing for the New Year and Wall Street makes its 2016 predictions. I’ll get right to the point here – these annual predictions are largely useless. But it’s still helpful to put these predictions in perspective because it highlights a good deal of behavioral bias and some of the mistakes investors make when analyzing their portfolios. The 2016 annual stock market...

Read More »Revisiting the Destabilizing Force of Misguided Market Intervention

Share the post "Revisiting the Destabilizing Force of Misguided Market Intervention" I’ve spent an excessive amount of time in the last 7 years talking about the various market distortions that QE can cause (I even dedicated a paper to the commodity bubble in 2011). I would argue that the two primary places where these distortions occurred were in the commodity markets and the corporate bond market (though probably less directly attributable in the commodity market). The thinking relative...

Read More »Three Things I Think I Think

Share the post "Three Things I Think I Think" Here are some things I think I am thinking about. 1 . Wall Street’s Biggest Lie. Jason Zweig had a piece earlier this week that I highly recommend. There are a number of good nuggets in there. He also refers to “The big lie on Wall Street” being the promise that advisors or portfolio managers can conjure the returns needed to meet your financial goals. This is a version of promising higher returns than most managers or advisors are...

Read More »The Dangers of Being Focused

Share the post "The Dangers of Being Focused" We love guru worship in the field of finance. We’ll find someone who sounds smart, says all the right things, makes a few good calls and cling to their every word. Until they fall on their face. Then we find another guru to worship until the process repeats itself. There is a revolving door of “gurus” in this field. The problem with a lot of these “gurus” is that they’re focused. They’re specialists in specific parts of the financial...

Read More »Everyone Wants to Hit the Long Ball

Share the post "Everyone Wants to Hit the Long Ball" If you ever go to a golf driving range count the number of people hitting their driver relative to the number of people hitting their pitching wedge. You’ll notice that the vast majority of amateur golfers focus excessively on how far they can hit a golf ball. This makes no sense though. If you’re like most amateurs you probably have trouble breaking 100. And that means you’re going to pull your driver out of your bag fewer than...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism