from Maria Alejandra Madi The current WEA Conference: Monetary Policy after the Global Crisis marks the tenth anniversary of the greatest recession after 1929-33. The aims of this conference include discussing key theoretical insights in order: To provide a framework for improving monetary policy practices. To review and advance knowledge on the recent financial crisis regarding the main challenges and prospects of central banking. To particularly survey and discuss the use of Divisia...

Read More »Understanding Macro: The Great Depression (1/3)

from Asad Zaman Preliminary Remarks: “The trouble is not so much that macroeconomists say things that are inconsistent with the facts. The real trouble is that other economists do not care that the macroeconomists do not care about the facts. An indifferent tolerance of obvious error is even more corrosive to science than committed advocacy of error.” From The Trouble with Macroeconomics (Paul Romer) Personally, I do not understand why indifference to error is worse than committed...

Read More »Economics — a science with wacky views of human behaviour

from Lars Syll There is something about the way economists construct their models nowadays that obviously doesn’t sit right. The one-sided, almost religious, insistence on axiomatic-deductivist modelling as the only scientific activity worthy of pursuing in economics still has not given way to methodological pluralism based on ontological considerations (rather than formalistic tractability). In their search for model-based rigour and certainty, ‘modern’ economics has turned out to be a...

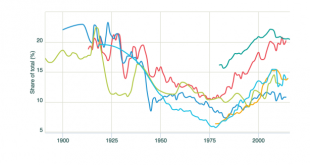

Read More »Regraphing USA unemployment history. An addendum to the USA data

Source: Bureau of Labor Statistics Broad unemployment today is, compared with the period before 1994, worse than you think. A new way of estimating ‘part time workers for economic reasons’ shifted this series downward with almost 1% of the labor force. To gain a proper understanding of historical developments present day data have to be increased or historical data have to be decreased a little. I’m trying to write a book about the relation between economic statistics and neoclassical...

Read More »Oil, gas and coal 2040 (4 graphs)

2017

Read More »Utopia and inequality

from David Ruccio Economic inequality is arguably the crucial issue facing contemporary capitalism—especially in the United States but also across the entire world economy. Over the course of the last four decades, income inequality has soared in the United States, as the share of pre-tax national income captured by the top 1 percent (the red line in the chart above) has risen from 10.4 percent in 1976 to 20.2 percent in 2014. For the world economy as a whole, the top 1-percent share...

Read More »Bribe offers for academics

from Edward Fullbrook Norbert Häring’s story about misleading academic research reminds me of another story. Big-money offering bribes to academics is, I suspect, more common than people, including academics, realize. I first encountered the practice when I was an undergraduate. My university’s most popular course, “Insurance”, was taught by an economics professor whose students affectionately called Doc Elliot. He taught not only how the insurance industry purported to work, but also...

Read More »CEPR vs. NBER: Two approaches for dealing with false research in favor of tuition fees

from Norbert Häring For international readers, I would like to summarize a piece on false economic research supporting tuition fees, which appeared in German in Handelsblatt on 19 February. As interesting as the fake research itself is the differing reactions of the two main channels, which had been used to publicize it: One was the prestigious Working Paper series of the National Bureau of Economic Research in the US The other was the well-read platform Vox (voxeu.org) of the...

Read More »Science and the quest for truth

from Lars Syll In my view, scientific theories are not to be considered ‘true’ or ‘false.’ In constructing such a theory, we are not trying to get at the truth, or even to approximate to it: rather, we are trying to organize our thoughts and observations in a useful manner. Robert Aumann What a handy view of science. How reassuring for all of you who have always thought that believing in the tooth fairy make you understand what happens to kids’ teeth. Now a ‘Nobel prize’ winning...

Read More »Where does inflation hide?

from Herman Daly The talking heads on the media explain the recent fall in the stock market as follows: A fall in unemployment leads to a tight labor market and the prospect of wage increases; wage increase leads to threat of inflation; which leads the Fed to likely raise interest rates; which would lead to less borrowing, and to less investment in stocks, and consequently to an expected fall in stock prices. Therefore investors (speculators) rush to sell before the expected fall in stock...

Read More » Real-World Economics Review

Real-World Economics Review