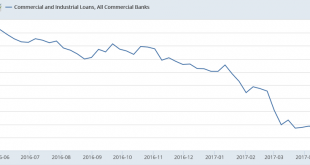

So I was reminded that I did write and post in November about what might happen if rates went up in anticipation of Fed hiking in a weak loan demand environment. (Thanks David for reminding me!) I was thinking that some portion of whatever borrowing interest there was might no longer qualify, causing a decline in the growth of borrowing to spend by businesses as well as consumers. If rates go up when loan demand is strong enough so the borrowing continues, the added loan...

Read More »Credit check

The charts show it all went bad around November. And it continues to deteriorate with every passing week, with the latest data showing cars, housing, and employment decelerating accordingly.Must have been some event that set it off? It was around the time of the election, but I can’t recall specifically what would set off something like this?Comments welcome!

Read More »Employment, Trade

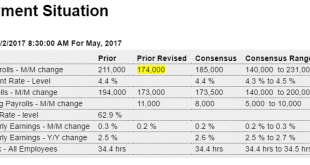

The chart says it all- deceleration that started when oil capex collapsed not abetting, and the decelerating credit charts indicate much more of same coming: Highlights An unexpectedly weak employment report has put a rate hike at this month’s FOMC in doubt. Nonfarm payrolls rose only 138,000 in May which is nearly 50,000 below expectations. Importantly, April and March have been downwardly revised by a net 66,000. Average hourly earnings are also not favorable, up only 02...

Read More »ADP employment, Construction spending, PMI and ISM manufacturing, Car sales

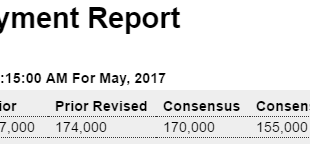

While it did spike up some this week, the downtrend is still intact as per the chart: Highlights On the strong side this year, ADP is calling for a resumption of outsized employment gains, at 253,000 for private payrolls in tomorrow’s May employment report vs Econoday’s consensus for 172,000 (Econoday’s consensus has since moved to 173,500 following ADP’s report). ADP has been hitting and missing this year, making remarkably good calls for oversized strength in January and...

Read More »Mortgage purchase applications, ISM Chicago, Pending home sales, Vehicle sales

Another down week but still a bit higher than last year. But actual loan growth is far lower than last year: Trumped up expectations coming down: Highlights Business growth is slowing in the Chicago area with weakness appearing in orders. The May PMI of 55.2, though down more than 3 points in the month, is still very solid but new orders slowed abruptly in the month to a 4-month low with backlog orders in contraction for a sixth straight month. Employment is flat and...

Read More »Personal income and spending, consumer confidence, small business hires, gone mainstream…

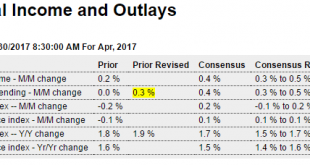

As expected with prior month’s spending revised up .2. Annual growth rates still not looking so good, as per the charts: Highlights April was mostly a favorable month for the consumer who benefited from strong wage gains, kept money in the bank, and was an active shopper at least compared to the first quarter. Consumer spending opened the second quarter with an as-expected 0.4 percent gain with strength in durables spending, including vehicles, offsetting another subpar...

Read More »Credit check

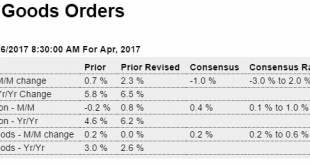

If these numbers don’t turn up q2 gdp could be a lot worse than q1:

Read More »GDP, Durable goods, Profits

Real consumer spending revised up a bit, and not to forget that includes health care premiums, and q2 now looking a lot worse than previously expected: Highlights First-quarter GDP gets a small but much needed upgrade, now at a 1.2 percent rate of annualized growth which is nearly double the advance estimate. The gain is centered where it is best, in consumer spending where the rate did double to 0.6 percent. This is still slow but is an improvement with durable goods, at...

Read More »Philly Fed State index, Pending legislation, North Korea, Basic income

As previously discussed, seems to me it’s unlikely any of the trumped up expectations willcome to pass: McConnell: ‘I don’t know how we get to 50’ votes on ObamaCare repeal (The Hill) Senate Majority Leader Mitch McConnell says he doesn’t know how Senate Republicans are going to get enough votes to pass an ObamaCare replacement bill. “I don’t know how we get to 50 [votes] at the moment. But that’s the goal,” McConnell told Reuters in an interview Wednesday. McConnell...

Read More »Trade, Inventories, Tax receipts

Larger than expected and last month revised higher, indicating GDP was a bit lower than estimated, and weak sales matched with weak inventories don’t clear the shelves: Highlights A key early indication on the strength of second-quarter GDP is not favorable as the nation’s goods deficit widened $2.5 billion in April to $67.6 billion. Exports of goods continue to show weakness, down 0.9 percent in the month to $125.9 billion that show sharp declines for vehicles and consumer...

Read More » Mosler Economics

Mosler Economics