Reversed some but still higher than expected, and still historically depressed: However, the weather was very nice again in January (just like in December), and the weather probably had a significant impact on the seasonally adjusted housing starts number. The winter months of December and January have the largest seasonal factors, so nice weather can really have an impact. A huge driver of stock prices got off to its worst start in 7 years, but that could change Share...

Read More »NY PMI, Walmart, Japan, Oil

Another move up that may or may not reverse: Walmart earnings and outlook fall short as holiday season disappoints This price drop will negatively effect capital expenditures as well as the value of oil being produced, both negatives for GDP:

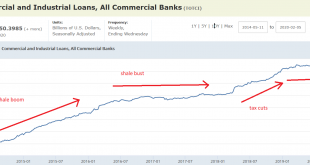

Read More »Bank loans, Containers, Bloomberg

Largely unchanged for over a year now: Historically depressed, and adjusted for inflation and population growth real estate lending growth isn’t much above 0: This much credit tightening has historically been followed by recession: Still no candidates showing an understanding of monetary operations, so it’s not a distinction :( Bloomberg unveils plans for Americans’ Social Security, retirement savings

Read More »Euro area GDP, Germany, Industrial Production, Retail sales, Consumer sentiment

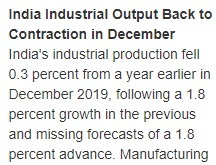

Contraction: The index is up but the mix of details is odd:

Read More »India, euro area

JOLTS, Small business index, Household debt, Wholesale inventories and sales, Germany

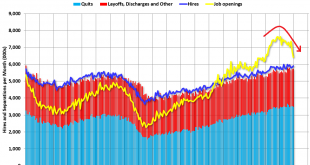

https://tradingeconomics.com/united-states/job-offers The number of job openings in the US fell by 364,000 to 6.423 million in December 2019 from a revised 6.787 million in November and well below market expectations of 7.0 million. It was the lowest level since December 2017, as openings slumped by 332 thousand in the private sector and were down by 32 thousand in government. Over the year, the job openings level declined by 14.9 percent. Still with the trumped up...

Read More »Employment, Mtg purchase apps, Rails, Germany

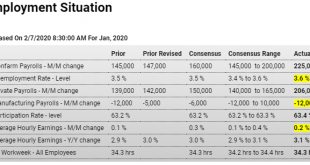

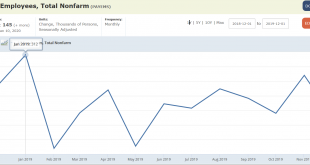

Year over year growth declined, at least for now reversing a small move up in the context of a larger move lower. Decelerating employment growth generally coincides with decelerating GDP, as has been the case: Another indicator that’s been perking up. May be weather related: Intermodal traffic’s prolonged contraction shifted to expansion last month:

Read More »Employment

Jan 2019 printed 312,000 net hires, so anything less in tomorrow’s report means the year over year growth was lower. The average for the rest of the year was about 200,000, well below prior years: This is how it stands before tomorrow’s release:

Read More »Vehicle sales, ISM services, ADP employment

Typical collapse prior to recessions: Still working its way lower: Another example of a small move up after a long downtrend that are touted to be a ‘reversal’: Another somewhat misleading headline, as per the year over year chart:

Read More »Durable good orders, ISM NY, Mexico PMI

Up a bit this month but still trending lower. And on an inflation adjusted basis well below prior highs. The chart is not inflation adjusted: A blip up this month, but remains in contraction (below 50):

Read More » Mosler Economics

Mosler Economics