Read More »

Ray Bratcher Interview

Viya Town Hall – 10/05

Viya Town Hall – 10/05

Car sales, Redbook retail sales, Mtg apps, ISM and Markit services index

A bit stronger than expected, but still trending lower, particularly adjusted for population: Highlights Unit sales of motor vehicle proved very strong in September, rising sharply to a 17.4 million annualized rate from 16.6 million in August. This points to a sharp rise in dollar sales of motor vehicles for the September retail sales report which in prior months had been flat. Note that some of the month’s gain may reflect replacement demand tied to Hurricane Florence which...

Read More »The Center of the Universe 2018-10-01 20:02:17

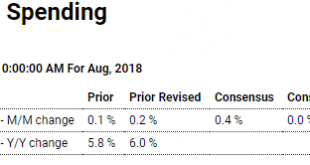

Lots of evidence of slowing; Highlights A marginal headline gain of 0.1 percent in construction spending masks significant declines in residential spending during August. Residential spending fell 0.7 percent in the month to more than offset a 0.2 percent rise in July. Looking at sub-components, single-family spending was also down 0.7 percent in August with multi-unit spending down 1.7 percent. Home improvement spending fell 0.6 percent. Strength in the report is in...

Read More »Step Up radio interview 9/28

Starts at 8 min: https://youtu.be/PG2_apO5faI?t=8m3s

Read More »Step Up radio interview 9/28

Starts at 8 min: https://youtu.be/PG2_apO5faI?t=8m3s

Read More »Trade, Pending home sales, New home sales, Durable goods, Bank lending, Earnings

Need more tariffs… Highlights Amid the unfolding of tariff effects, exports are moving in the wrong direction and look to be a big negative for third-quarter GDP. The nation’s trade deficit in goods was a whopping $75.8 billion in August with exports down 1.6 percent for a second straight month. Imports are also a negative for the trade balance, up 0.7 percent following a 0.9 price rise in July. Not good: Highlights It’s hard to find good news in the housing sector and...

Read More »PMI, Existing home sales, Permits, Homebuying index, Fed book, China car sales, Federal budget

Highlights Amid a backdrop of rising inflation pressures, sharp slowing in the services PMI sample pulled down September’s composite flash and masks a strong showing for manufacturing. The PMI composite fell to 53.4 which is well below Econoday’s consensus for 55.1 and also below the low estimate for 53.8. Services fell to 52.9 vs a consensus for 55.0 while manufacturing, however, rose to 55.6 vs expectations for 55.0. Weakness in services is centered in the year-ahead...

Read More » Mosler Economics

Mosler Economics