Download Stig & Preston's 1 page checklist for finding great stock picks: http://buffettsbooks.com/checklist Subscribe to The Investors Podcast on iTunes: https://itunes.apple.com/us/podcast/the-investors-podcast/id928933489 Subscribe to The Investor Podcast on Stitcher: http://www.stitcher.com/podcast/theinvestorspodcast/the-investors-podcast?refid=stpr Subscribe to The Investor Podcast on SoundCloud: https://soundcloud.com/theinvestorspodcast Have a question? Get your voice heard on the...

Read More »TIP60: The Pragmatic Capitalist – With Cullen Roche

Download Stig & Preston's 1 page checklist for finding great stock picks: http://buffettsbooks.com/checklist Subscribe to The Investors Podcast on iTunes: https://itunes.apple.com/us/podcast/the-investors-podcast/id928933489 Subscribe to The Investor Podcast on Stitcher: http://www.stitcher.com/podcast/theinvestorspodcast/the-investors-podcast?refid=stpr Subscribe to The Investor Podcast on SoundCloud: https://soundcloud.com/theinvestorspodcast Have a question? Get your voice heard on...

Read More »The Relative Thinking Trap

Share the post "The Relative Thinking Trap" Humans have an easier time understanding the world by thinking about things in relative terms. These comparisons help us better compartmentalize our thoughts and benchmark our performance. Relative thinking creates order in a seemingly orderless world. But it can be both productive and highly unproductive since, in addition to thinking in relative terms, we also tend to overestimate how good we are at certain things. The better than average...

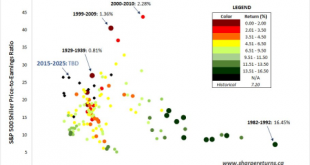

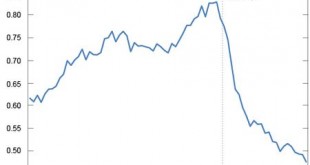

Read More »Three Charts I Think I’m Thinking About

Share the post "Three Charts I Think I’m Thinking About" Here are three charts I think I am thinking about: 1. Prospects for the 60/40 portfolio don’t look so good. This is something I’ve talked about in the past, but I have to wonder – given the surging popularity of the 60/40 – are we witnessing one big example of performance chasing? Given the low interest rate environment and strong recent stock performance (leading to high-ish valuations by many metrics) the 60/40 has entered one...

Read More »ETFs Don’t Kill Investors, Investors Kill Investors

Share the post "ETFs Don’t Kill Investors, Investors Kill Investors" There was a good piece in the WSJ today discussing potential “flaws” in Exchange Traded Funds (ETFs). ETFs are a relatively new product that have amassed huge quantities of assets in the last few decades but are still dwarfed by the mutual fund space (roughly 2.1 trillion in assets vs 12.6 trillion in mutual funds). The SEC recently said “It may be time to re-examine the entire ETF ecosystem.” That sounds a bit...

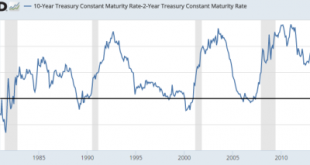

Read More »How Much Can the Fed Raise Rates?

Share the post "How Much Can the Fed Raise Rates?" Larry Summers has a very good piece today in the FT on the irrationality of raising rates and the limits of monetary policy in the current environment. I largely agree with his views as I hashed out in September. But the Summers piece got me thinking about the precise limits of Fed policy here. Summers says the limit is about 100 bps. I think he’s probably pretty darn close. Historically, the economy does not perform well in an...

Read More »Three Things I Think I Think – Bubble Spotting Edition

Share the post "Three Things I Think I Think – Bubble Spotting Edition" Here are some things I think I am thinking about: 1) Dean Baker says bubble spotting is easy. Dean Baker was among the few people who spotted the housing bubble fairly early. In a recent blog post he goes through how he identified it and asserts that this was “easy”. He says it was inexcusable for policymakers to be blindsided by it. Hmmm. I don’t know about that. I remember the housing bubble quite well because I...

Read More »Could the Fed Have Prevented the Financial Crisis?

Share the post "Could the Fed Have Prevented the Financial Crisis?" Janet Yellen’s Congressional testimony today brought up an interesting line of questioning from Ted Cruz who said that the Fed was “passively tightening” policy in 2008 which contributed to the financial crisis. This is a popular line of reasoning among many economists. David Beckworth, whose work I admire greatly, posted some nice comments explaining this view. In essence, by not signaling an offsetting change in the...

Read More »The Temporal Problem in Market Forecasting

Share the post "The Temporal Problem in Market Forecasting" You can’t talk about money and investing without talking about time. After all, the two are inherently interconnected. There’s the time value of money, the erosion of value due to inflation, the linkage between money and interest rates, etc. The problem is, time is a great unknown for all of us. It is a concept that we apply in a strict sort of theoretical sense to create structure to our lives. But there is nothing certain...

Read More »Capitalism Needs More Capitalists like Mark Zuckerberg

Share the post "Capitalism Needs More Capitalists like Mark Zuckerberg" Yesterday Mark Zuckerberg announced his intention to give 99% of his Facebook stock to charity. I found the responses to this announcement largely unfair. The Guardian referred to it as a form of “imperialism”. Thomas Piketty called it a “big joke”. Others referred to it as “tax avoidance”. The other common criticism was that 1% of $45B left Zuckerberg with $450MM which is, well, a lot of money (too much being the...

Read More » Cullen Roche: Pragmatic Capitalism

Cullen Roche: Pragmatic Capitalism