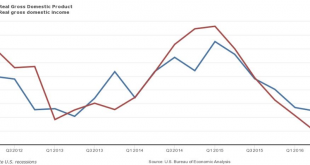

GDI (gross domestic income) = GDP (gross domestic product) by identity. The funds spent to buy the output are the income of the sellers of the same output. But the government gets the data for each independently, which includes estimates of various categories, so the reported numbers don’t equate when initially released, but do tend to come together over time as more data is collected. And right now it looks to me like GDI has been running quite a bit weaker than GDP:...

Read More »Personal income and spending, Chicago PMI, corporate profits, Comments on tax reform

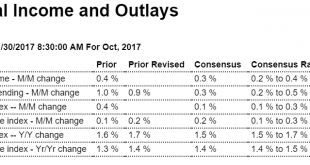

Income a bit higher than expected due to higher interest income, but as per the charts income growth has slowed and seems the only thing keeping spending growing even at these very modest levels is consumers dipping into savings: Highlights Inflation is showing the slightest bit of life yet probably more than enough to assure a rate hike at this month’s FOMC. The core PCE price index, which is the inflation gauge FOMC members most closely watch, rose an as-expected 0.2...

Read More »GDP, Profits, Pending home sales, Mtg purchase apps

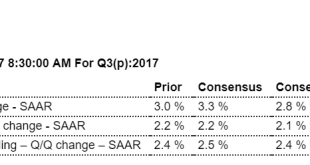

First revision has the consumer a bit weaker than expected, which means the savings rate isn’t quite as weak as initially reported. The savings rate, however, is still unsustainable weak, meaning either consumer spending falls further or personal income growth reverses its deceleration. The other revisions include an increase in already too high inventories that have already turned negative in Q4, and a smaller trade deficit that is now showing increases in q4. And the...

Read More »Trade, New home sales chart, Redbook retail sales, Consumer confidence

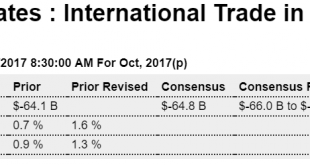

As previously discussed, the food export spike was a one time event: Highlights With housing and manufacturing showing strength the outlook for fourth-quarter GDP was building, until that is this morning’s advance trade and inventory data. October’s goods deficit was much higher-than-expected, at $68.3 billion for a very sizable $4.2 billion increase from September. The details speak to weakness with exports down 1.0 percent, reflecting declines for food products and...

Read More »New home sales, Bank lending, Philly Fed state coincident index

A better than expected, but somewhat peculiar details, and note the approximate average over the last 4 months. And maybe some tax related buying? Last month, new single-family homes sales soared 30.2 percent in the Northeast to their highest level since October 2007. Sales in the South increased 1.3 percent also to a 10-year high. There were also strong gains in sales in the West and Midwest last month. More than two-thirds of the new homes sold last month were either...

Read More »Mtg purchase apps, Durable goods orders

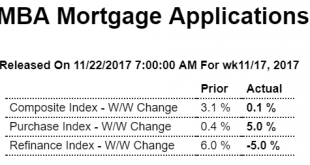

I don’t see any convincing evidence of a housing market revival, particularly with the growth of real estate lending remaining well below that of last year: Highlights Purchase applications for home mortgages rose a seasonally adjusted 5 percent in the November 17 week, though overall mortgage activity was only barely higher (by 0.1 percent) than in the prior week as the increase in buyers was offset by a 5 percent decline in refinancing activity. On an unadjusted basis, the...

Read More »Existing home sales, Chicago Fed, Commercial real estate prices, Bank lending

Up a touch more than expected, but still down year over year: Up a bit for the month but the chart shows the weakness vs prior cycles: No improvement yet:

Read More »Industrial production, Household debt, Business sales and inventories, Container counts, Animal trophies

A dip and a recovery due to the hurricane (as per vehicle sales data), chugging along at modest rates of growth, and still down from high a couple of years back, not adjusted for inflation: The NY Fed reports household debt growth decelerated in q1, in line with the deceleration in bank lending: Note the deceleration since January for both of these charts, inline with decelerating bank loan growth: Analyst Opinion of Business Sales and Inventories This was a worse month for...

Read More »Retail hiring, Container count, Truck sales

October Retail Hiring Lowest In Six Years from Challenger Gray and Christmas Fewer major retailers have announced large-scale hiring announcements so far this year, which reflects the drop in the number of October employment gains in the sector. Gains fell 8 percent from last year to 136,700, the lowest October gain since 2011, when the sector added 134,200 jobs. Imports up and exports down doesn’t help US GDP: Port of Long Beach: Another Record Month in October By Bill...

Read More »Credit check, Commercial real estate index, Unemployment, Margin debt

Still no sign of a rebound: Home prices rising about 6% annually and loans now growing at under 4% annually looks in line with at best flat housing sales: Looks like the blip up as hurricane destroyed vehicles were replaced has run its course: This had looked like it peaked a couple of years ago, but since went back up to new highs:

Read More » Mosler Economics

Mosler Economics